Investing.com’s stocks of the week

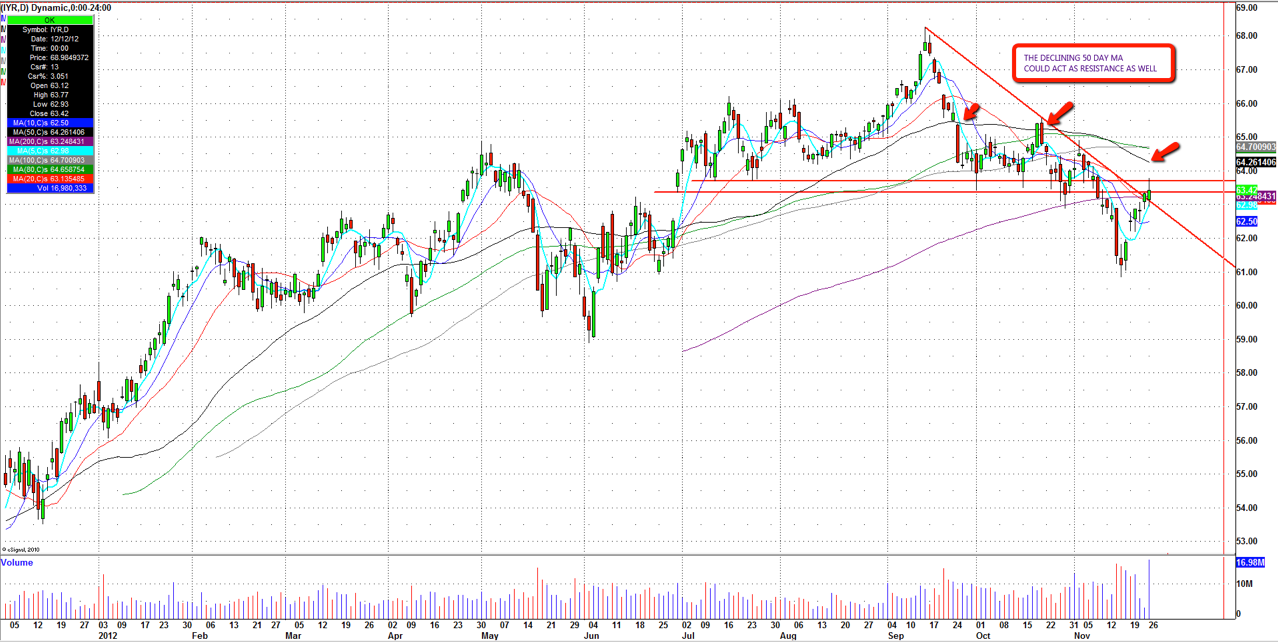

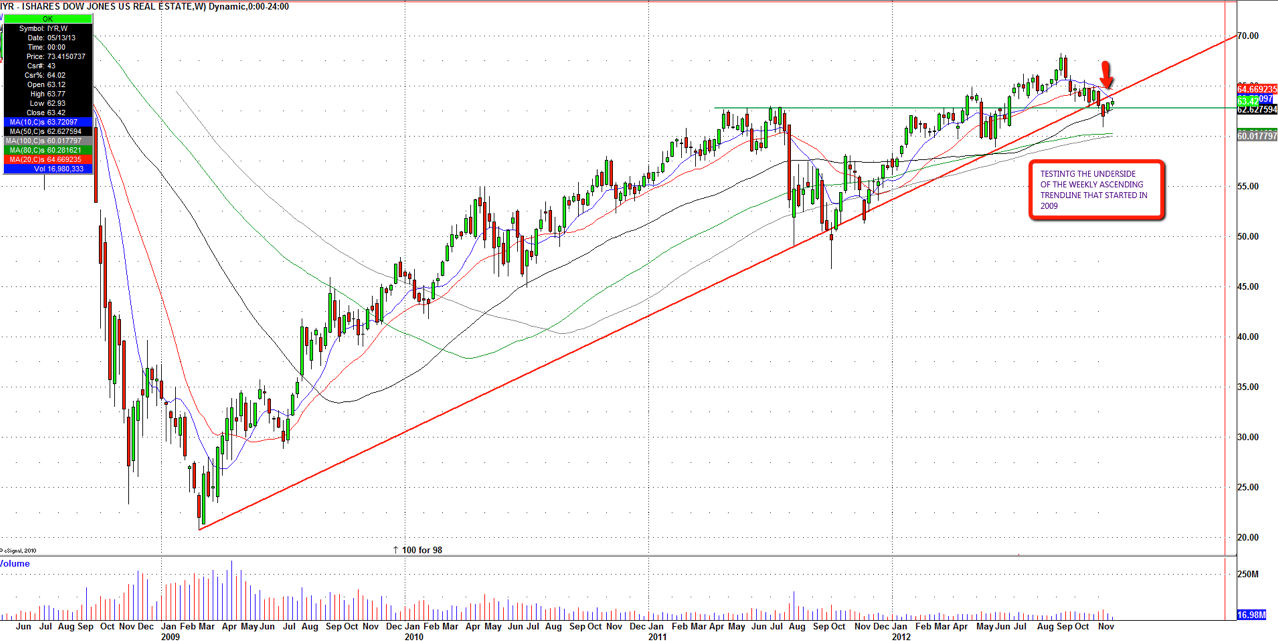

The Dow Jones U.S. Real Estate Index etf (IYR) is testing critical levels. If one is aggressive and believes in shorting, a decent risk-reward opportunity has presented itself. As you can see from the daily chart below, the IYR is testing the $63.50-$64 level, which has acted as a support since the end of June until it finally broke that level on November 8. On the weekly chart it is testing a more significant level, which is the underside of the ascending trendline that started in March 2009. The opportunity lies in a short trade against a closing move above the declining 50-day moving average ($64.25) and the first target will be a retest of the recent low, $60.84. Direxion Daily Real Estate Bear 3X Shares (DRV) is 3x IYR inverse ETF. Currently 95% of the stocks within the IYR are trading above their 10-day moving average and its up five out of the last six days.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.