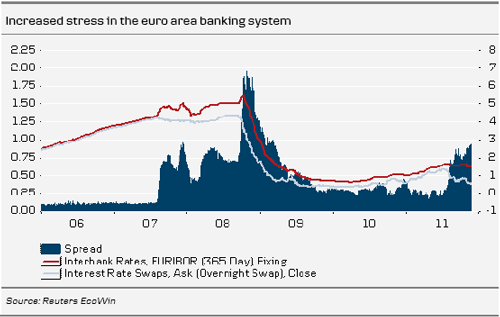

Unfortunately, the European debt crisis has probably prevailed for too long without politicians being able to come up with a comprehensive strategy for how to deal with mounting debt. The European banking system is under increased stress and banks are becoming even more dependent on term funding via the ECB.

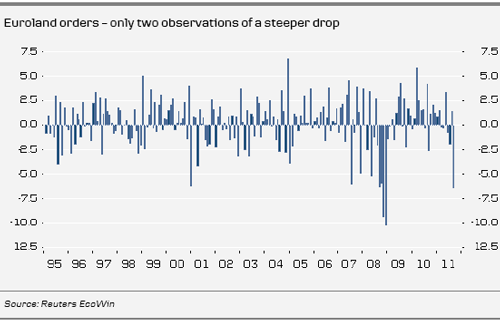

Contagion is spreading fast with widening risk premiums on France, Italy and Spain to mention but a few. Political tension between France and Germany is surfacing. The market is hoping for: (a) surrender by the ECB, with the central bank declaring that it is prepared to buy European debt on a significant scale, i.e. to act as lender of last resort, and/or (b) Germany to give up its resistance against issuing eurobonds (or stability bonds or solidarity bonds or whatever). Both ideas are heavily supported by France and equally rejected by Germany. It appears increasingly probable that euroland has gradually entered “recession mode” in Q4. The sharp fall in European industrial orders (6.4%) in September is a serious warning.

Of course, there is a chance that the number is an outlier but it is worth considering that there are only two earlier observations when orders showed a larger decline in one month namely November and December 2008.

However, if it is not a matter of an outlier, we should be prepared for worse order data in Sweden too. A standard OLS estimation shows a correlation of about 80%. In spite of market mistrust concerning politicians’ ability to cope with the crisis, many governments including France, Italy and Spain have made decisions to undertake significant austerity measures next year and that will undoubtedly weigh on economic activity. The ECB is the only institution that is able to moderate pressure on demand by easing rates further and probably support the financial system by offering even longer term funding facilities. However, the banking sector will also dampen demand going forward, because higher capital requirements are likely to mean tighter credit conditions.

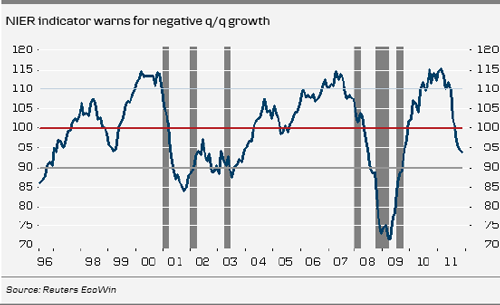

For Sweden, our baseline scenario has until now been that a clear-cut recession can be avoided but since Europe must start to address the debt crisis – and that will take time – growth is likely to be below par for several years. One obvious risk to that scenario is that consumer confidence deteriorates to an extent that makes businesses and consumers more or less passive. This risk, unfortunately, appears to be materialising and, therefore, it will probably be hard to avoid at least a mild recession in Sweden too. In fact, the NIER economic tendency indicator (94.0 in November) is already at a level that has typically been followed by negative q/q growth (see grey area in the chart below).

Our preliminary fourth-quarter GDP forecast is -0.1% q/q. Still, we have hope that consumer spending can keep a decent pace. On the other hand, a contraction in export volumes is likely and that would be a clearly negative factor for business investments and inventories. So, we have reduced our 2012 forecast to -1% and we suspect that 2013 will also be a meagre year. Consequently, employment falls by some 1.5% next year and unemployment increases to almost 9%. We have also made some significant revisions to our inflation projection (see separate section), which in short suggests a substantial decline in inflation in 2012.

