Quiet action for the most part in stocks but I am seeing some signs of strength to come in the short-term and you can find out more on that at my free blog.

As I’ve said, I will be retiring my newsletter business the end of September and just trading, living, travelling, and I will still write when I see something worthy of words.

Time is expensive, spend it wisely.

The metals may be ready to take a turn higher after a nice healthy rest so let’s check the charts.

Gold fell 2.09% as the normal correction played out.

The 50 day moving average has provided some support to gold and it’s trying to turn now.

A break of the downtrend line would be confirmation of this view so let’s see what Monday brings.

I think it would be a solid move to go long on a break above $1,300 with tight stops near cost.

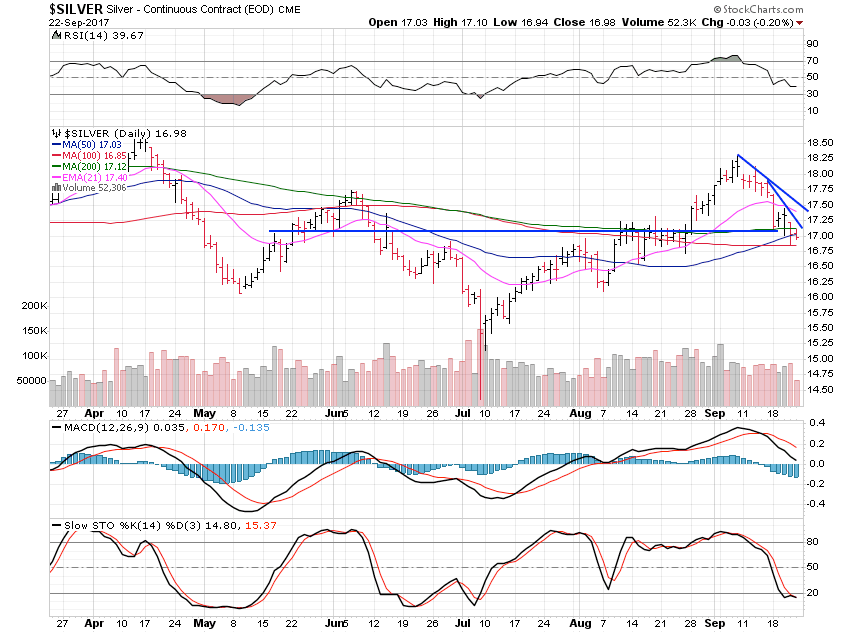

Silver slid a hefty 4.05% and is now at the $17 support level.

Let’s see if we turn up as we should from this support zone.

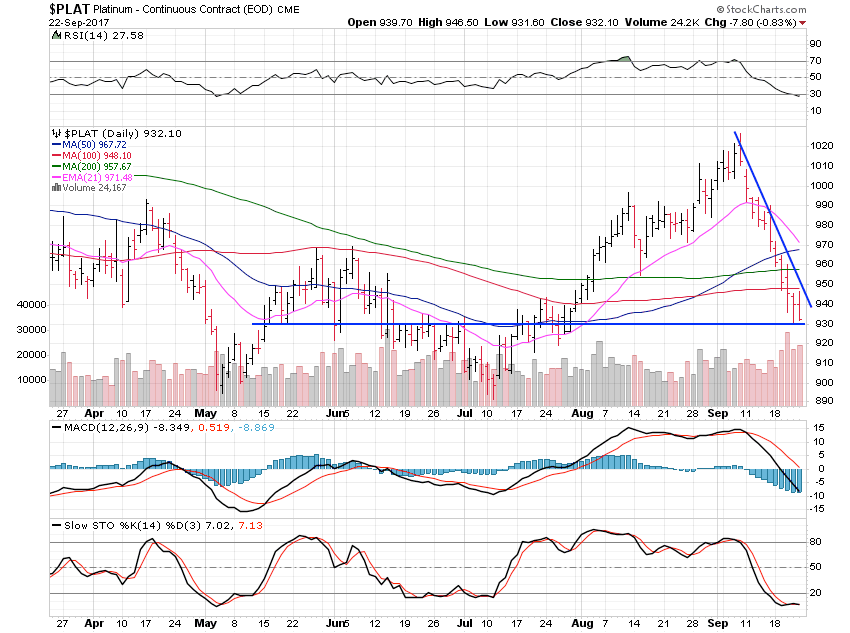

Platinum was the biggest loser this past week dropping 4.09%.

$903 is a big support area for platinum as well so let’s see if we can make the turn, as we should.

Palladium was flat losing just 0.21% and is starting to turn higher.

A break of this downtrend channel would be great and point to a move back to $980 where rest would likely be due.