Extreme market action continues. What began earlier this week as a rout in the Turkish lira has quickly spread throughout all markets and now it seems to be affecting the cryptos as well.

All the major cryptos fell over the last 24 hours. Bitcoin managed to hold the most steady and Ethereum bore the brunt of the selling.

This article on Bloomberg indicates that the reason for this could be that some ICO's are cashing out.

However, there is a need for further analysis backed up by more in-depth intel before a final conclusion can be drawn.

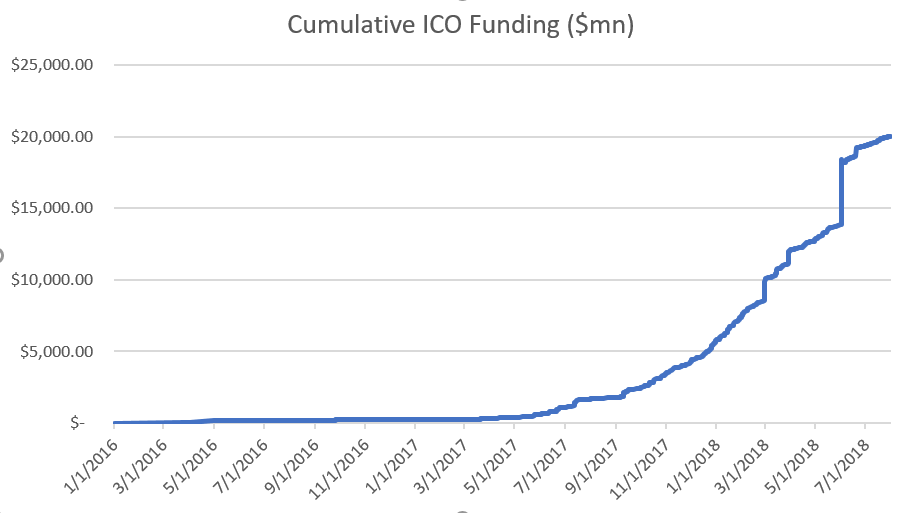

The reality is that more money is flowing into ICOs than out of them. According to data collected from CoinDesk, $14.3 Billion has been raised so far in 2018. Nearly triple the $5.7 billion raised in 2016 and 2017.

On the ground, we continue to see positive headlines that show a clearly developing crypto industry. So the fact that token prices are falling could very well be a reaction to external factors like the rapidly rising US dollar, as we'll explore below.

Today's Highlights

Volatility is Back

Gold < $1200

Crypto Reaction

Please note: All data, figures and graphs are valid as of August 14th. All trading carries risk. Only risk capital you can afford to lose.