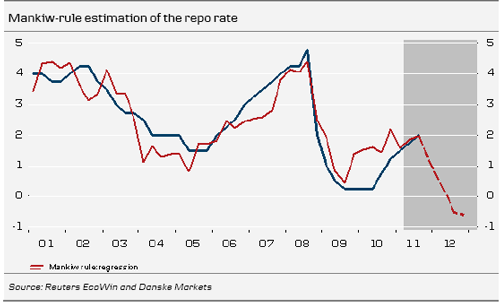

This has important implications for our view on monetary policy. Our reading of the latest monetary policy report is in short: a solution to the European debt crisis could be found and then things will improve or the debt crisis could get worse – so wait and see. Things since have not improved, they have become worse. Sovereign credit spreads have widened, plans to boost the European Financial Stability Facility (EFSF) seem to have stalled, banks are under increasing stress and the ECB is talking about a mild recession and has cut rates, which the Riksbank did not expect. US data have admittedly been somewhat better of late but there too politicians are in a deadlock as far as reaching a deal on how to curb debt is concerned. China is gradually slowing.

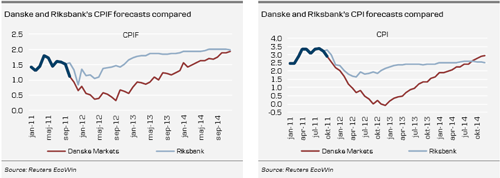

Against this background, we think it is time for the Riksbank to make up its mind. Our guess is that it will start easing as soon as December (25bp is probably the best guess), with further cuts towards a repo rate of 50bp by autumn. In addition, we believe that central banks, including the Riksbank, will have reason to maintain such low rates for a considerable period of time. Indeed, using our forecasts for inflation and unemployment as input in a standard Mankiw rule estimation of the policy rate suggests a repo rate below zero.

Swedish inflation towards zero in 2012

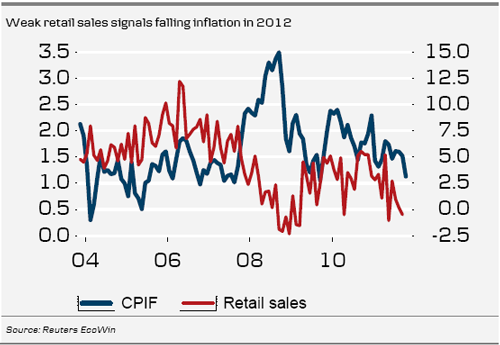

Our view that Swedish inflation will be in recession in 2012 is of course an important explanation for the considerably lower inflationary pressure we forecast. More specifically, it is the gradually weaker development in the retail sector that will put downward pressure on core CPIF inflation. The low outcome in October came as a surprise and closer analysis reveals that 11 out of 15 price components turned out lower than forecast, a few of them even indicating falling prices. Surely, part of this is probably related to the mild weather but it is also probably the case that consumers are less prone to spend against the background of the accelerating eurozone debt crisis. It seems likely that consumers anticipate a risk of rising unemployment at the same time as prospects for stocks and house prices are still very shaky. In our view, this perception is not likely to change in the near term. To this, we have to add that consumers are putting an unusually large share of their income into interest payments, which can be interpreted as monetary policy being tight.

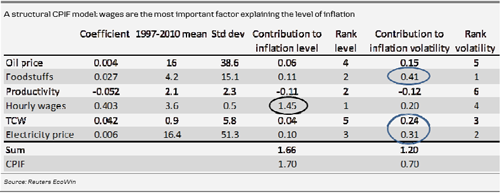

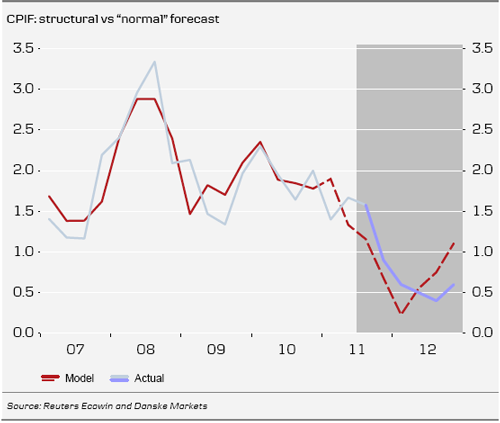

A factor that has the potential to complicate the picture is wage gains. Taking mediators’ proposal for industry wages, which was dismissed by both employees’ and employers’ organisations, as a starting point for how core CPIF inflation might be affected, it supports the view that inflation pressures will fall. The bid was 3.9% over 22 months including a 1% wage revision. Adding to this that other sectors are likely to have 0.5 % higher demands and that there is wage drift of the same order, we get to a figure of 3% per year. A structural inflation model reveals that wage increases are the single most important factor for the level of CPIF inflation. The table below shows that wages “explain” 1.45 percentage points of the average 1.7% CPIF inflation, while other factors are more important in explaining the swings in the inflation rate (volatility). The model, which is estimated for 1997-2010, says that the impact of wages is 0.4, i.e. a wage increase of 3% would give a 1.2 percentage point contribution per year to CPIF over the next two years. The model forecast is, however, lower than this due to our assumptions for the other variables

