More bad (job) data

Time to receive SEK 1Y 1Y vs EUR

Will the Riksbank follow Norges Bank's lead? Don't count on it !

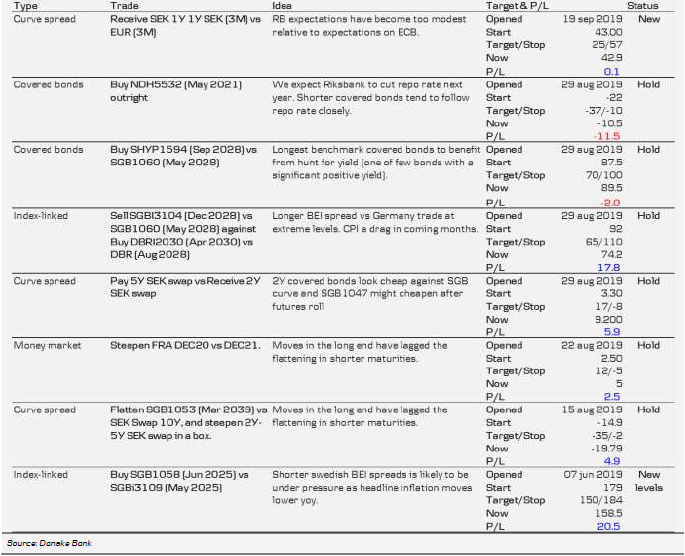

Trades

New, receive SEK 1Y1Y vs EUR 3M @ +42.7bp. P/L: +25bp/+57bp.

New levels, buy SDGB1058 (May 2025) against SGBi3109 (June 2025). We have reached our initial profit target. Since we believe in more potential, we adjust P/L levels downwards by 10bps. New P/L levels: 150bp/184bp.

More bad (job) data

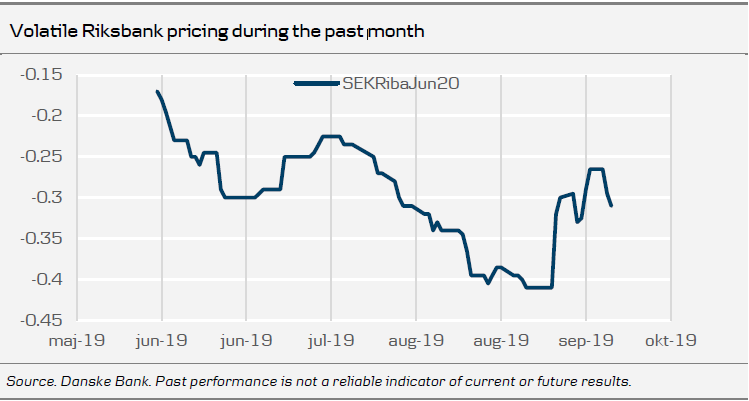

In the latest couple of weeks we’ve had soft GDP for H1, a low CPIF print and terrible jobdata. In the meantime, market pricing of the Riksbank has been reduced from a 17-18bp cut over the next year, to about 5bp. Even after last week’s ECB decision to lower the deposit rate and re-start QE – with considerable objection from some board members one might add – the market is looking for something like another 15bp in cuts over the same timeframe. We find that combination interesting – see more below.

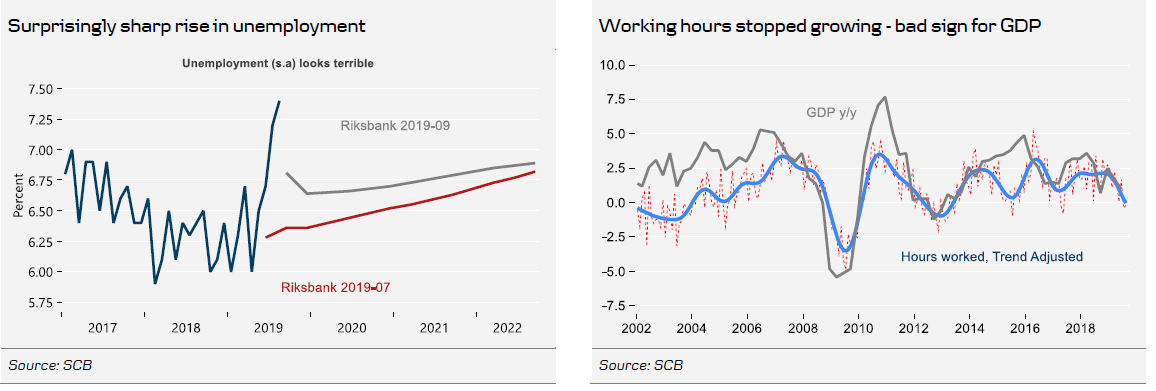

The latest batch of job market data cannot easily be dismissed. After a couple of months of sharply rising unemployment, we really thought it was time for a correction in August. That did not happen, instead unemployment jumped again. Data during summer are usually more uncertain, but that does not mean that the jobless rate always spikes, but simply that volatility is high. From that point of view, recent prints are noteworthy. The Riksbank hiked its unemployment projections only a couple of weeks ago, but even the new forecast appears to be obsolete.

