Decentralized Finance (DeFi) yields have been on a free fall since the crypto market peaked in November 2021. But with the bull market hype cooling down, innovators in the DeFi space are pivoting to a new source of yield: Real World Assets (RWAs). This new crypto asset class is fast gaining popularity as the bridge between traditional finance and DeFi.

Unlike most DeFi yield products that depended on transaction volume and market activity to generate high yields, RWAs are introducing DeFi products that are backed by real value in the form of traditional assets. They represent off-chain assets such as real estate, stocks, gold, credit and other types of traditional products on the blockchain (on-chain) through tokenization.

For context, tokenization is the process of transforming ownerships and rights of real world assets into digitally recorded entries that can be accounted for. While this has always been the ultimate goal of DeFi, it is only recently that the bear market has forced stakeholders to make significant strides in integrating traditional assets with on-chain economies.

Although debatable, RWAs are the most revolutionary DeFi products yet, and their potential impact on future markets could be transformative in the following ways:

1. Fractionalisation of traditional asset ownership:

RWAs enable the division of ownership of traditionally large assets, such as real estate or fine art, into smaller portions that can be bought and sold by multiple investors. This increases accessibility to these assets, allowing a wider range of investors to participate in these markets.

2. Bridging the access to global markets:

RWAs allow for the transfer of ownership of traditional assets to be done digitally and across borders, providing greater access to global markets. This means investors from different parts of the world can now invest in traditionally inaccessible markets.

3. Improved transparency and security:

RWAs are able to provide a high level of transparency in transactions through blockchain technology, making it more difficult for fraudulent activities to take place. This also enhances security for investors as they can be assured that their investments are safe and secure.

4. Automation of asset ownership:

With the use of smart contracts, RWAs can be managed automatically, reducing the need for intermediaries and increasing the speed and efficiency of transactions. Compliance requirements can also be programmed into smart contracts, ensuring that all legal and regulatory requirements are met.

The Future of DeFi? Numbers never lie!

As we highlighted in a previous article earlier this year, tokenization is one of the crypto themes to keep a close eye on in the coming months. Already, we are seeing some action with the rise of RWAs as an area of interest for both crypto natives and traditional institutions that have long opposed crypto innovations.

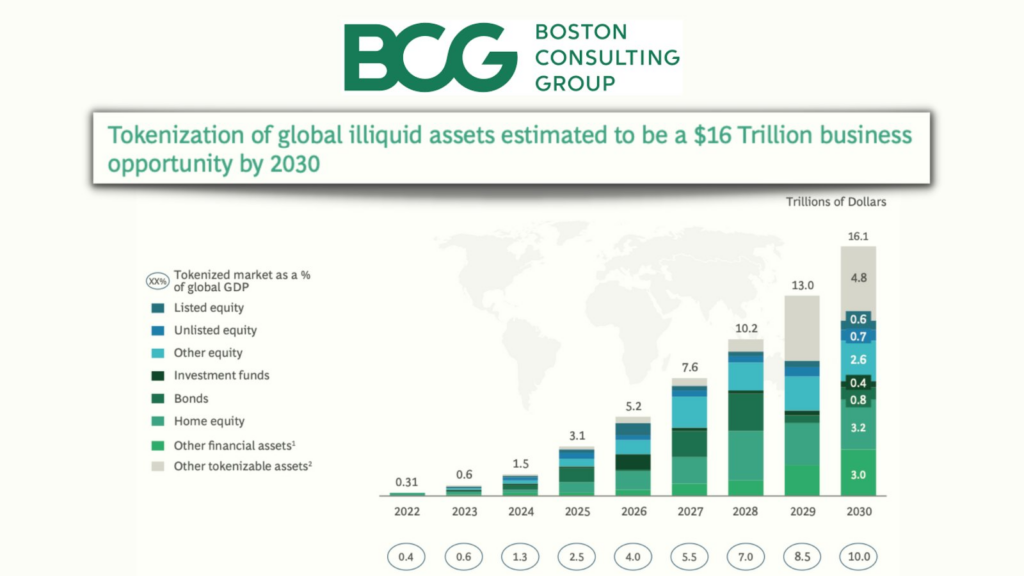

But more importantly, predictions from well-established players such as Boston Consulting Group (BCG) estimate that this burgeoning field could balloon into a $16 trillion industry by 2030.

