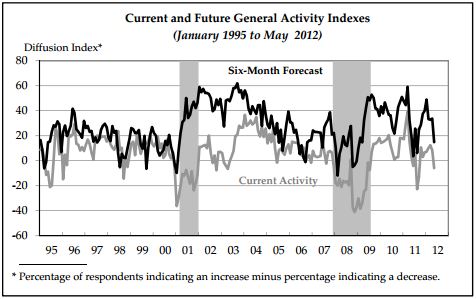

The Philadelphia Fed Manufacturing Index is a monthly survey of Philadelphia-area manufacturers. Firms report on how business conditions have changed for a number of indicators, including production, new orders, employment, prices and company outlook. The Index is primarily a regional survey, but its key indexes are highly correlated with state-level measures of business activity and employment. According to the Phili Fed Index, general business activity in May decreased to -5.8 from 8.5 in April. that was worse than the expected estimate of 10.0, and was essentially bearish for the manufacturing sector and negative for general economic growth in the United States.

According to the report, firms responding to the May Business Outlook Survey indicated that manufacturing growth fell back from the pace of recent months. The survey's broad indicators for general activity fell into negative territory for the first time in eight months. Indicators for new orders and employment also suggested slight declines from April. Input-price pressures were less in evidence this month, and for the first time in nine months, more firms reported price declines for their products than reported increases. The survey's indicators of future activity remained positive but weakened considerably from April. The future general activity index fell notably, from a reading of 33.8 in April to 15.0 in May. The indexes for future new orders and shipments remained positive but fell 9 and 10 points, respectively. While still positive, the future employment index showed notable deterioration this month, decreasing 17 points.

ACTION ITEMS:

Bullish:

Traders who believe that the Phili Fed Index is a leading indicator for the U.S. economy might want to consider the following trades:

- Long general industrial companies (NYSE: XLI) like Illinois Tool Works (NYSE: ITW) or Caterpillar (NYSE: CAT) as these companies will benefit from increasing industrial production.

- Also, long Consumer Discretionary companies like Target (NYSE: TGT) or the Consumer Discretionary ETF (NYSE: XLY)

Traders who do not believe that the Phili Fed Index is a leading indicator for the U.S. economy might consider alternative positions:

- Long Consumer Staple companies like Procter & Gamble (NYSE: PG) and Colgate (NYSE: CL) because even if the economy is struggling, people still need to buy staple products like shampoo and toothpaste.

- Also, short big-ticket appliance makers like Whirlpool (NYSE: WHR) if the manufacturing trend is worse-than-expected.