Other labour market data do not look any better. Employment continued to drop. Total hours worked has come to a standstill in y/y terms. The latter is worth monitoring because it could be a sign that GDP growth is coming close to a stand still too. Probably not in Q3 because GDP (q/q) made a one-off half a percentage point decline a year ago. But Q4 is definitely at risk. In any case, recent months’ job data have taken us all by surprise.

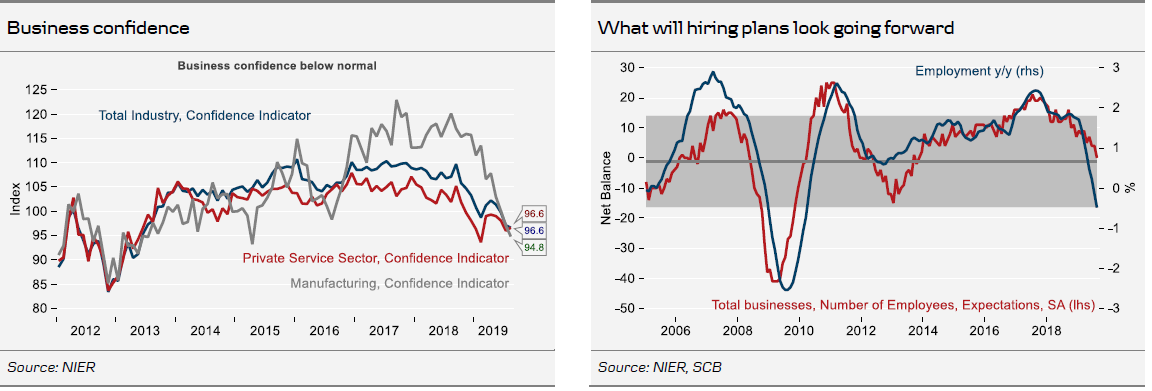

It was no surprise then, that social partners made a story of this, but from different angles. Employers of course stress that bad signals mean that wage deals due to be agreed next year must be set at lower levels than the current one (2.1-2.2 percent). Unions do not deny that economic conditions are getting worse, but say that now is not the time to shift down wage growth because that would only shave demand further. Our impression is that next year’s wage deals will not differ much – if at all – from the latest wage round.

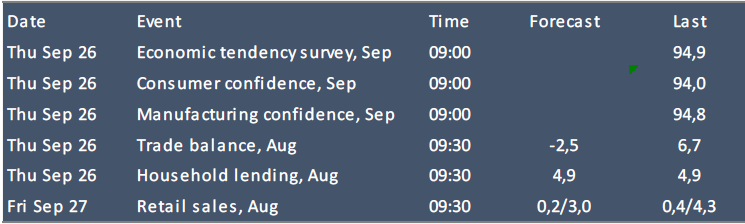

Against this background, next week’s data – especially the NIER business confidence survey – will be of great interest. Businesses’ views on demand developments and hiring plans going forward deserve attention.

Swedish events next week

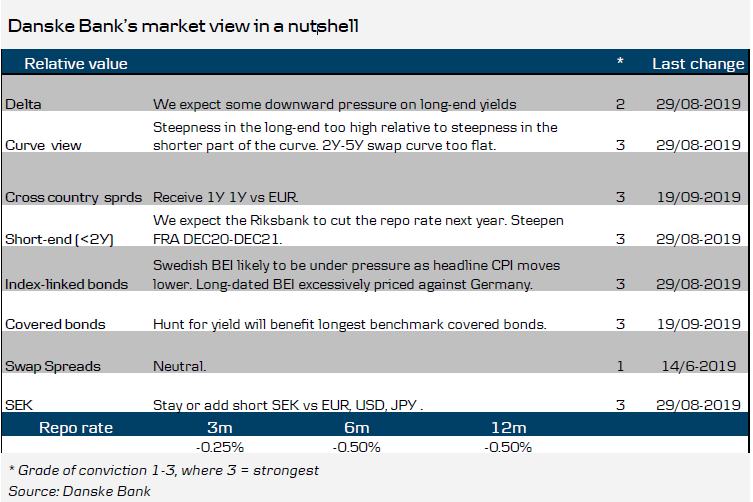

Time to receive SEK 1Y 1Y vs EUR

In our view, the Riksbank minutes from the September meeting were already somewhat obsolete at the time of their publication, as we have received crucial information since then, both in terms of central bank action (the extensive ECB measures) and domestic data. For the latter, the weak GDP numbers (with two consecutive quarters of near zero growth), another worrisome unemployment number in a row and disappointing inflation outcome stand out.

