- Fixing rates – we take a look at issues related to fixing problems in Euroland and Sweden. Trades:

Profit taken

, Buy 2DEC11 against SchatzDEC11. In last week’s edition of RtM Sweden we moved both profit and loss targets to 35/48bp. During the week Swedish short rates have underperformed and the spread reached +48bp. We took profit of 22bp.

Profit taken, Sell FRAJUN12. We reached our profit target during the week and realised profit of 26bp.

New level, Buy SHYP2MAR12 vs 10MAR12. We reached a profit target in the week but believe there is more in the spread. We move targets to 25/45bp. In that way we have locked in a profit of 13.5bp.

Next week will be important. The ECB board meets on Thursday and another Euro summit starts on Friday. Expectations are high for both events. With regard to the summit, it is necessary that a credible road map for increased fiscal coordination is presented in line with recent signals from Germany and France – but how will be achieved and what does it mean? Another important issue is how to proceed with creating sufficient firewalls around the banking industry. After the latest finance minister meeting it appears clear that the original idea – to leverage EFSF to EUR1,000bn or more by means of private investor involvement – is no longer seen as possible. Therefore the hope is to increase the fire-power of the IMF by means of member countries (SDR) and/or by market funding.

It is important to underline that what is going on in Europe right now is a multidimensional problem. One aspect is the acute lack of confidence, disruptions in the financial system and higher risk premia for an eventual euro breakdown, which has pushed interest rates in countries such as Italy and Spain to unsustainable levels. It is this type of immediate systemic risks that governments and central banks are trying to counter by building firewalls and involving the IMF.

But then there is the true underlying problem, namely that a large number of euro economies are running high fiscal deficits and debt levels. On top of that there is also a serious lack of competitiveness in southern Europe. This is certainly not something that can be solved by simply getting help from the IMF or EFSF, or even if the ECB bought debt on a massive scale. The only solution here is establishing a long-term credible strategy for how to achieve balanced budgets (and the surpluses) stabilising and finally reducing debt.

Then again, efforts made to address the acute market distrust are important as well, since there is otherwise a significant risk that something vital breaks before governments have had time to really get government finances under control. Still, the reason why we see this as important to stress is that we sometimes get the impression that the view is if only the ECB would fire its big bazooka the problems would go away. That’s not how we see it.

The joint action by the Fed, ECB and a number of other central banks to reduce prices and haircuts on the US dollar swap arrangement and create bilateral swap facilities is of course positive but also something that highlights the degree of stress in terms of access to dollar funding in Europe. The ECB’s Christian Noyer recently stated that the situation in Euroland has deteriorated significantly in recent weeks and that we are now looking at a true financial crisis with serious market disruption. Other ECB representatives such as

Jürgen Stark have repeated the message that the ECB staff projection would show a significant downward revision of the economic outlook and that the euro area could be in negative growth territory in Q4 this year.

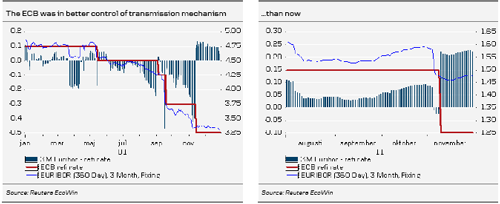

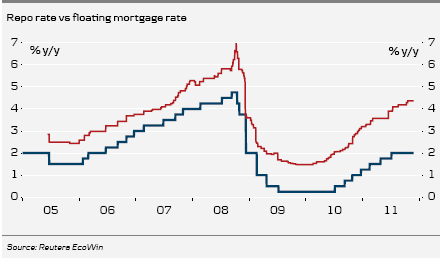

So, signs that the ECB wants to get rates down are strong. But this also means that the ECB must get control of the transmission mechanism. An interesting comparison is to look at the rate cuts carried out in 2001 under normal market conditions – easing that was not triggered by a financial crisis. Then, the ECB cut rates by 150bp to 3.25% and 3M Euribor moved down during the easing phase more or less in tandem with the refi-rate. Of course Euribor, for a period, traded below the refi-rate reflecting expectations of future rate cuts. Now, after the 25bp rate cut in November, 3M Euribor has come down by only some 10bp and trades above the refi-rate, something that certainly isn’t explained by the market not expecting any further cuts.

In order to get “in command” of the transmission mechanism it wouldn’t be a big surprise if the ECB decided to take a bigger step than the traditional 25bp in combination with offering banks a very long borrowing facility (LTRO). The discussion about the transmission mechanism is in fact applicable also for Sweden (see below).

Central banks flooded with dollars - does this mean anything?

