Armstrong World Industries, Inc. (NYSE:AWI) designs and manufactures innovative commercial and residential ceiling, wall and suspension system solutions. Pennsylvania- based, Armstrong World’s ceiling systems are used in the construction and renovation of residential, commercial, and institutional buildings worldwide.

Currently, the company carries a Zacks Rank #3 (Hold). Here's why investors should hold on to the stock at present.

Positive Earnings Surprise History

The company has outpaced the Zacks Consensus Estimate in three of the trailing four quarters. The company has a positive average earnings surprise of 0.73%.

Return on Assets (ROA)

Armstrong World currently has a ROE of 7.7% while the industry's ROE is 3.1%. An above-average ROA denotes that the company is generating earnings by effectively managing assets.

Price Performance

The company outperformed the industry it belongs to in the past year. The stock has gained 17.8% while the industry rose 14.4%.

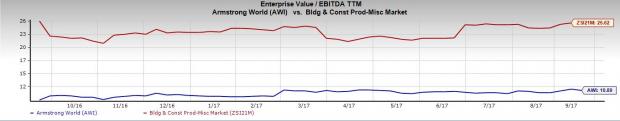

Cheap Valuation

Armstrong World’s trailing 12-month EV/EBITDA ratio is 10.89, while the industry's average trailing 12-month EV/EBITDA is at 25.65. Consequently, the stock is cheaper at this point based on this ratio.

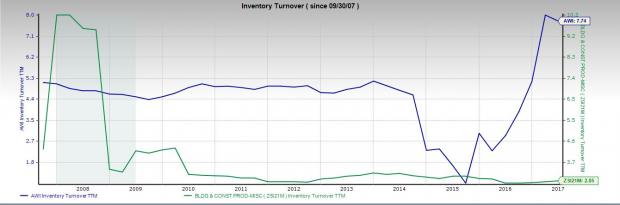

Higher Inventory Turnover Ratio

In the trailing 12 months, the inventory turnover ratio for Armstrong World has been 7.7% compared with the industry’s level of 2.9%. A higher inventory turnover than the industry average means that inventory is sold at a faster rate, suggesting inventory management effectiveness.

Value Growth Momentum (VGM) Score

In aggregate, Armstrong World currently has a Zacks VGM score of B. Here V stands for Value, G for Growth and M for Momentum. The score is a weighted combination of these three scores (Value - B, Growth - A, Momentum - B). Such a score allows you to eliminate the negative aspects of stocks and select winners. The VGM Score of B along with some other key metrics makes the company a solid choice for investors.

Earnings Estimate Revisions

Investors should also consider the positive trends on the estimates revision front. Analysts have been raising their estimates of Armstrong World lately, resulting in a favorable earnings picture.

In the past 60 days, the Zacks Consensus Estimate fiscal 2017 has gone up 1% to $2.74 and for fiscal 2018 has moved up 1% to $3.06. The Zacks Consensus Estimate for fiscal 2017 projects a 19.7% year-over-year growth and for fiscal 2018, earnings are expected to grow 11.61% year over year.

The company has an estimated long-term earnings growth rate of 11.87%.

Growth Drivers in Place

Armstrong World’s volume growth will stem from repair and remodel as well as new construction activity. Its performance in America should benefit from continued improvement in average unit value (AUV), driven by the mix up trend within the industry along with good pricing realization and volume growth. Further, improving global oil prices will support volume growth in international markets over the medium term. Key markets like Russia, Middle East, and China are expected to improve. The company will continue to focus on delivering margin expansion to improve cost structure in these markets.

Armstrong World is striving to grow beyond the traditional core mineral fiber ceiling products. In line with this, Armstrong World acquired Tectum that will enable it to expand its leading portfolio of durable, sustainable and acoustical solutions.

Bottom Line

Investors might want to hold on to the stock at present as it has ample positive prospects of outperforming peers in the near future.

Stocks to Consider

Some better-ranked stocks in the same industry include Owens Corning (NYSE:OC) , Patrick Industries, Inc. (NASDAQ:PATK) and TopBuild Corp. (NYSE:BLD) . While Owens Corning and Sterling Construction sport a Zacks Rank #1 (Strong Buy), TopBuild carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Owens Corning has an average earnings surprise of 20% in the past four quarters. Patrick Industries has an average earnings surprise of 20% in the last four quarters while TopBuild has an average earnings surprise of 10% in the trailing four quarters.

New Report: An Investor’s Guide to Cybersecurity

Cyberattacks have become more frequent and destructive than ever. In fact, they’re expected to cause $6 trillion per year in damage by 2020.

The cybersecurity industry is expanding quickly in response to these threats. In fact, a projected $170 billion per year will be spent to protect consumer and corporate assets. Zacks has just released Cybersecurity: An Investor’s Guide to Locking Down Profits which reveals 4 promising investment candidates.

Download the new report now>>

TopBuild Corp. (BLD): Free Stock Analysis Report

Armstrong World Industries Inc (AWI): Free Stock Analysis Report

Owens Corning Inc (OC): Free Stock Analysis Report

Patrick Industries, Inc. (PATK): Free Stock Analysis Report

Original post

Zacks Investment Research