The RB minutes reveal a certain appetite for normalizing monetary policy (Ingves: “the very expansionary monetary policy was never intended to last forever”, Ohlsson: “In Sweden, we can conduct our own monetary policy”), but that remains contingent on the Swedish economy continuing to operate at a high capacity utilization.

As Gov. Ingves himself stated, both market pricing and the Riksbank cannot be right, and someone has to be wrong about the economic outlook. We suspect that the Riksbank is much too optimistic regarding the labour market and, by extension, for the inflation outlook. Still, the Riksbank’s continued hawkishness has meant a reluctance to maintain a high probability of a rate cut.

The recent ECB meeting was more contentious than is normally the case for the consensusdriven organisation. The idea of increasing QE in particular met internal resistance.

However, we also note that the cut in the deposit rate was a modest 10 bps, and the downward pressure on Euribor was further constrained by the fact that the ECB chose to introduce a two-tier system. Compared with where 3M (NYSE:MMM) Euribor traded in June, the fixing is only down by less than 10bps. Going forward, it could be argued that the threshold for further stimulus is probably higher. Moreover, as the ECB obviously has some concerns regarding bank profitability, another cut in the deposit rate may not even be the preferred instrument if the ECB decides to stimulate further. At the same time, the OIS market prices around 15bps in cuts over the next year.

Over the last couple of weeks pricing on the RB has been reduced from 17-18 bps in cuts to currently some 5bps over the coming year. We believe it will take more for the ECB to meet market expectations than for the RB to postpone further rate hikes and move towards easing.

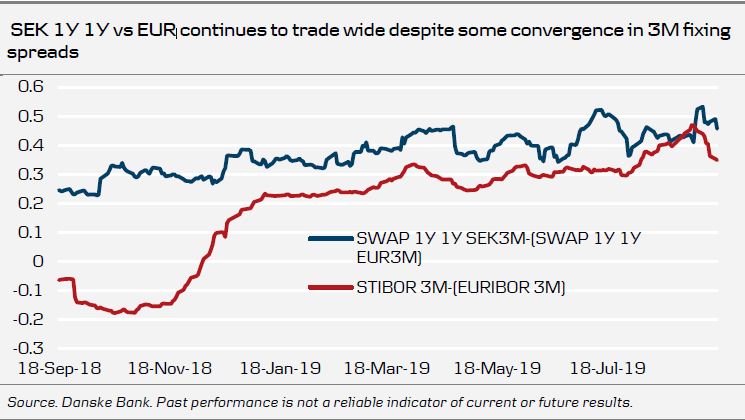

Thus, in our view, pricing for a RB cut is relatively modest, especially when compared with pricing on ECB. Moreover, we note that the upward pressure on 3M (NYSE:MMM) Stibor has subsided. Predicting where Stibor is heading in the short run can be difficult, though we note that the significant drop (around -7.5bps) in the Swedish fixing has not affected the level in SEK 1Y 1Y.

Thus, we like receiving SEK 1Y 1Y vs EUR SWAP (3M (NYSE:MMM)) @ 42.7bps. We set the P/L levels to 25/57bps.

Will the Riksbank follow Norges Bank’s lead? Don’t count on it!

Norges Bank just announced its fourth hike since September 2018, and its third during 2019. The policy rate was raised to 1.50%, which is to be considered respectable in the current market. It is not completely unreasonable to point towards Norges Bank’s action and rhetorically ask oneself: “hey, if they can move against ECB/Fed and hike rates, then why shouldn’t the Riksbank be able to do so as well?”

A justifiable question, as it concerns two small open economies after all. Nevertheless, one would then overlook the fact that both the composition and the current state of the two economies differ markedly. Where Norway has a certain oil cushion against a global downturn (at least up until the price of oil falls markedly), Sweden instead relies heavily on a globally exposed manufacturing sector. In the meantime, Norges Bank remains successful in maintaining inflation above target, unemployment is near record lows and the growth prospects are still relatively fair, at least compared with the rest of Europe. Once again, the situation is completely different in Sweden, where the Riksbank has seen inflation sliding down towards 1%, unemployment has taken an unexpected leap (albeit from low levels, but the rate of change is still rather remarkable) and growth is at a virtual standstill (0.1% q/q during both Q1 and Q2) and has plunged to 1% y/y. Nothing, short of the Riksbank disregarding economic fundamentals and plainly deciding that it wanted to leave negative territory, could in our view warrant a year-end hike, which we see as very unlikely (we go for a cut in early 2020). Anyway, the fact that Norges Bank once again hiked rates should play no role whatsoever in the Riksbank’s decision, as the states of the economies are simply too different to be comparable. Potential dips in EUR/SEK following repricing in favour of the Riksbank’s hiking ambitions that may emerge on the back of today’s hike from Norges Bank should be taken with a pinch of salt, and could instead be used for an entry towards 11.00, our 12M target.

Open strategies