Image source: Boston Consulting Group

It is also worth mentioning that decentralized cryptocurrency lending platforms such as MakerDAO are making efforts to incorporate traditional asset-backed financing. MakerDAO, which has a Total Value Locked (TVL) of $8.6 billion, recently introduced five vaults that support traditional financial assets. Additionally, they also provided a $30 million loan denominated in DAI, using bond tokens as collateral, to a subsidiary of Société Générale (EPA:SOGN) bank.

While the tokenization of RWAs is just gaining momentum, there is still a lot of untapped potential in traditional markets such as real estate and non-financial corporate debt. In 2020, the former’s value was estimated to be $327 trillion, while the latter’s valuation has jumped significantly from $46.6 trillion in the second quarter of 2009 to $87.38 trillion in the second quarter of 2022.

Both of these are potential markets that could set the stage for RWAs to be a game-changer in DeFi adoption.

Another financial market niche that could potentially open up to a wider audience with tokenization is the $11.7 trillion global private market. Already, there are some interesting developments with Fintech companies, such as Finpeers (a Swiss-based company that leverages tokenization to democratize the private financial market), emerging to serve the growing demand for tokenized private market assets. We spoke with the founder Sander Andersen who commented :

“As regulatory frameworks evolve and technology advances, tokenization is set to disrupt traditional financial markets, particularly in the private market. Tokenization will shape a more inclusive and efficient financial future, redefining how we interact with and invest in assets.”

RWA DeFi Protocols in Action

Although the market capitalization of RWAs is still a drop in the ocean compared to the trillions of U.S. dollars in traditional markets, this piece would be incomplete without exploring the fundamental progress being made.

According to a recent report by Binance Research, emerging DeFi protocols like Centrifuge, Goldfinch, and Maple are making significant strides in the development of RWA offerings.

Centrifuge

Centrifuge has developed a decentralized marketplace called Tinlake that provides borrowers with crypto-denominated debt using a structured credit process similar to traditional finance. The platform aggregates debt offerings that are collateralized by structured credit assets and tokenizes real-world assets like property loans and invoices, turning them into non-fungible tokens. These tokens are then used as collateral in asset pools, where investors can provide capital to pools that align with their risk preferences.

Goldfinch

This DeFi protocol enables businesses, particularly those in emerging markets, to access crypto loans without needing to provide crypto collateral. The loans are collateralized with real-world assets (RWAs), making it more accessible for businesses to obtain crypto-denominated loans. Since its inception, Goldfinch has successfully facilitated over $120M in RWA-based loans to emerging market businesses.

However, before being granted a loan, borrowers must undergo an eligibility audit to determine if they meet the necessary criteria. As for lenders, they have the option to supply capital to individual pools and earn a higher return, or act as liquidity providers by supplying capital across all borrower pools for lower returns.

Maple

Maple Finance is another innovative DeFi-RWA protocol that provides uncollateralized borrowing and lending services. The platform stands out for its use of “pool delegates,” who are credit professionals that assess creditworthiness and determine loan terms, making it distinct from Goldfinch’s community-based underwriting process. Institutional borrowers can leverage the DeFi ecosystem for loans, while lenders can earn MPL interest by depositing funds into liquidity pools.

Traditional Companies Quickly Jumping on Board

As mentioned earlier, the tokenization frenzy is also catching up with traditional companies, particularly those at the helm of the e-commerce, banking, and tech industries.

So far, Amazon (NASDAQ:AMZN) is among the firms that have signaled that it will soon roll out NFTs tied to real-world assets, such as a pair of jeans, allowing its customers to experience the best of both the virtual and real world.

Meanwhile, in the banking sector, Goldman Sachs (NYSE:GS) has already launched a tokenization platform on the Canton blockchain. This global investment bank has slowly been embracing the digital asset industry.

The firm’s Global Head of Digital Assets, Mathew McDermott, has previously stated that their goal is to “help their clients realize the benefits of end-to-end digital lifecycle processing across tokenized assets, digital currencies, and other financial instruments.”

Finally, Siemens AG (OTC:SIEGY), the renowned German industrial giant, also made a significant move into the digital bond market with the issuance of a 60 million euro bond on the Polygon blockchain.

This one-year bond was issued in compliance with Germany’s Electronic Securities Act, which came into effect in June 2021.