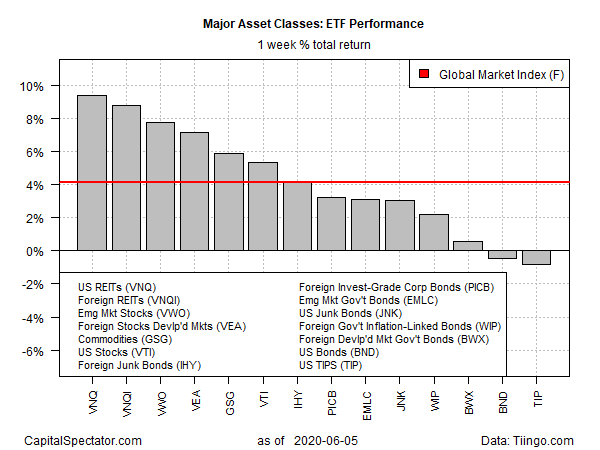

US and foreign property shares led returns in last week’s broad rise in global markets, based on a set of exchange traded funds tracking the major asset classes over the trading week ended June 5.

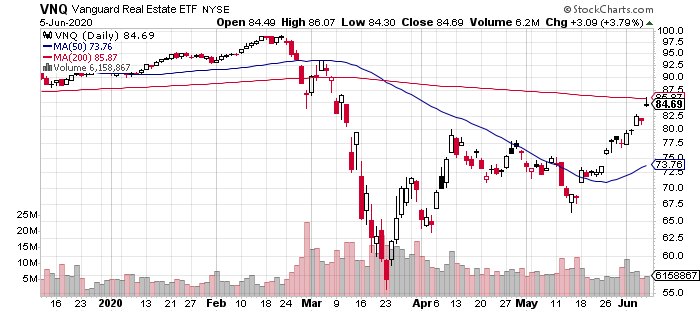

Vanguard Real Estate Index Fund ETF Shares (NYSE:VNQ) was the top performer, rallying 9.4%. The gain is one of the best weekly advances on record for the fund. Despite the bounce, VNQ is still well below its previous high, although the latest rise suggests the crowd is rethinking the case for dramatically discounting property shares in the wake of the coronavirus crisis.

Foreign real estate stocks were last week’s second-best performer for the major asset classes. Vanguard Global ex-U.S. Real Estate (NASDAQ:VNQI) rose a strong 8.8%, lifting the ETF to its highest close since March 11.

Last week’s biggest loser were inflation-indexed Treasuries. The iShares TIPS Bond ETF (NYSE:TIP) slipped 0.8%–the first weekly decline for the ETF in five weeks.

For the major asset classes overall, the trend remained positive last week, based on the Global Markets Index (GMI.F). This unmanaged benchmark, which holds all the major asset classes (except cash) in market-value weights via ETFs, gained an impressive 4.2% last week, marking its third straight weekly advance.

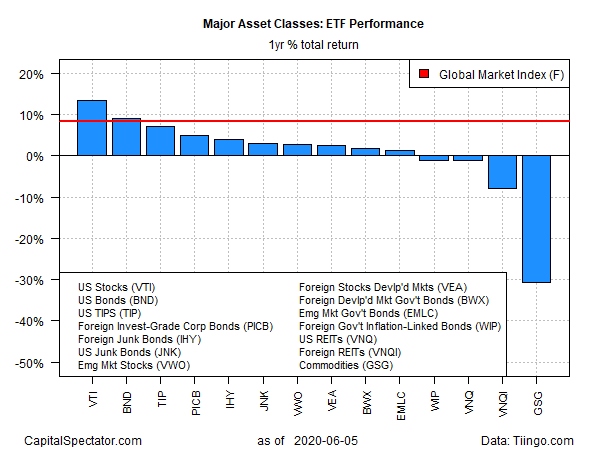

For the one-year performance data, US stocks remain firmly in the lead among the major asset classes. Vanguard Total Stock Market Index Fund ETF Shares (NYSE:VTI) closed on Friday with a 14.0% total return for the trailing 12-month window.

VTI’s gain is well ahead of the second-best one-year performer: US investment-grade bonds via Vanguard Total Stock Market Index Fund ETF Shares (NYSE:VTI), which is ahead by 9.1% over the past year after factoring in distributions.

Broadly defined, commodities remain deep in last place for the one-year trend. The iShares S&P GSCI Commodity-Indexed Trust (NYSE:GSG) is down a hefty 35.8% vs. the year-earlier level.

Meanwhile, GMI.F is enjoying a healthy one-year performance at the moment, closing on Friday with an 8.4% total return over the past year.

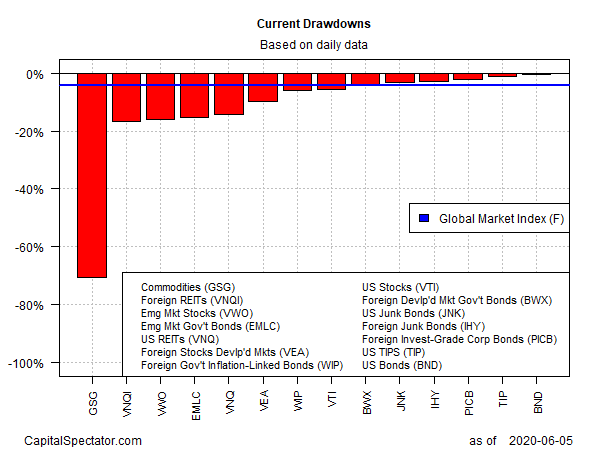

Ranking asset classes via current drawdown continues to show a wide range of results, ranging from the deep 70.6% peak-to-trough decline for commodities (GSG) to the fractional drawdown for US investment-grade bonds, via Vanguard Total Bond Market Index (NASDAQ:BND).

For comparison, GMI.F’s current drawdown is -4.0%.