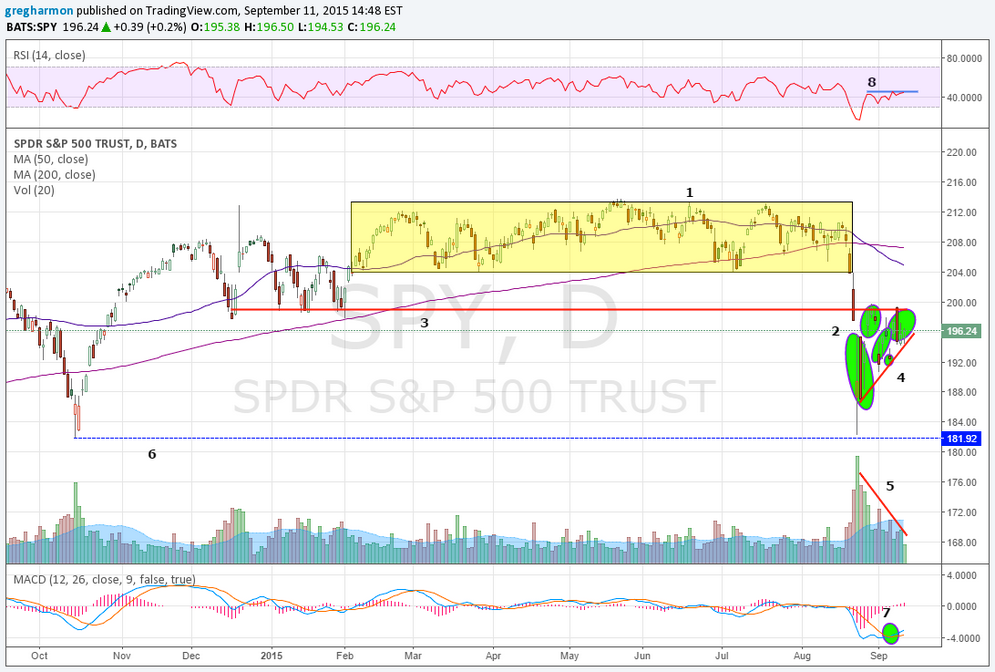

Below is a quick chart of the SPDR S&P 500 (NYSE:SPY). There's a lot going on, but here's the bottom line in 8 bullet points:

1. It fell out of a long narrow consolidation. Long consolidations can lead to increased volatility and even trend moves.

2. There are a lot of Islands. 2 more and we have Hawaii. These show the choppiness visually but also tell of open gaps. More chop will likely fill them.

3. Support becomes Resistance. The support level from December and January is now resistance. A move over that would be significant and positive.

4. Ascending Triangle. The recent series of higher lows is making an ascending triangle, which often resolves higher. It would target a move of 12 points on a break.

5. Volume is trending lower. Is the sell-off showing signs of exhaustion?

6. Never below October 2014 major low. Not lower low, so still an uptrend.

7. MACD cross up. This is a positive divergence and to some a buy signal.

8. RSI has rebounded and is testing mid line. A cross above the mid line is a bullish signal.

The signs are indicating that something will happen very soon. Will it reverse up? Perhaps. Many signs are biased that way. But something could still drive a continuation lower.

Watch, prepare and react.