Market Brief

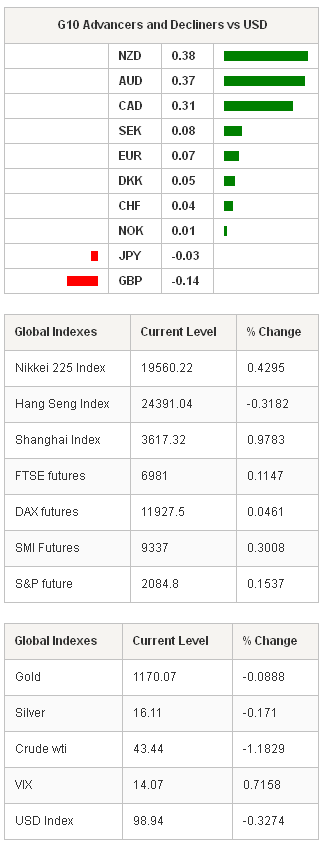

The FX traders continue consolidating the post-FOMC dollar weakness. The U.S. 10-Year yields recover to 50-dma (1.9608%), as the sovereign yield curve declines on the back end compared to last Friday levels. Lower US yields cap the upside attempts in USD/JPY, however the pair closed / opened above the Ichimoku conversion line (120.67). Step below this level should face support at 120.00/120.10 (optionality /Ichi baseline) before heading toward the daily cloud cover (118.43/71). On the upside, fresh boost is needed to clear resistance at 122.03, stops are touted above. Option markets are supportive with vanilla bids trailing from 121.15 to 122.00+. No surprise came out of the BoJ minutes overnight. In their February Board meeting, lawmakers voiced concerns over higher volatilities in JGB market and lower risk tolerance. Views on inflation split, showed the minutes. EUR/JPY sits on Fibonacci 61.8% on 2012-2014 rally (128.52). Technicals turn neutral, markets are more comfortable with EUR/JPY longs as the pair approaches the conversion line (129.39). The persistent EUR risks are still an important barrier however, as Greece is running out of time before the deadline on their repayments. EU leaders ask for more concrete and convincing reforms / proposals to achieve agreement on bailout.

EUR/USD gave back post-FOMC gains and traded in the tight range of 1.0650/95 in Asia. The sentiment in EUR remains strongly negative. The wide trading range is seen at 1.0458/1.0865 before any clarity is seen on Greek situation. We remain seller on upside attempts and refrain from long EUR positioning across the board. EUR/GBP converges toward its 21-dma (0.72279). The market is skewed positive in short-term EUR/GBP, buyers abound at 0.70/0.72. Next key resistance is set to 0.73935/0.74000 (Fibonacci 38.2% on Dec’14 - Mar’15 sell-off / 50-dma).

GBP/USD opens ranged following highly volatile 48 hours of post-FOMC trading. There is no appetite in sterling whatsoever as the election jitters anchor the market on the downside. The latest YouGov / Sun poll prints 35% support for Conservatives, 33% for Labour. The UK publishes its public finances in February. Higher public borrowing hence wider budget deficit would be a good reason for refreshed GBP-bears targeting 1.45 (psychological level), then 1.4231 (May 2010 low).

Canada releases February inflation figures before the week-end. Although the inflation expected to have improved on month, the disinflationary trend and the low inflation levels give the BoC the flexibility to remain dovish despite the persistent selling pressures on the Loonie (thanks to fresh lows in oil prices this week). Post-FOMC move has sent the USD/CAD down to Jan-Mar ascending base and 50-dma (1.2450), the correction has been rapid however. Any disappointment in inflation read today (softening inflation) should give a fresh boost to CAD-bears and pave the way for fresh highs (above 1.2835).

Else, the USD/BRL hits fresh 12-year high (3.3058) before the IPCA-15 data and anti-corruption proposals pre -weekend. While 1.25% acceleration in nationwide consumer prices on month to mid-March is already priced in, the political focus dominates the BRL market. We see the anti-corruption proposals hardly satisfying the market and stand ready for new street protests this weekend. Traders will certainly be reluctant to hold long-BRL positions over the weekend, so that we should see further weakness before the week close.

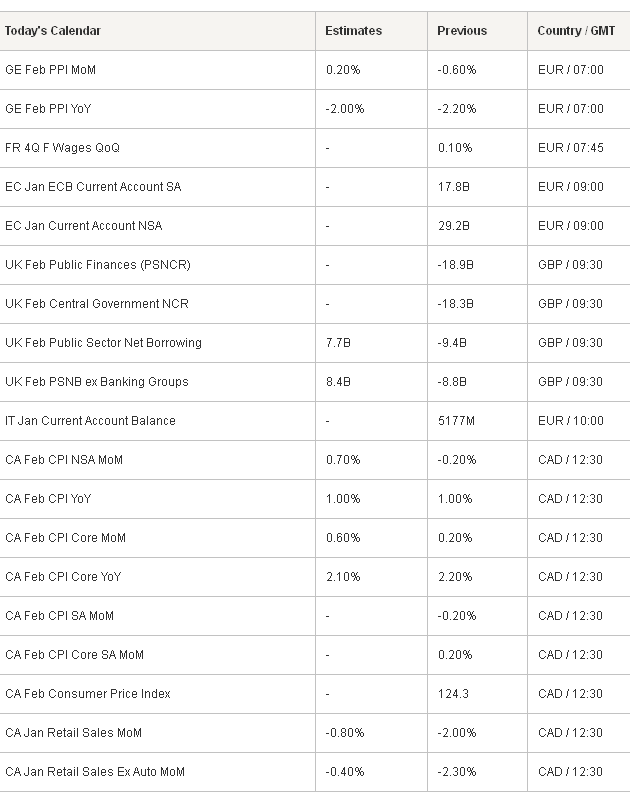

Today’s economic calendar: German February PPI m/m & y/y, French 4Q (Final) Wages, ECB January Current Account Balance, UK February Public Finances and Public Sector Net Borrowing, Italian January Current Account Balance, Canadian February CPI m/m & y/y and January Retail Sales m/m.