One of the most widely discussed stocks right now is Apple (AAPL) given its recent correction after hitting a high of $705 on 9/21. What has caused many investors to take notice is the fact that the stock has also declined beneath its 200-dma, perhaps the most popular of all technical indicators.

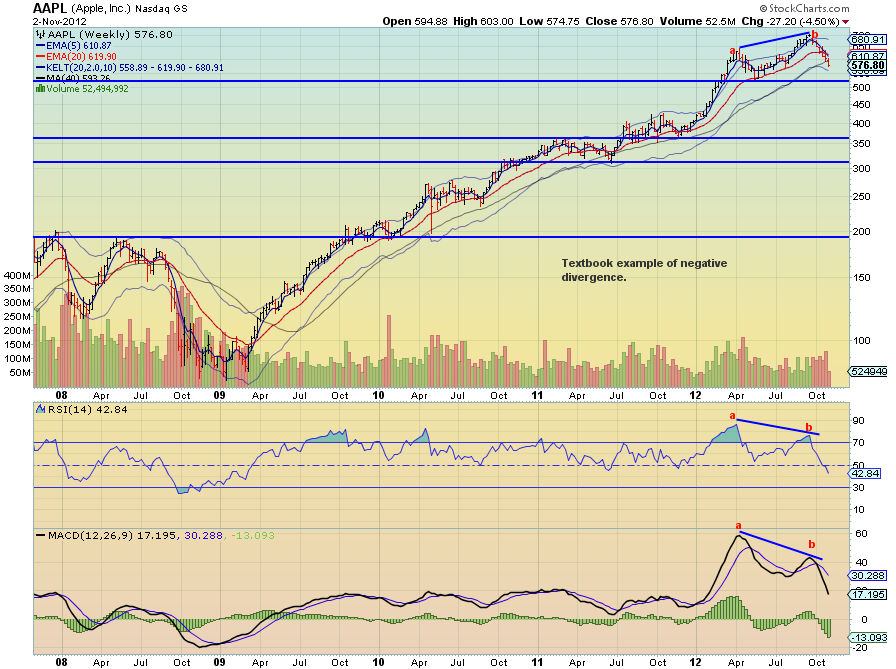

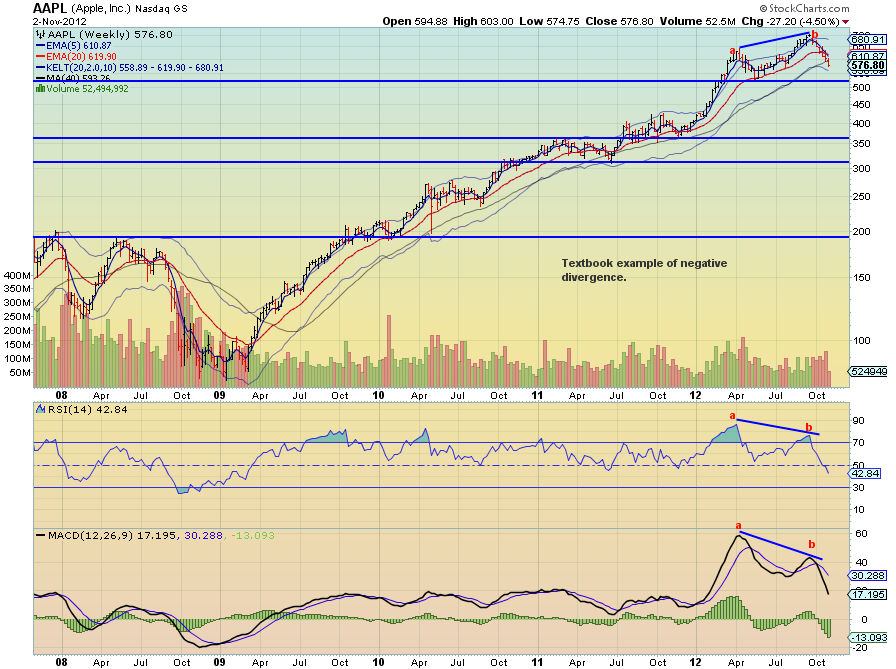

While the recent decline in AAPL may have surprised some investors, it should not have. One of the very first things I learned in my studies of technical analysis was to look for divergences…negative divergences at tops and positive divergences at bottoms. AAPL has just provided us with a textbook example of a negative divergence.

