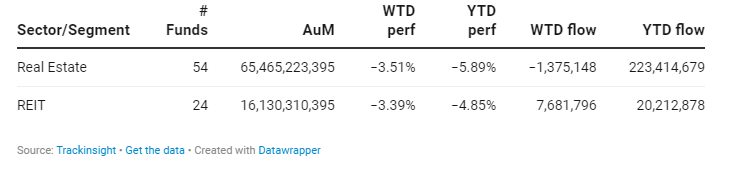

The real estate sector plunged by 3.70% this week, already being the worst performer (down 7.07%) within the S&P 500 benchmark index since the beginning of the year. Such a plunge can be explained by the Fed minutes, which show a willingness to maintain high interest rates for a longer period than the markets had hoped for. Real Estate and REIT ETFS respectively lost 3.51% and 3.91 last week.

Interest Rate Sensitivity

The real estate sector is a capital-intensive industry known for its sensitivity to interest rate changes. It has been heavily weakened since the Federal Reserve has unleashed the steepest series of interest-rate increases in decades during their two-year drive to combat inflation. High interest rates impact borrowing costs, thereby reducing investment and property valuation.

Federal Reserve's Stance

Christopher Waller, Governor of the Federal Reserve, extinguished speculations regarding potential rises in interest rates. He remarked that current inflation data is "comforting" and added that the U.S. central bank's policy remains "well-positioned."

The market's reaction to Waller's comments has been mixed. Growing concerns about an inherent buoyancy in the economy potentially reigniting inflation limited investor hopes for short-term rate cuts. This sentiment has been fueled by the Fed's minutes from May. Fed members noted disappointing readings on inflation over the first quarter.

Yet, Raphael Bostic, President of the Atlanta Federal Reserve, offered a more optimistic outlook. On Thursday, he said that recent inflation statistics suggest a consistent adherence to the return trajectory towards the 2% target at a moderate pace.

No Improvement in Sight in the Short Term

In any case, fresh comments from policymakers, along with a series of stronger-than-expected economic data, are diminishing the prospects of any near-term policy easing. As a result, traders have adjusted futures pricing, now expecting only one reduction by the end of the year. This is not good news for the real estate sector.

Impact of ETFs

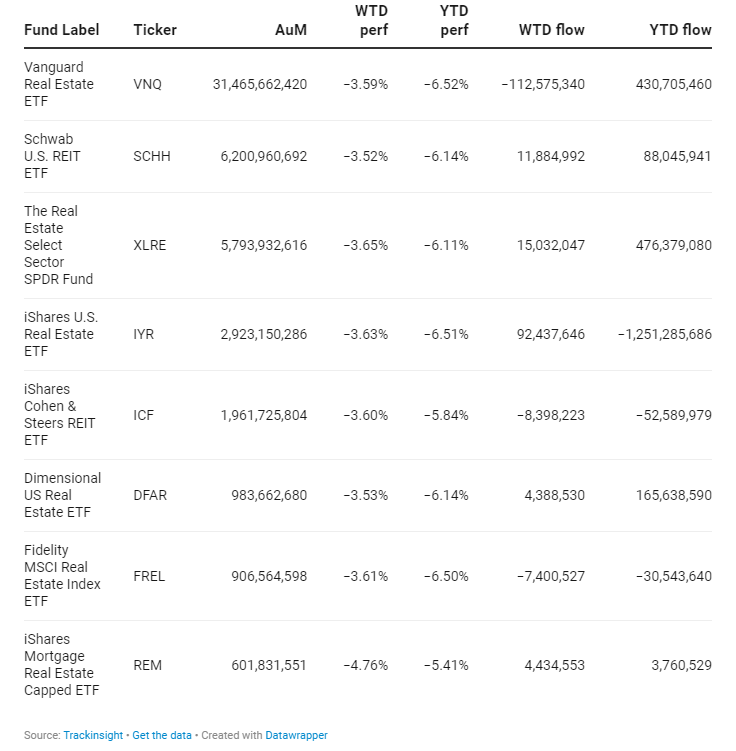

The Vanguard Real Estate ETF VNQ+0.07% and the Schwab U.S. REIT ETF SCHH+0% experienced declines of 3.59% and 3.52%, respectively last week, resulting in their year-to-date performance being -6.52% for VNQ and -6.14% for SCHH. It is pertinent to note that both ETFs have witnessed positive inflows since the start of this year, totaling $430 million for VNQ and $88 million for SCHH.

Group Data

Funds Specific Data: VNQ, SCHH, XLRE, IYR, ICF, DFAR, FREL, REM