The Real Estate sector ranks tenth out of the 11 sectors as detailed in our 2Q18 Sector Ratings for ETFs and Mutual Funds report. Last quarter, the Real Estate sector ranked tenth as well. It gets our Unattractive rating, which is based on an aggregation of ratings of 18 ETFs and 202 mutual funds in the Real Estate sector as of April 10, 2018. See a recap of our 1Q18 Sector Ratings here.

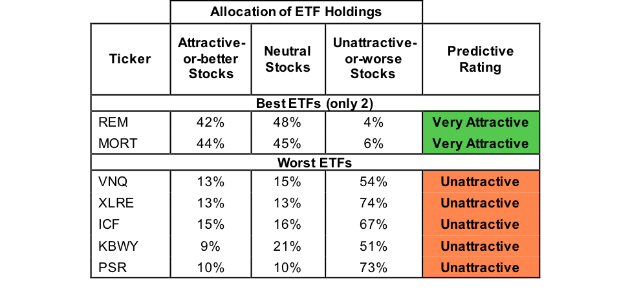

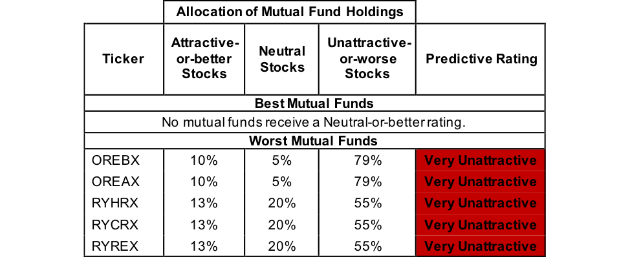

Figures 1 and 2 show the best and worst rated ETFs and mutual funds in the sector. Not all Real Estate sector ETFs and mutual funds are created the same. The number of holdings varies widely (from 22 to 186). This variation creates drastically different investment implications and, therefore, ratings.

Investors seeking exposure to the Real Estate sector should buy one of the Attractive-or-better rated ETFs from Figure 1.

Our Robo-Analyst technology[1] empowers our unique ETF and mutual fund rating methodology, which leverages our rigorous analysis of each fund’s holdings.[2] We think advisors and investors focused on prudent investment decisions should include analysis of fund holdings in their research process for ETFs and mutual funds.

Figure 1: ETFs with the Best & Worst Ratings

* Best ETFs exclude ETFs with TNAs less than $100 million for inadequate liquidity.

Sources: New Constructs, LLC and company filings

Hartford Multifactor REIT ETF (NYSE:RORE) is excluded from Figure 1 because its total net assets (TNA) are below $100 million and do not meet our liquidity minimums.

Figure 2: Mutual Funds with the Best & Worst Ratings

* Best mutual funds exclude funds with TNAs less than $100 million for inadequate liquidity

Sources: New Constructs, LLC and company filings

iShares Mortgage Real Estate ETF (NYSE:REM) is the top-rated Real Estate ETF. There are no mutual funds that receive a Neutral-or-better rating. REM earns a Very Attractive rating.

PowerShares Active U.S. Real Estate Fund (NYSE:PSR) is the worst rated Real Estate ETF and Rydex Series Real Estate Fund (RYREX) is the worst rated Real Estate mutual fund. PSR earns an Unattractive rating and RYREX earns a Very Unattractive rating.

180 stocks of the 3000+ we cover are classified as Real Estate stocks.

The Danger Within

Buying a fund without analyzing its holdings is like buying a stock without analyzing its business and finances. Put another way, research on fund holdings is necessary due diligence because a fund’s performance is only as good as its holdings’ performance. Don’t just take our word for it, see what Barron’s says on this matter.

PERFORMANCE OF HOLDINGs = PERFORMANCE OF FUND

Analyzing each holding within funds is no small task. Our Robo-Analyst technology enables us to perform this diligence with scale and provide the research needed to fulfill the fiduciary duty of care. More of the biggest names in the financial industry (see At BlackRock, Machines Are Rising Over Managers to Pick Stocks) are now embracing technology to leverage machines in the investment research process. Technology may be the only solution to the dual mandate for research: cut costs and fulfill the fiduciary duty of care. Investors, clients, advisors and analysts deserve the latest in technology to get the diligence required to make prudent investment decisions.

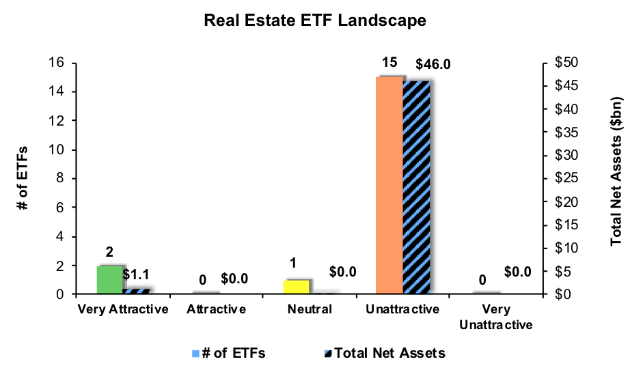

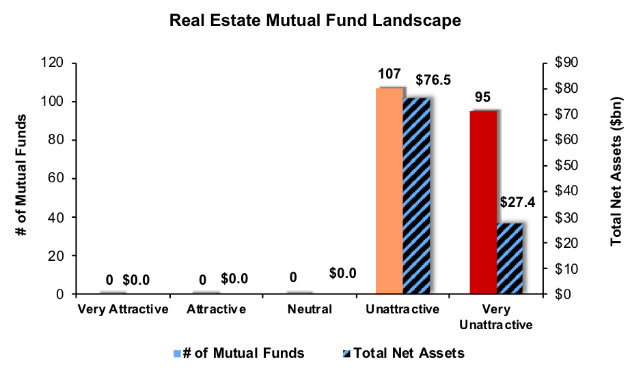

Figures 3 and 4 show the rating landscape of all Real Estate ETFs and mutual funds.

Figure 3: Separating the Best ETFs From the Worst ETFs

Sources: New Constructs, LLC and company filings

Figure 4: Separating the Best Mutual Funds from the Worst Mutual Funds

Sources: New Constructs, LLC and company filings

Disclosure: David Trainer and Kyle Guske II receive no compensation to write about any specific stock, sector or theme.