The above is a weekly chart of AAPL going back a few years. Note that when the stock recently peaked at its high how both RSI and MACD created classic divergences by failing to reach their own respective new highs. Folks, they don’t make them any more obvious than this.

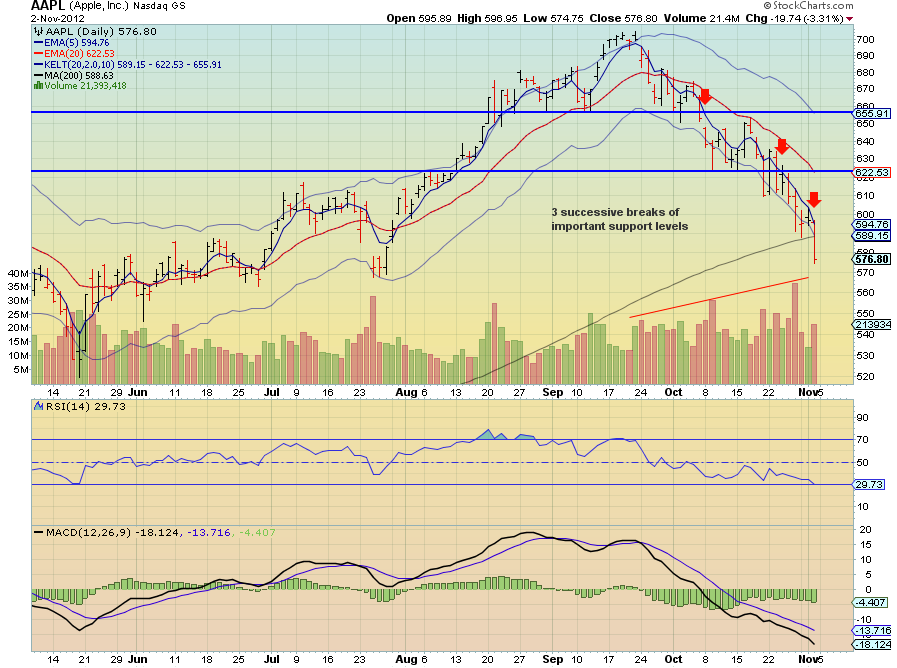

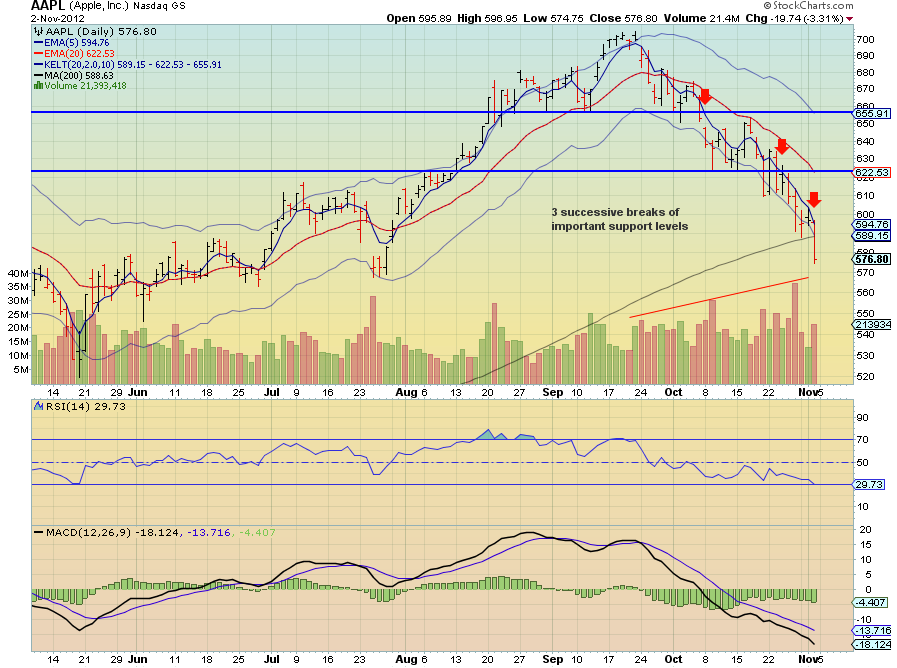

The final nail shows up on the daily chart:

