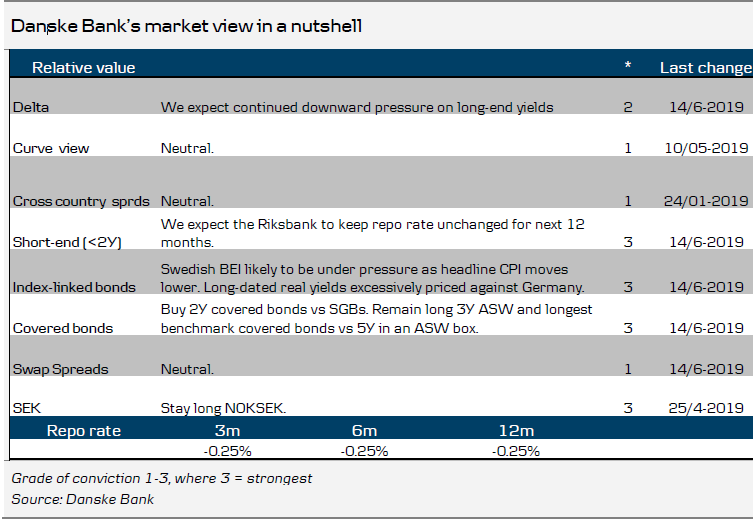

- Riksbank rate cut?

- Comment on CPIF

- Debt Office

- 2Y covered bonds cheap against SGBs

- Inflation miss supporting the SEK - but one swallow does not make a summer

Trades

New , Buy SWH189 (Dec 2020) vs SGB1047 (Dec 2020) @49.5bp. P/L: 41bp/55bp.

Riksbank rate cut?

The higher than expected inflation print for May (CPIF came in at 0.3% m/m versus expected 0.1% m/m – see more below) quickly removed the tiny probability of a rate cut (2bp in Riba) that was priced in before the figures were released. We have no objection. Inflation is completely in line with the RB forecast and inflation on domestically produced goods and services is running at a ‘healthy’ 2.8% y/y. So from that point of view, a rate cut appears far-fetched.

Is it then reasonable that the market prices in (almost) three cuts by the Fed this year, and apparently lower rates were also discussed at the latest ECB meeting - especially regarding the Fed, after all growth data in the US still looks decent and inflation is not that far from target. The ECB might be a different story considering disappointing manufacturing data and core inflation obviously stuck far below target.

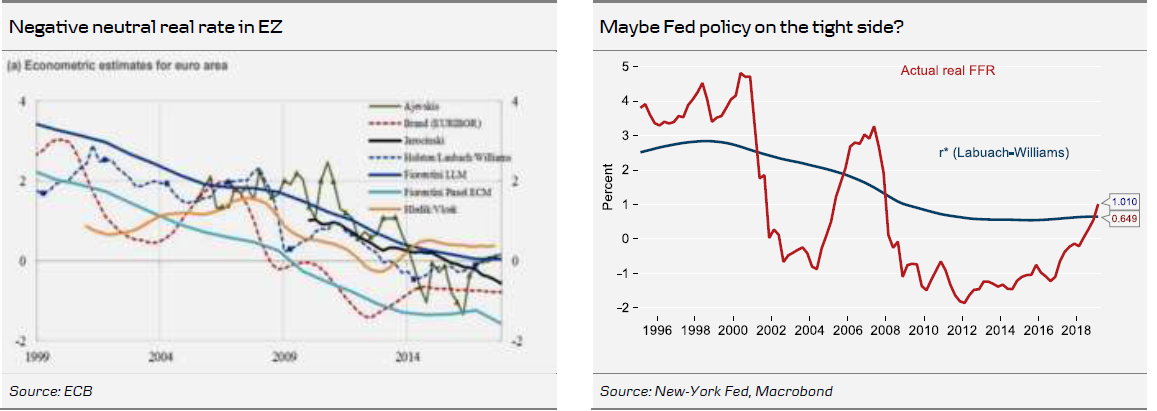

In the case of both the Fed and the ECB, however, there also seems to be a different issue that has attracted policy makers’ attention: More specifically, where is the neutral real rate of interest (r*)?