Traditional Markets

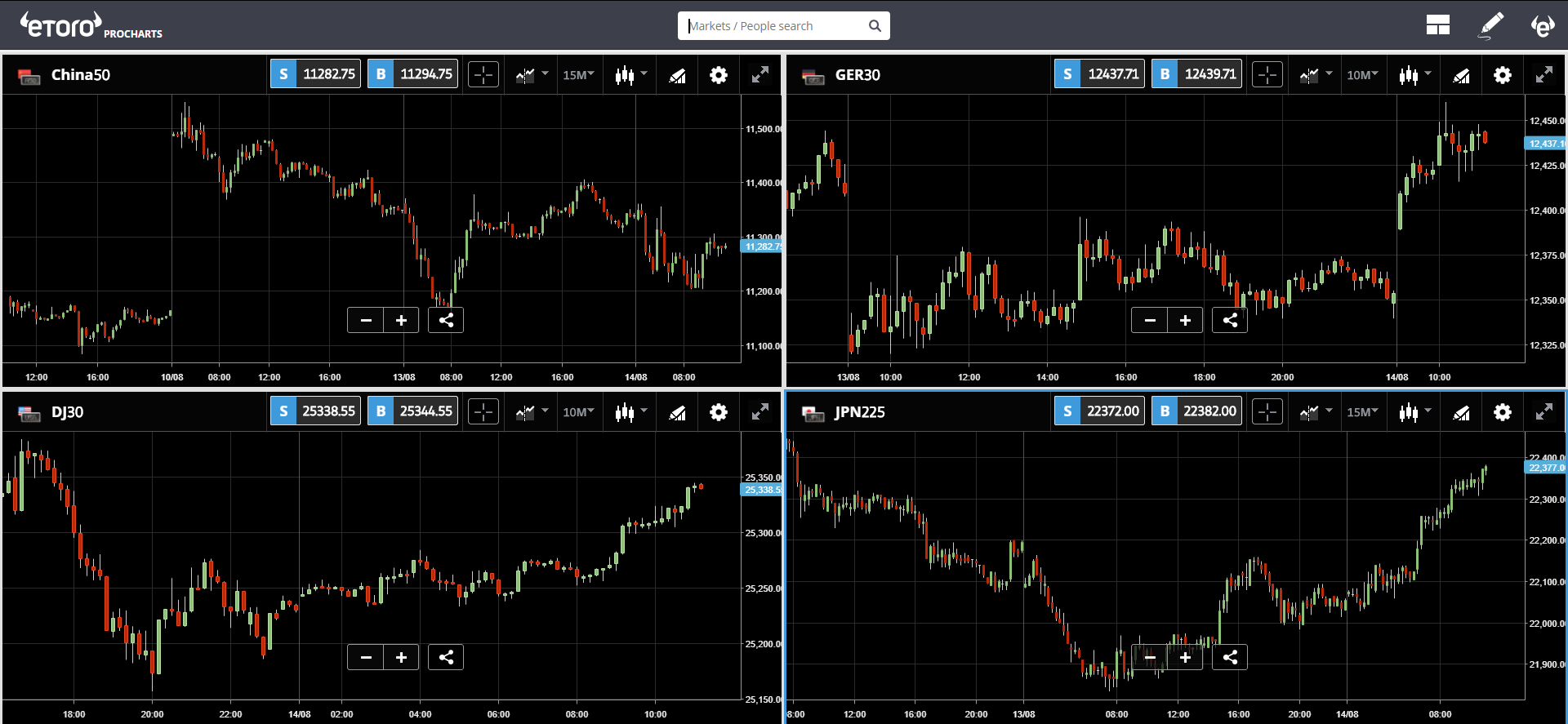

Looks like we're getting a bit of a rebound in the markets today as the markets are mostly reversing many of yesterday's moves.

Looking at the lira, it seems we've backed slowly away from resistance at 7 Lira to the dollar (USD/TRY). We should be hearing from Turkish officials including Erdogan later today.

Stocks are up across Asia and Europe. All except China 50 who is processing some sour economic data.

No Safety

Perhaps the strangest thing about the current market action is the lack of safe haven sentiment.

We can see clearly that volatility is rising...

Yet, gold and other precious metals continue to fall. Yesterday, Gold dropped below the important level of $1,200 for the first time since January 2017.

This is a rather clear indication that whatever volatility is happening it's not freaking anybody out.

Crypto Reaction

Though I couldn't say with absolute certainty that the meltdown in emerging market currencies is what's getting the crypto market down lately, it is the most likely explanation given the current market conditions

As the United States moves to tighten its economy and avoid strong inflation, they're taking action that is strengthening the dollar. Because the US dollar is the global reserve currency, many smaller economies rely heavily on a stable exchange rate with the greenback.

So too, as the dollar is being seen as a stable store of value at the moment, there really isn't much incentive for people to store their money in digital assets.