After prices peaked at over $700, observe how the first pullback paused around the $655…a level the stock had also paused at on its ascent. The stock next actually gapped lower, tested the $655 area again, (now resistance) and established a temporary floor around $620.

Once that level gave away, prices have quickly now come down to test (and penetrate) the all-important 200-dma. And while I dont have it pictured, I will point out that on a Point-and-Figure chart AAPL has also issued a successive series of sell signals at $655, $625, and again at $610. Will prices continue lower? I think so.

On the weekly chart I have placed levels which I think will attract some buying interest. I don’t necessarily think the market will make a beeline for these levels but for right now all you need to know is that supply is greater than demand.

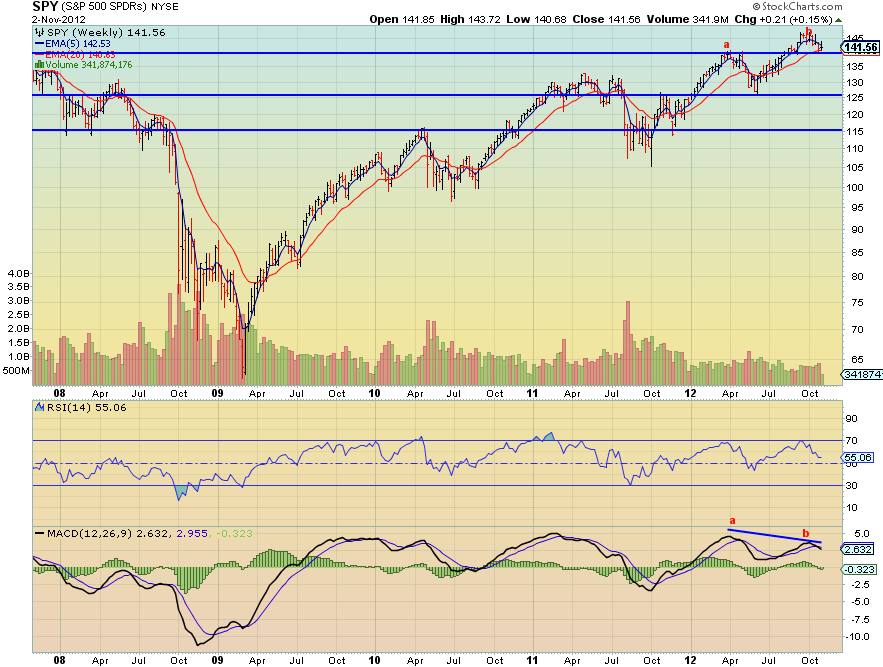

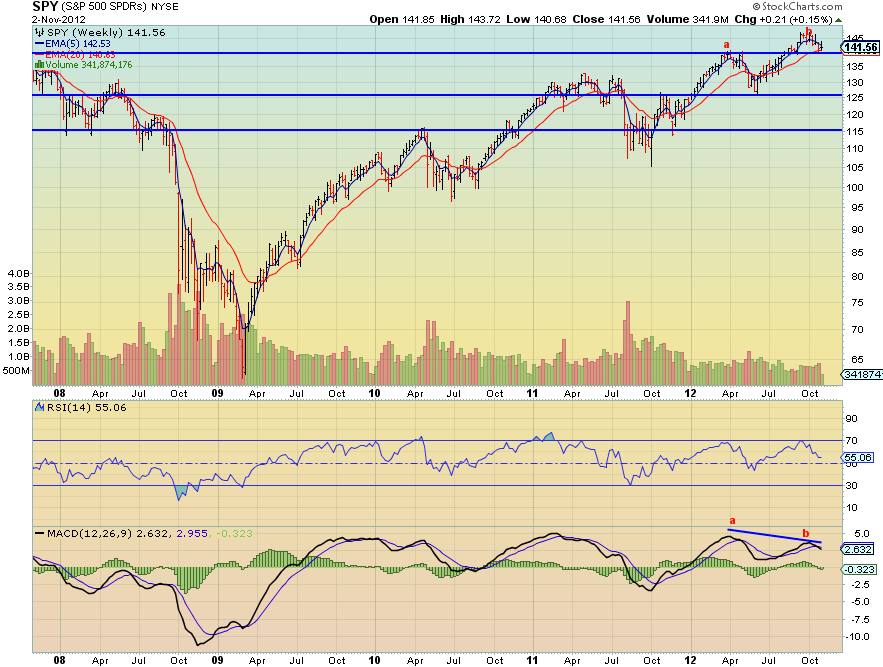

It’s hard to comment on AAPL without also taking a look at the broader markets. When a recent market leader is taken to the woodshed, what does that portend for the general market. Not surprising, the action in AAPL and the general market closely parallel each other. Below is a chart of the SPY (SPDR S&P 500).

The $140 level in the SPY is vitally important to the health of the market. I think it is no surprise that the market has been testing that level over the past week. I do believe that the next test, which could occur this coming week, will fail and lead to lower prices. I have indicated some levels that should offer some initial price support.