The ECB published some ideas about this in an occasional paper (217) late last year showing various estimates of r* ranging from marginally above zero to close to -2%. This suggests that the current real (deposit-) rate actually is within the range of estimates of the neutral rate, meaning that the current policy stance might not be so stimulatory as one would have thought. Similarly, looking at for instance New-York Feds (Laubach-Williams) estimates of r* in the US (currently slightly above 0.5%), the current real Fed funds rate is actually slightly on the tight side. We think this is one important reason for the surprising U-turn by the Fed in January.

Turning back to the Riksbank, we have not seen much discussion about this, either from staff or from the executive board. Sure, some board members have mentioned that the neutral rate is probably lower today than earlier, but we have seen no comprehensive attempt at estimating where a Swedish r* is. And no doubt, the Riksbank is convinced that the current -0.25% policy rate definitely is very stimulatory indeed.

The Riksbank will of course have to factor in the fact that the ECB has postponed rate hikes again – and we expect them to continue down that road for a very long time. Also, we think the market is probably correct to price in rate cuts by the Fed (starting July according to our Fed analysts). In addition, we believe that the Riksbank is too bullish on inflation later this year. Even so, we are far from convinced that this will be enough to make the RB go in reverse and cut the repo rate. Rate cut(s) will in our minds require that growth decelerates to an extent that makes the labour market outlook clearly worse.

Can the market again start to ‘sniff’ out a rate cut? Sure, but we would not recommend overdoing it unless macro-data really turns worse. Instead it is much easier for the Riksbank to basically kick the can down the road, postponing rate hikes over and over again. We do not see a rate hike within our 12-month forecast horizon.

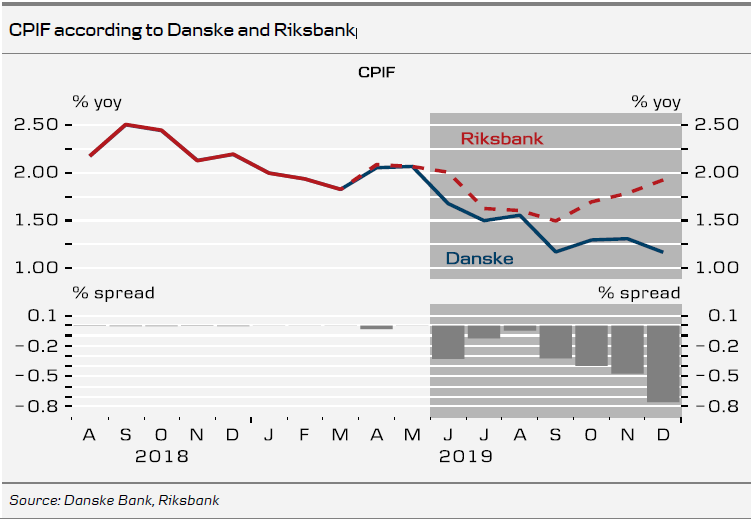

Comment on CPIF

May CPIF and CPIF ex Energy inflation turned out spot on #Riksbank's forecasts (2.1% y/y and 1.7% y/y). We saw a 0.2pp downside risk from charter package prices which did not materialise. Instead clothing, hotels, furniture and cars were higher than expected. It is too soon to judge whether this will correct back in June or if is a lagged response from last year’s weakening of the SEK which may prevail for a while.

We see no reason to change the idea that domestic underlying cost pressures are too weak to push CPIF excl. Energy to 2% on a sustainable basis.

Looking forward to the June outcome, energy prices are in a steep decline, pulling CPIF below (as it looks right now) the Riksbank's forecast. However, the Riksbank will provide a new set of forecasts before that data is released. Supposedly, it will have to lower the starting point, at least for CPIF, despite today's upside surprise.

Debt Office

Admittedly the Debt Office’s borrowing forecasts have in the past couple of years attracted less attention than before. Nevertheless, a new projection is released on 18 June. In February, the DO forecast a budget surplus of SEK40bn in 2019 and a deficit of SEK30bn in 2020.

As a result, it planned to issue SEK30bn in nominal bonds in 2019 and SEK40bn in 2020 (SEK9bn each in linkers). The DO has expressed the view that it has already reached what it perceives as the lower bound for issuance in order to keep the bond market alive. From that perspective it is only more supply that could be of interest.

To read the entire report Please click on the pdf File Below..