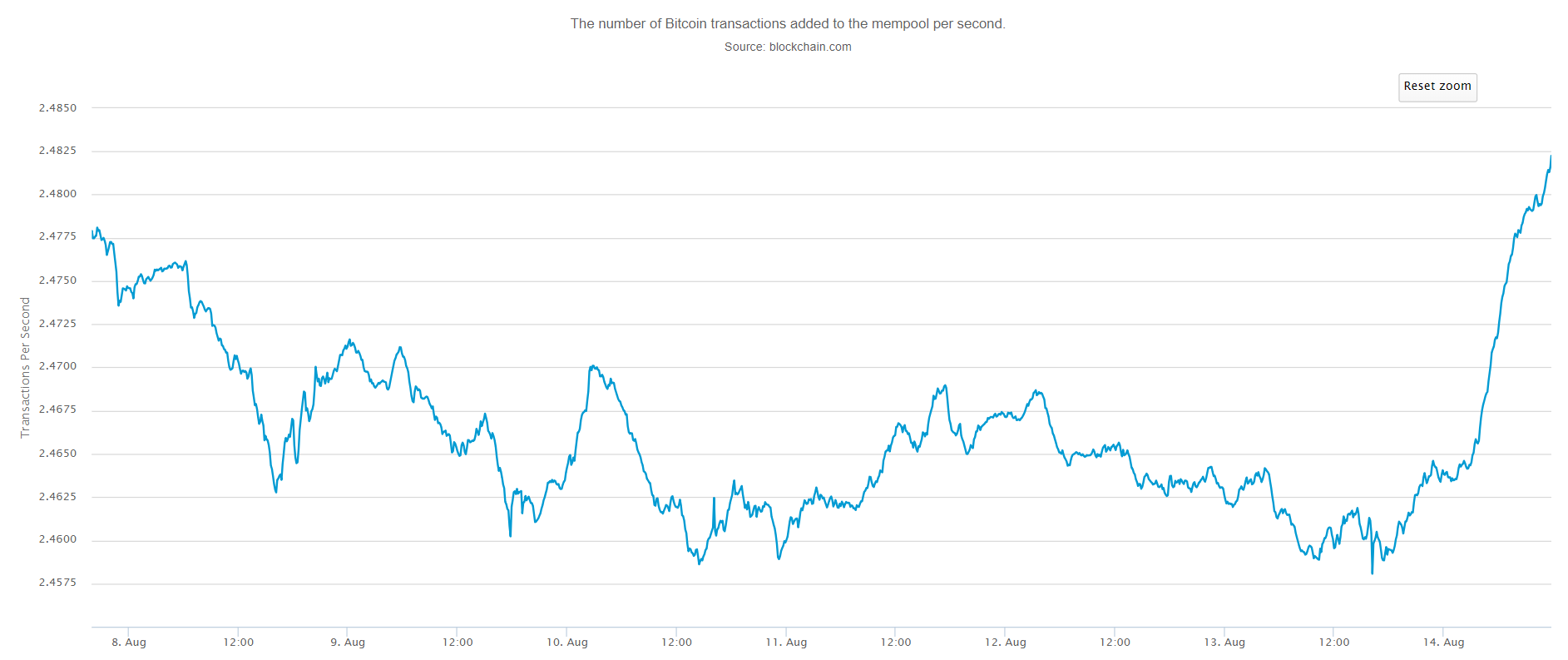

Still, it does seem that we're seeing some of the excitement spilling over onto the blockchain. In this chart, we can see the TPS (transactions per second) is rising rapidly over the last few days.

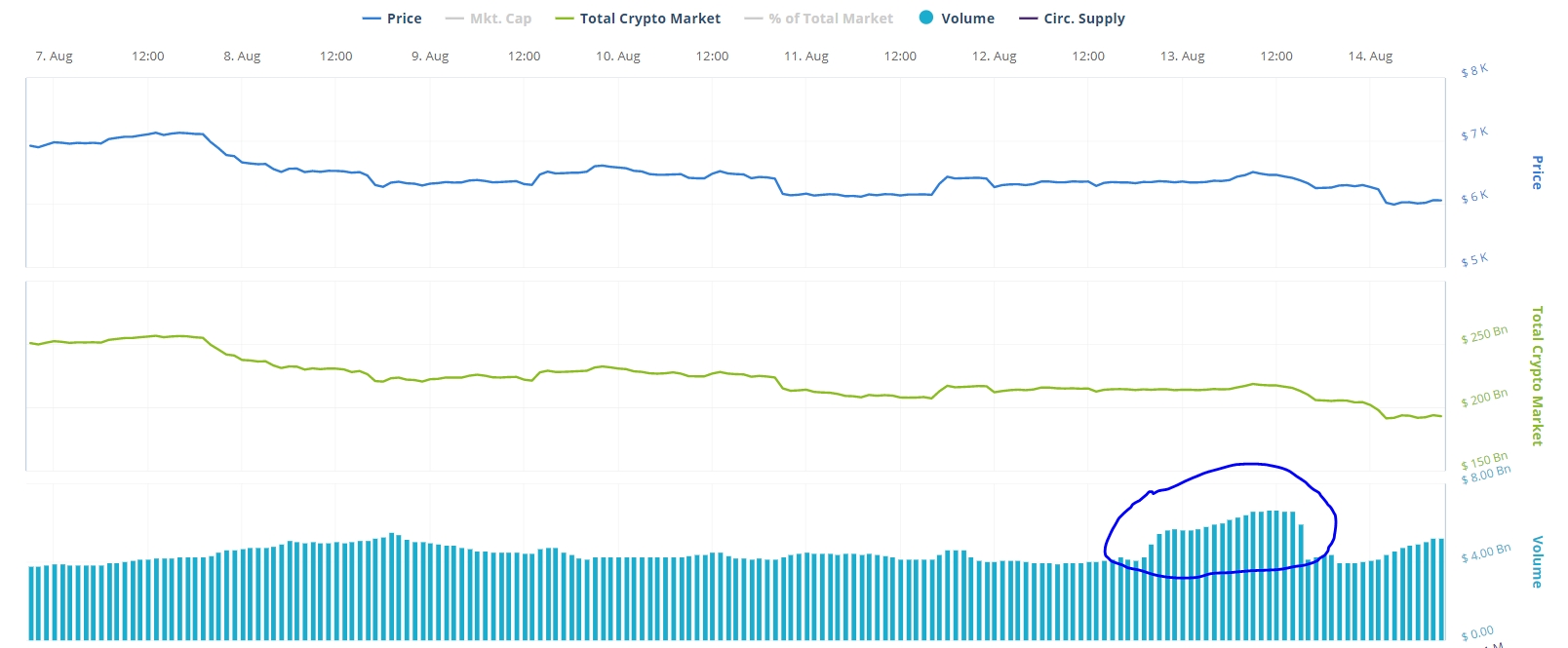

As well, we can see a noticeable spike in exchange volumes during the entire market action yesterday.

Many thanks to you for reading and to everyone sending me your questions, thoughts, feedback, and insight. It's extremely valuable.

eToro, Senior Market Analyst

Disclosure: This content is for information and educational purposes only and should not be considered investment advice or an investment recommendation. Past performance is not an indication of future results. All trading carries risk. Only risk capital you're prepared to lose.