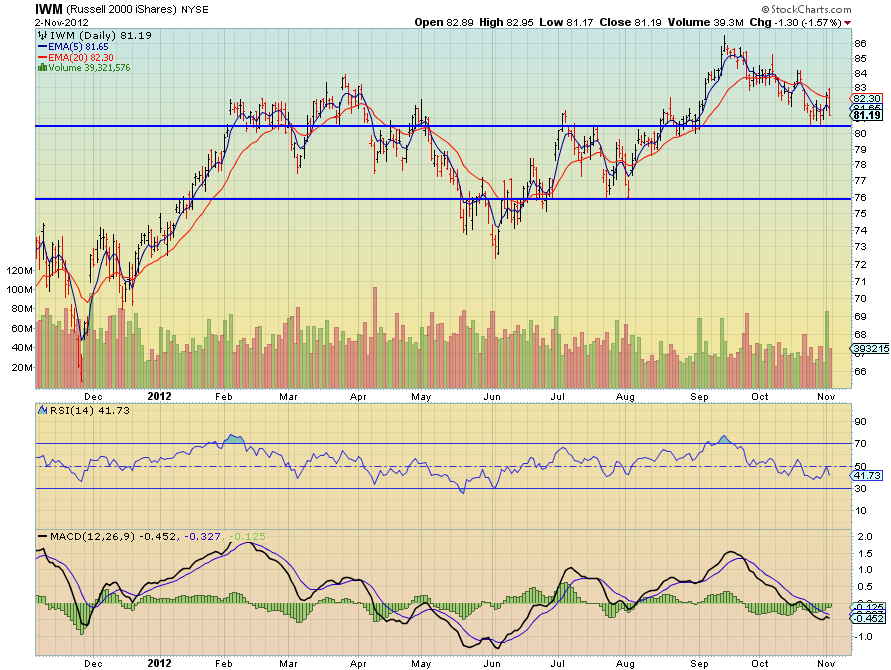

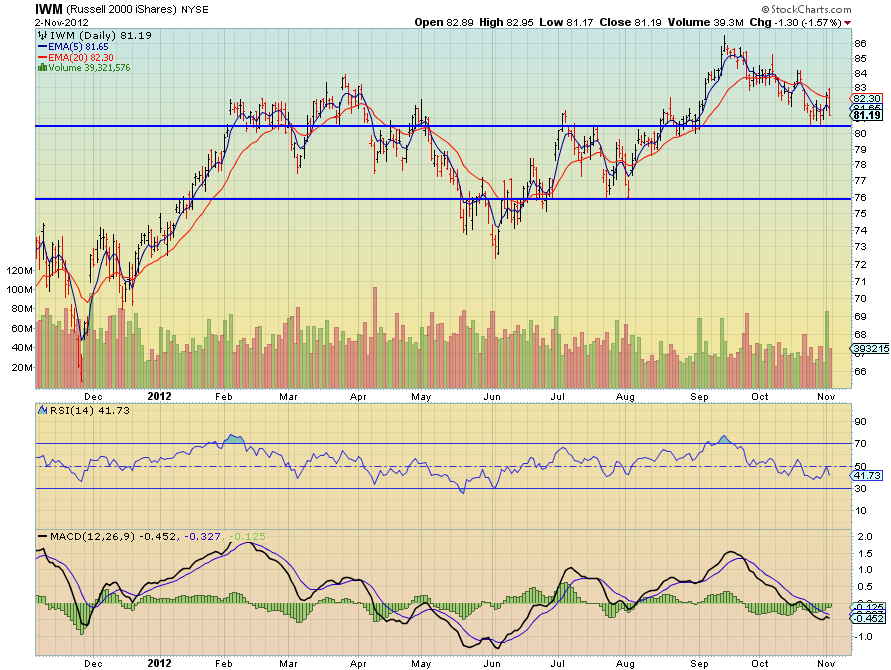

The same pattern is uniform across the market. Here is the Russell 2000 (IWM):

Below $80 should bring forceful selling in the smallcaps. Investors looking to hedge might want to consider RWM (ProShares Short Russell 2000).

