Is This A Sign Of Things To Come For The Wider Market?

Real Estate stocks in Saudi Arabia did not take kindly to the announcement that the Saudi Council of Ministers had approved the implementation of taxon undeveloped land in urban areas.Investors are awaiting additional details on the plan.

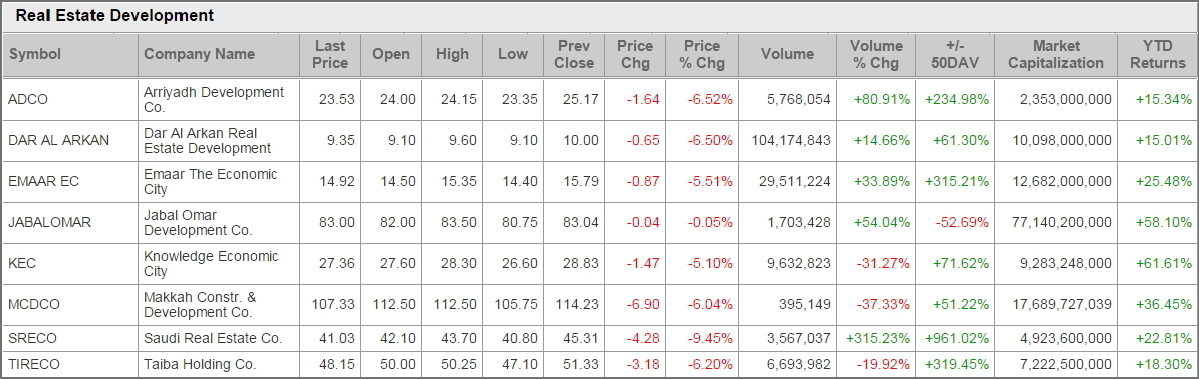

The Real Estate Sector Index fell 245.72 or 2.86% on Tuesday following the news, closing at 8,357.31. All the stocks in the sector dropped by more than 5% except for Jabal Oman Development (JABALOMAR), which was down only0.05%. The biggest loser was Saudi Real Estate Co. (SRECO), dropping 4.28 or 9.45% to close at 41.03. This on the back of essentially flat performance for the (Tadawul All Share Index), which advanced by 11.50 or 0.12% to end at 9,331.19.

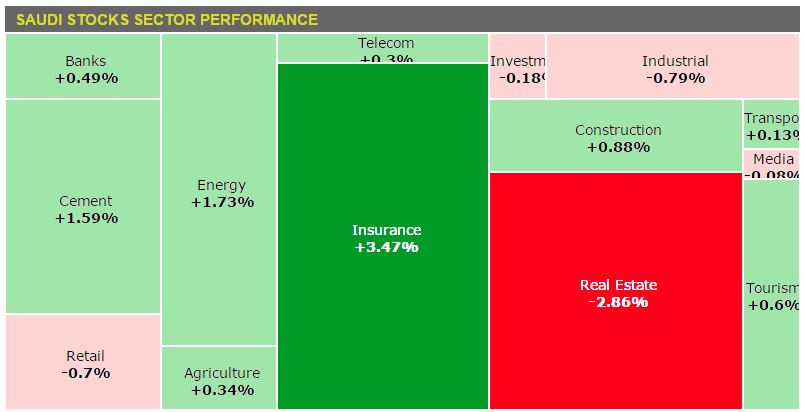

NCB Capital reportedyesterday that they anticipate the impact of the new fees will be a negative for listed developers and a positive for companies in the Cement and Construction sector, the fourth and third best performing sectors on Tuesday, respectively. This can be seen in the sector performance Heat Map below.