Our “usual” inflation forecast (not the model mentioned above) has a few downside risks. First, we make a very cautious assumption about the impact of the reduced (actually halved) VAT on restaurant prices in effect from January, namely that prices will not be affected at all. In principle, prices could fall some 10%, hence the downside risk. Second, turning to CPI, there is a January “reweighting effect” for the mortgage cost component. This has been significant over the past two years. We assume there will be a smaller negative effect this time. This is partly because the weight for the mortgage component will fall slightly again (shifting to 2010’s consumption pattern), partly because of internal base changes for price and volume components between loans with different maturities and because we assume the Riksbank will cut the repo rate starting in December. The eurozone debt crisis, recession and a CPIF far below the Riksbank’s current inflation forecast suggest to us that the Riksbank will make significant rate cuts in 2012, pulling down mortgage costs and, hence, also CPI.

We estimate inflation turns up again by the end of 2012 but during the course of the year we expect CPI to touch zero and CPIF to hit record-low levels.

We hold on to our established view on the market

Lower inflation and its eventual impact on Swedish growth are likely to force the Riksbank to act in a manner not yet priced in by the market (see earlier text on the Riksbank). So, we stick to our guns and recommend receiving in the FRAJUN12 contract and buying 2-year mortgage bonds, which tend to outperform once the Riksbank starts to cut rates. So, the way is open for lower short rates in Sweden. At the other end of the curve, things are more complicated as correlation with the natural hedge for years is challenged. The disastrous Bund auction yesterday has set old relationships at stake. Both yesterday and today Swedish rates are down, whereas German bond yields are higher. This is a very uncommon move. The 10-year spread has been stable and correlation has been between 0.8 and 1.0 for years. If this has altered on a permanent basis, it is likely to have a big impact on the Swedish fixed income market and on what to expect going forward. One thing worth mentioning is that during the last year we have heard more and more domestic investors arguing for moving holdings and hedges from euroland back to Swedish fixed income instruments. There is a palpable risk that these flows will accelerate. For instance, EUR swaps have been a good hedge for Swedish L&Ps over the years. Will this continue to be the case in the future? Repatriation flows might intensify. Add to this that more and more foreign investors are seeking for safe havens – shunning European bonds and looking at Nordic markets as alternative markets. Hence, this supports our positive view on Swedish bond rates.

If the sour sentiment in German bonds continues, resulting in a steeper bond curve, it will probably influence the shape of the Swedish curve towards a steeper one and pushing spreads wider still, i.e. outperformance of Swedish bonds. Despite spreads at lows, 10- year at -56bp, we do not see anything for the moment that will halt the move unless the sentiment in German bonds improves significantly. So, what is the risk that the market has overreacted on the auction? Well, first, the markets always tend to overreact. Nevertheless, markets are nervous and the auction was nothing else than a disaster. Having said that, remember that we are getting close to year-end and, traditionally, a new 10-year Bund is not launched so close to year-end. Moreover, normally the first auction in a new 10-year bund is not really impressive and many recent Schatz, Bobl and Bund auctions have had low b-t-c. So, low liquidity in combination with turmoil in euroland is not a good environment to sell 10-year debt at historical low rates. German bonds are clearly trading special in the repo market and T-bills now trade negative, indicating that this is not reflecting problems in Germany but rather a euro issue.