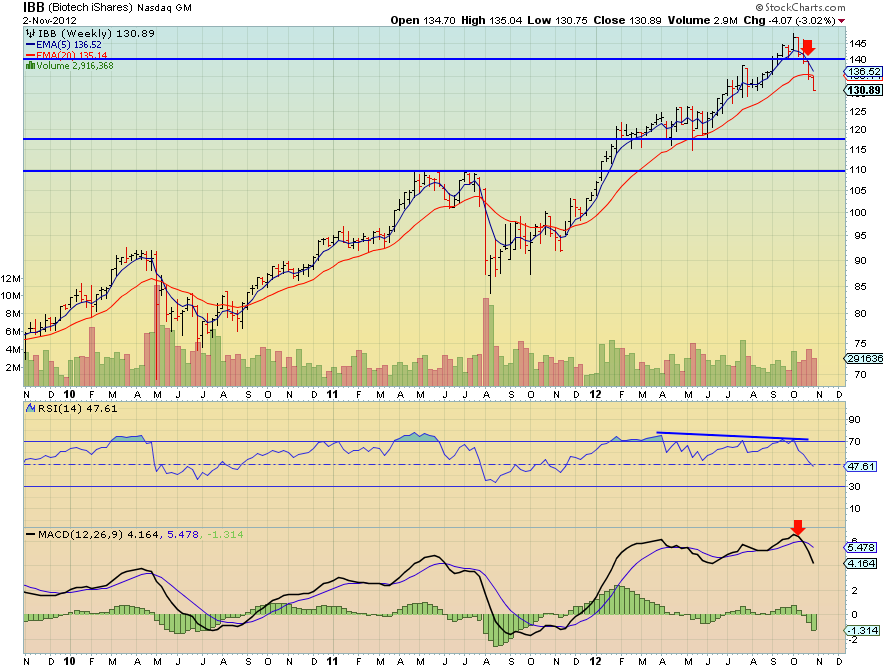

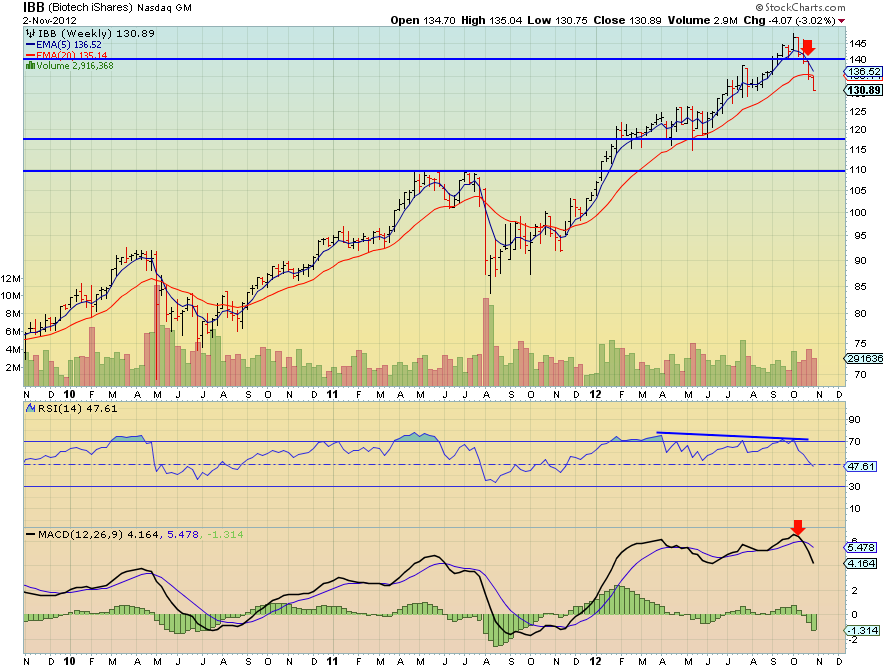

The biotechs, one of this year’s leaders, are also showing signs of breaking down:

It is not uncommon to see the higher beta areas of the market lead on the downside. Within the biotech sector I have spotted a number of really nice shorting opportunities. ETF investors may want to consider (BIS), (Proshares Ultrashort Nasdaq Biotechnology).

While the recent decline in AAPL may have surprised some investors, it should not have. One of the very first things I learned in my studies of technical analysis was to look for divergences…negative divergences at tops and positive divergences at bottoms. AAPL has just provided us with a textbook example of a negative divergence.

The above is a weekly chart of AAPL going back a few years. Note that when the stock recently peaked at its high how both RSI and MACD created classic divergences by failing to reach their own respective new highs. Folks, they don’t make them any more obvious than this.

The final nail shows up on the daily chart:

After prices peaked at over $700, observe how the first pullback paused around the $655…a level the stock had also paused at on its ascent. The stock next actually gapped lower, tested the $655 area again, (now resistance) and established a temporary floor around $620.

Once that level gave away, prices have quickly now come down to test (and penetrate) the all-important 200-dma. And while I dont have it pictured, I will point out that on a Point-and-Figure chart AAPL has also issued a successive series of sell signals at $655, $625, and again at $610. Will prices continue lower? I think so.

On the weekly chart I have placed levels which I think will attract some buying interest. I don’t necessarily think the market will make a beeline for these levels but for right now all you need to know is that supply is greater than demand.

It’s hard to comment on AAPL without also taking a look at the broader markets. When a recent market leader is taken to the woodshed, what does that portend for the general market. Not surprising, the action in AAPL and the general market closely parallel each other. Below is a chart of the SPY (SPDR S&P 500).

The $140 level in the SPY is vitally important to the health of the market. I think it is no surprise that the market has been testing that level over the past week. I do believe that the next test, which could occur this coming week, will fail and lead to lower prices. I have indicated some levels that should offer some initial price support.

The same pattern is uniform across the market. Here is the Russell 2000 (IWM):

Below $80 should bring forceful selling in the smallcaps. Investors looking to hedge might want to consider RWM (ProShares Short Russell 2000).

The biotechs, one of this year’s leaders, are also showing signs of breaking down:

It is not uncommon to see the higher beta areas of the market lead on the downside. Within the biotech sector I have spotted a number of really nice shorting opportunities. ETF investors may want to consider (BIS), (Proshares Ultrashort Nasdaq Biotechnology).