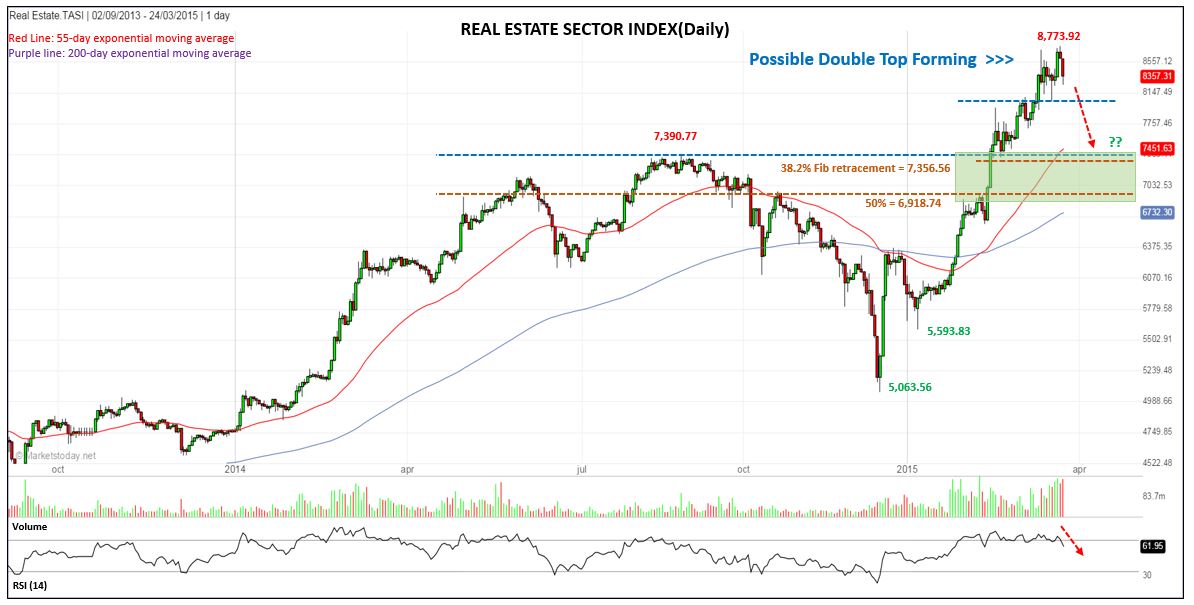

The Real Estate Sector has led the Saudi market higher over the past three months, having gained 73.3% since the December 2014 low. It broke out to a new high for the uptrend in mid-February before finding short-term resistance at 8,773.92 on Sunday. The land tax news could be what triggers a further decline as the index moves into a correction.

A potential double top is now in place, but doesn’t trigger until there is a drop below the neckline at 8,035.16. Further, the Relative Strength Index (RSI), a measure of momentum, has been in overbought territory for a couple of months and has now turned down. If the decline accelerates a minimum drop to 7,390.77 is likely, which begins a potential support zone down to the 50% retracement of the three-month uptrend.

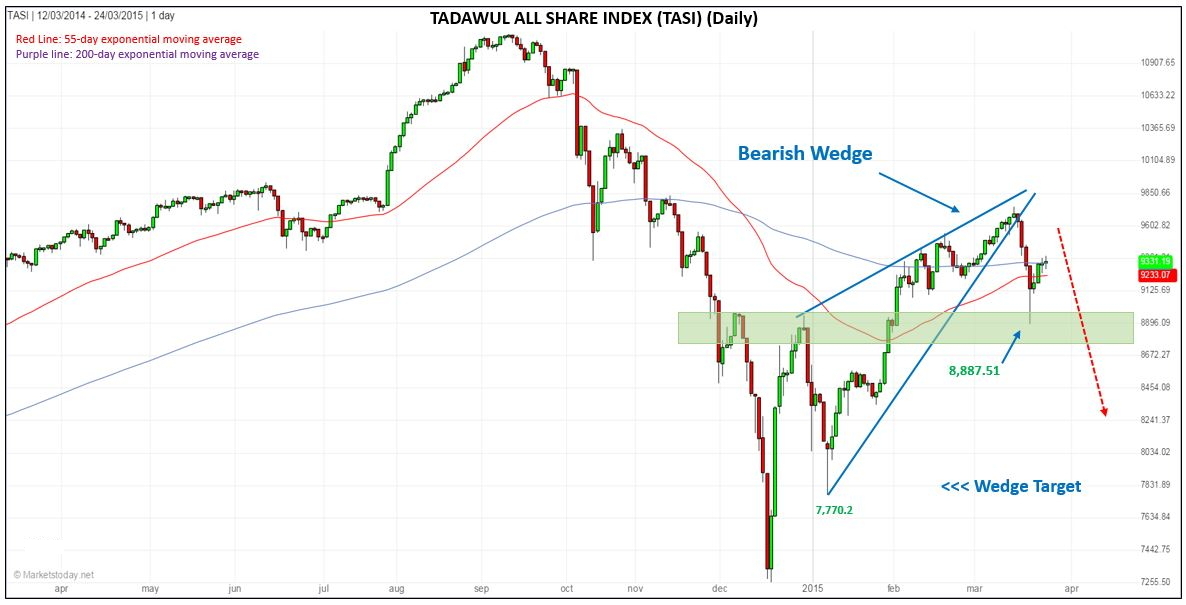

Since real estate has been leading the market, there is a chance that the bearish sentiment spreads to the wider market. This is a real possibility given that the TASI is retracing a prior decline up into potential resistance, following a breakdown from a Bearish Wedge pattern (see previous analysis from March 17, 2015). A likely scenario is that resistance will be seen on this bounce and the TASI will turn back down to follow-through on the target expectation from the wedge formation, which is 7,770.2. (www.marketstoday.net/en/)