Okay, so it’s time again. The European banking system is under increasing strain and, as it is usually labelled, there is a lack of US dollar funding. Markets – stock markets in particular – show a seldom seen euphoria. However, it may be wise to ponder the importance of these measures. Before going into detail, we would like to emphasise that this in no way is a solution to the underlying debt crisis, but rather measures aimed at stopping a collapse of the banking system, due to a lack of liquidity.

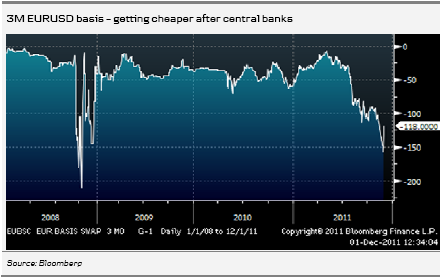

The fact that central banks in this coordinated way supply US dollars to the market is nothing new. Actually, the Fed in co-operation with BoC, BoE, SNB and ECB reintroduced unlimited US dollar facilities (swap lines) on 9 May 2010 as the Eurodollar market was upset. That arrangement has been extended three times since then: on 21 December 2010, 29 June 2011 and 30 November 2011. The dollar has been offered at full allotment (unlimited) at one-week and three-month maturities. The difference this time is that the price is reduced from OIS + 100bp to OIS + 50bp, while at the same time reducing the “haircut” on collateral from 20% to 12%.

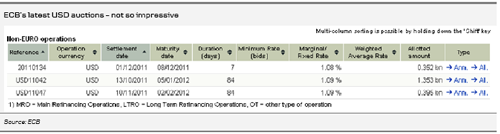

Well, how important is this supply of dollars? Looking at the demand for US dollars at ECB’s auctions in October, November and the first day in December, you would not be particularly impressed. The table above – taken from the ECB’s home page – shows that the bids at auctions in October, November and December were a mere USD1.35bn (six takers), USD0.4bn (four takers) and USD0.35bn (two takers)! Hence, the paradoxical picture evolving here is one in which the market is supposedly screaming for a huge scarcity as in 2008 and the price of creating US dollars from euros is rising dramatically (see following chart), but at the same time there is apparently no demand from European banks for US dollars that the central banks supply. Why is that?

The reason is probably the “stigmatization” for a bank to receive financial support from the central bank – there is of course a big risk that the market will believe, if this comes out, that the bank is in serious trouble. The alternative is to sell other US dollar assets.

This time it is cheaper and financing conditions have improved. This may make the US dollar really interesting. The level of 3M US dollar offered would be at OIS+ 50bp, which currently means 60bp. That could be compared with 53bp for 3M USD Libor.

The market impact of this is difficult to judge. It may lead to a positive development if “strong” banks see business opportunities in this that they want to use. Then, maybe other banks will follow suit. However, it may also be the case that the strong names have all the funding they need. Then there is a risk that nothing has really changed and that the financial stress will continue. We will have an indication of the market impact on 7 December next week at the first of these auctions. It is also important to continue monitoring whether or not European banks continue to put the euro liquidity received by the ECB back into the central bank at a low O/N rate. Also we should keep checking whether the ECB can sterilise the total amount of the SMP programme or not. And, for goodness sake, don’t forget the 3M Euribor-OIS spread – it actually rose today the day after central bank intervention. These indicators should give decisive signals about whether confidence is returning.

What does this imply for the Swedish market? The backbone reaction is that this has to be good for the level of Swedish funding rates too. However, it is not quite that simple.

Money market - the Riksbank and short rates

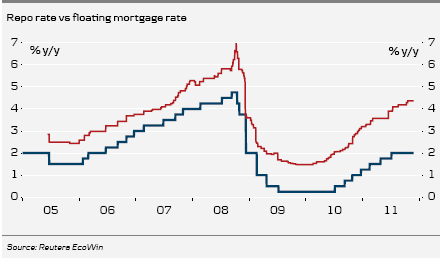

The repo rate has continued to climb during the autumn! Interest rates valid for households and companies, such as the 3M STIBOR rate, have increased since the last hike in the summer. This has happened despite more cuts being priced in to the market. So what is the reason? What effects will it eventually have and how will the Riksbank react if repo rate cuts are not completely transformed into eased credit conditions in the real economy.

The most important cause for higher STIBOR fixings despite lower market rates and expectations of repo rate cuts is the European debt crisis and how it has dislocated the money markets (other factors, such as new banking regulation, have of course also had an affect). As the debt crisis has deteriorated, confidence for the European banking system has declined in the markets. Banks deposit more and more money overnight at the ECB rather than lend to each other, despite yielding a much better return. This lack of confidence (higher credit risk) has sent EURIBOR rates higher and the spread EONIA/FRA has widened substantially. 3MEURIBOR was at 1.58% before ECBs cut in November and today at 1.47%. This is in spite of more cuts has been priced into the markets.

