Federal Reserve Chairwoman Janet Yellen, in a speech given in Chicago, last Friday, March 3rd, 2017, suggested that the Fed will likely resume raising interest rates later this month.

Yellen also said that the Fed expects steady economic improvement to justify additional rate increases. While not specifying how many rate hikes could occur this year, Dr. Yellen noted that Fed officials, in December, had estimated that there would be three in 2017. The Fed's next meeting will occur on March 14th to 15th, 2017. They will “evaluate whether employment and inflation are continuing to evolve in line with our expectations, in which case a further adjustment of the federal funds rate would likely be appropriate.” Our personal bias is that the Fed will raise rates again.

Brad McMillan, Chief Investment Officer at Commonwealth Financial Network, noted “The real takeaway here is if the Fed is willing to start moving, they see the economy as not only doing better but likely to do better going forward. The Fed is notorious for waiting until the evidence of growth is absolutely undeniable.” The ECB is running out of corporate and public bonds to purchase, so now they are looking to buy stocks.

The Next Real Bubble Is In Commercial Real Estate!

The coming financial implosion is not going to be about the large global banks. It will be concentrated on Insurance Companies, Pensions Plans, Trusts and Endowments and small banks and credit unions. These are the institutions with the bulk of their invested assets in some form of U.S. commercial real estate!

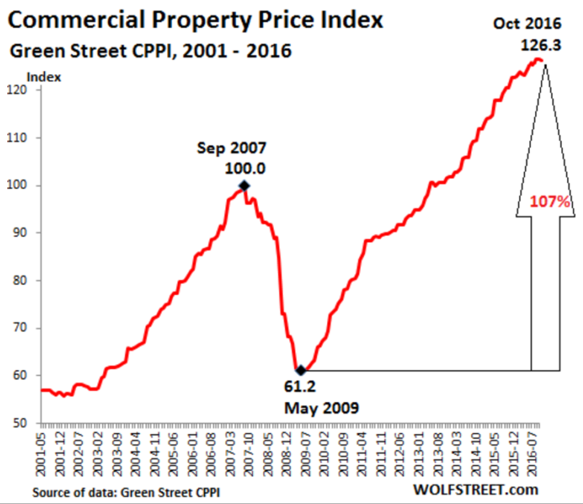

The availability of cheap debt has propelled property investment sales. The Federal Reserve has kept interest rates at historically low levels. Is the era of cheap money coming to an end? It can’t last forever! When interest rates begin to climb up quickly and unexpectedly, that will put pressure on investors’ interest in commercial real estate assets. Only if the Fed maintains its’ status quo, will the real estate market remain stable.

Fitch rating company estimates that if interest rates rise at a quicker-than-expected pace, borrowers, on most of those loans, will not be able to refinance. These under-performing assets borrowers may be forced to come up with extra equity to cover valuation gaps. Where will they get the money from? This is the weak link in the chain in regards to the global economy.

U.S. Capital Trends shows “Commercial property deal volume fell last January 2017, 47% YOY. This was the sharpest monthly decline since the depths of the downturn in 2009.” The big money has radically cut back on investing in commercial property.

Prominent real-estate investors are reducing their holdings and I believe that they sense this eight-year bull market for U.S. commercial property is coming to a halt.

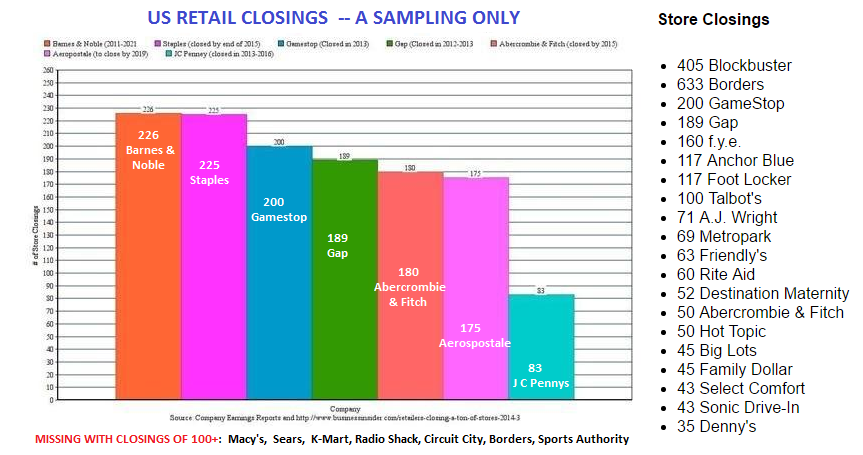

“In my opinion, the housing bubble of the mid 2000s allowed consumers to take out tons of cash from their homes and spend robustly even though incomes were stagnant. This masked the over-stored nature of the retail landscape.”

-Mr. Ken Perkins, the Head of Retail Metrics

Peter Rothemund, Senior Analyst at Green Street Advisors said: “Property pricing appears to have reached a plateau. Cap rates are slightly higher than they were three months ago, but growing rental income has offset that — values have been steady.”

Game Over? No Way – New Opportunities!

Gold is setting up for a historic rally based on our analysis. Recent news reports provide further evidence that the Precious Metals and Currencies are in for a wild ride.

Allow us to position you in the right asset class (stock or ETF), at the right time, to help grow your portfolio. Gold is still flying under the radar today and the stock market is not a one-way trip up. Regardless of where all the markets are going, trading and focusing on my Momentum Reversal Method (MRM) and trading only the hot stocks and sectors, for quick oversized gains, is my expertise. Therefore, these momentum trades are moving significantly in one direction on heavy volume. The length of time for which I may hold a momentum trade depends on how quickly the trade is moving — with trades lasting 3-25 days in length and then I look for a 7%- 35% potential gain.