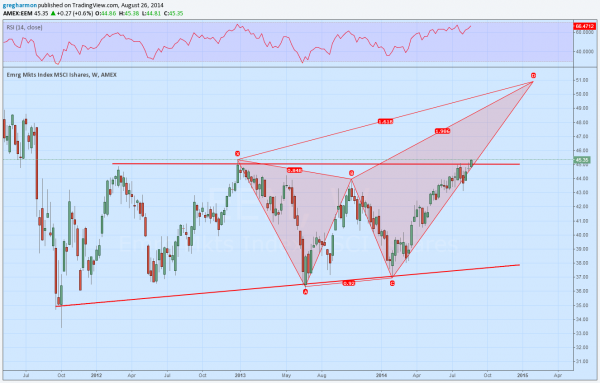

Emerging markets started to get a lot of press in the second half of 2013 as the US market started making new all-time highs. And the ETF that acts as a proxy for them, iShares MSCI Emerging Markets (ARCA:EEM), caught a bid. It ran higher, but not even to the prior resistance area. Boring. New highs in the US and the Emerging Markets could not follow. many saw this as a sign of a lack of risk taking. Time to exit? Maybe. Whatever. What I see it as is a sign of higher prices to come. Take a look.

The chart above shows that tightening range for the EEM ETF against resistance at 45. And now the price is breaking above the top of the range. If it holds up the technicals suggest some great things are in the offing. The range it is breaking is an ascending triangle and that would target a move to 55 above. But notably, the price action illustrated has traced out a bearish Deep Crab harmonic as well. This has a Potential Reversal Zone (PRZ) at 51. Meaning the price action should wander higher at least until 51 before reversing. Two very different types of technical analysis both pointing higher. But the momentum indicator RSI is also pointing higher. This mosaic of analysis all pointing higher should excite an investor. $6-10 of upside potential on a $45 stock is a great move. But pan out and it gets even better.

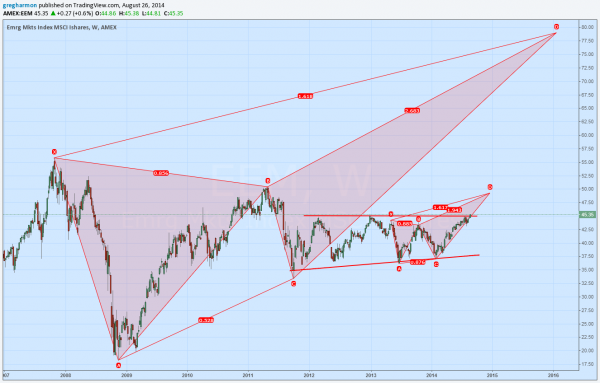

The entire timeframe of the first chart could be nothing more than a pause in the move higher in a much larger Deep Crab pattern with a PRZ at 79. That would be a monster move and indicate that Emerging Markets are just about to get going. A re-emergence.

Disclosure: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.