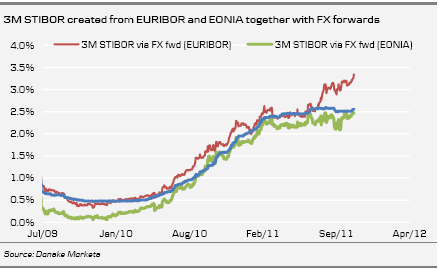

So the transmission mechanism is clearly not working properly in Europe. Higher EURIBOR fixings influence Swedish bank’s funding costs. Swedish banks collects (marginal) funding from abroad, primarily euro and US dollar. The creation of funding is done via EURIBOR/US LIBOR and FX forwards. So by monitoring what that implies in terms of interest rates when transformed into Swedish krona will give an idea about the short-term funding costs for Swedish banks and give a hint of where 3M STIBOR is heading. By creating SEK from EURIBOR and FX forwards 3M SEK rates are currently at 3.4%, whereas 3M SEK rates from US dollars can be created at 2.16%. An arbitrary weighting of, say 50/50 implies a 3M STIBOR at 2.79%. This is somewhat higher than the current 3M STIBOR at 2.66%. However, such a weighting might not reflect what is possible to get for the Swedish banks.

In fact, this shows that the current elevated fixing spread is to an extent imported from Europe. The credit quality on an average STIBOR bank is better than the EURIBOR peers. This motivates that banks should pay STIBOR plus a spread when krona are created from EURIBOR. While the ECB has expanded the monetary base into the European system, in order to counteract the liquidity situation, the situation Swedish market is much healthier. When bank credit risk (confidence) surges in Europe this spurs Swedish banks to hold on to krona and avoid creating krona from abroad – the Swedish krona has become a scarcer “asset”. So far the Riksbank has not been required to introduce extraordinary measures.

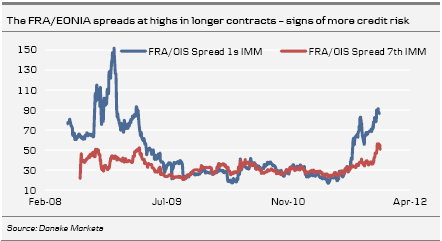

It is import to note that liquidity is not really a problem in euros but rather credit risk in the banking sectors, which has pushed EURIBOR rates higher, whereas EONIA fixings still are low. If the current situation remains it might become even more expensive (higher interest rate) to create SEK from EUR and US markets and thus delay a decline in Swedish short rates. The following chart illustrates that it is not really a lack of liquidity that drives the market, as was the case in 2008. At that time the spread FRA/EONIA was even more elevated at the very short end of the curve than today, suggesting a lack of liquidity, whereas the spread in longer contracts where at lower levels compared with the situation today. Although short spreads are elevated they are a long way from the levels

recorded in 2008. So this time term funding is a bigger problem for the European banks. Longer funding is difficult to get, pushing up fixings, affecting EURIBOR rates and swap rate. This is affecting Swedish FRA and short swap rates.

Another sign that European banks have difficulties in getting funding is the pending deleveraging among the banks. This will inevitable take its toll on growth in 2012, and possibly also beyond that point in time. Balance sheets are reduced and the fastest way to accomplish this is through selling assets. We reckon European banks are engaged in selling government bonds from debt stricken countries (peripherals), bank securities, corporate bonds and bonds denominated in other currencies.

There is a clear risk that STIBOR fixings will continue to inch higher short-term, despite the coordinated move by central banks on Wednesday to offer more dollar liquidity at a lower price and less collateral. We see krona created from EURIBORs at lower rates whereas krona from US markets at higher rates almost offsets the ease from EURIBORs. Still, there are clear signs that krona is becoming even scarcer. The backstop – i.e. creating krona from abroad, can only be done at high rates. So, in order to see a more significant decline in Swedish STIBOR rates the Riksbank will probably need to pour liquidity into the market. We doubt this will happen unless things get worse, or if rate cuts do not result in lower short market rates (crucial for transmission mechanism to work properly).

Note that the TED spreads (FRA vs RIBA rates) price that the Riksbank will act in 2012 (or that things will ease anyway). The current TED is trading near 90bp whereas the FRAMAR12/RIBAJUN12 is pricing some 73bp. So we expect things to turn worse before they get better. The Riksbank will react when the transmission mechanism is considered to be broken. It will probably not happen until the beginning of next year.

We still argue that short mortgage bonds will start to perform when the Riksbank starts cutting the repo rate. If more liquidity is given to the market early next year that will give additional support for such a positioning. The measures introduced yesterday give a hint that the ECB and other central banks will give their support and we expect more to come next week. Eventually more global liquidity will influence Swedish fixing rates as well. This will be supportive for short mortgage bonds. Lower repo rate and lower financing rates for a protracted period of time will make short mortgages look really favourable.