- 'Risk on' is the name of the game after the U.S. budget deal and long yields are testing recent range highs. However, the deal is fragile and considerable uncertainty remains.

- The Riksbank's minutes and a lot of domestic data are on the agenda for next week. The prospects for a cut in February are ice cold after November lending to households accelerated.

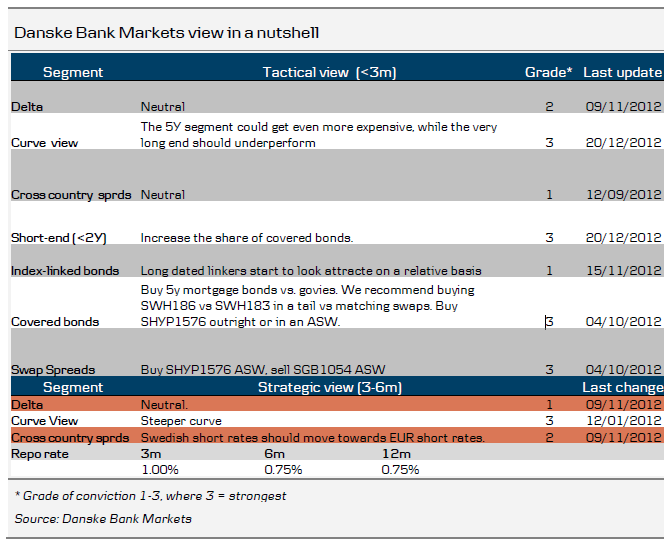

- Diverging trends in mortgage and government bond supply continue to justify tighter mortgage spreads and a steeper govvie curve.

Fragile Budget Showdown

The budget deal in the U.S. has boosted the world’s stock markets and long-term interest rates at the beginning of the year as the full impact of the fiscal precipice was, at least partially, averted. It is noteworthy that U.S., German and Swedish 10-year rates all traded in the upper part of their recent (multi-month) ranges. It will probably require a lot in the short term to push interest rates up further from here. In view of the rapidly rising supply in long maturities this year, we find Swedish long-term interest rates unattractive.

To Read the Entire Report Please Click on the pdf File Below.