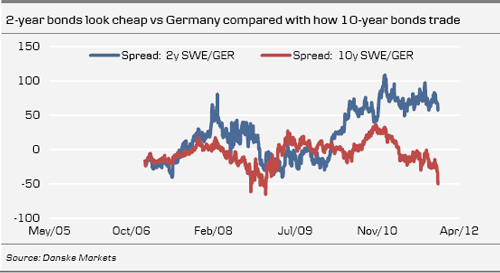

We suspect that some investors have big profits in German bonds to pare losses from peripherals this year. So what to do as we near year-end and you start losing money in your unrealised profits? We guess that some will be tempted to realise profits, pushing yields higher still. Forcing more to act? Starting off a spiral? We will have to wait and see how things unfold. In our view, Sweden will probably continue to outperform and, given our view on the Riksbank and current pricing, we see most potential in shorter bonds, both against German and longer bonds. Longer spreads have plummeted over the last few days and trade close to multi-year lows, whereas the 2-year bond spread is not particularly tight in a historical context – see chart. We do not expect this to prevail, as we believe more is likely to be priced in terms of rate cuts. Add the safe haven and repatriation flows and we see room for the Swedish 2-year bond yield to decline more. We have moved our profit target on the 2-year spread (2DEC11 versus SchatzDEC11) from +57bp to +35bp, now +41bp. The stop/loss level is altered to +48b, thus locking in a profit of 22bp. We also shift targets in the FRAJUN12 and SHYP2DEC11, as we have reached profit targets (see table at the back).

Curve steepening and short covered bond performance ahead

Our new Riksbank forecast implies steady rate cuts over the course of next year. We therefore see value in the Swedish short-end. In the longer run, we expect a near convergence of policy rates between the eurozone and Sweden. Moreover, SGB1041 already trades dear in the repo market and will remain under pressure due to the lack of material in the short-end. In our view, steeper curves are clearly on the cards.

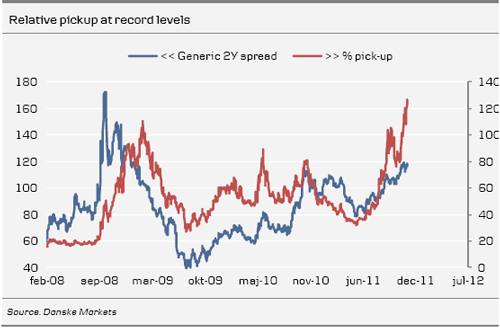

However, we believe that short-dated covered bonds could outperform government bonds. The relative pickup in covered bonds relative to government bonds is already at record levels at 127%. If government rates continue to decline, the relative pickup would rise to near absurd levels if covered bond spreads remained unchanged. In an environment with a very low repo rate, it is, in our view, likely that investors would look for some kind of pickup.

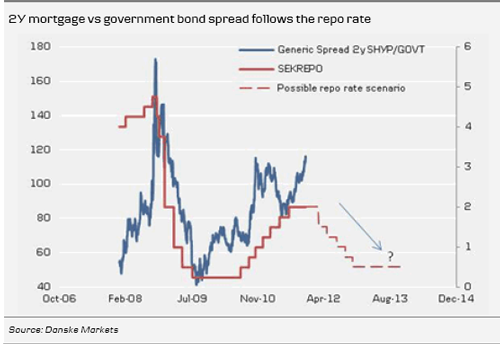

Historically, the mortgage versus government spread has tightened significantly once the Riksbank has actually cut rates. Pricing in future cuts has not been enough to get significant spread performance. Our conclusion is that actual repo funding costs play a very important part in determining the spread. With a sharply lower repo rate, repo rates on covered bonds would fall substantially. Covered bonds in the mid-2013 segment (SHYP1574, SEB566, LF505, NDH5525, SWH177) currently give a slightly negative carry of around -2bp per month. If repo funding were halved to 1.2%, the carry would amount to a more appealing 4bp per month. The roll-down, already positive in this segment, would also improve. Real-money investors would have a large incentive to overweight short-dated mortgage bonds. The alternative for getting a yield pick is to go far out on the government curve and buy govvies at levels that are far from appealing in a long-term perspective.

Worth thinking about is also how the Swedish FSA might react to the escalating problems in the L&P sector. The message so far has been quite confusing but we would expect the rules to be softened somewhat if Swedish long rates continue to decline, as it is difficult to argue that the current rate level will prevail in the longer term. This could remove some of the pressure on the 10Y segment.

Also, in the new guidelines, the SNDO has been mandated to increase the outstanding amount in 30Y bonds by SEK20bn. Even though part of this volume increase could be done in switches against 10Y bonds, it is likely to translate into issuance of more interest rate risk. The effect is, of course, uncertain until we know how the SNDO intends to proceed but it should, nevertheless, support a general curve steepening.

Thus, our preferred trade is to do a steepener by buying a 2-year covered bond versus a 10-year government bond. A bolder alternative is to go short in Bunds but, given the currently very stretched levels versus Sweden and the uncertainty related to what has driven the significant sell-off, we currently prefer to keep the exposure in the Swedish market.