is a relentless animal! In the overnight market we are trading just below $107 a barrel. See today’s chart of the day for more details but prices in my opinion have traveled too far too fast and we retrace lower very soon. Those with a low risk tolerance look elsewhere, in fact look in a different complex because energies of late has been the Wild West. I see WTI closer to $95/barrel then $105/barrel in the coming weeks but from what level I have not a clue. It’s better to be on the sidelines wishing you are in the market than in the market wishing you were on the sidelines. The crack spread that client exited at a profit just last week has picked up another $4200 per spread trading at unch today…in from 17 cents just two weeks ago. Energy traders that is insane. RBOB and heating oil are looking heavy but will move with Crude so stand aside for now with fresh entries. Higher trade was rejected with prices ending just above the 8 day MA in natural gas. Tomorrow's inventory numbers will set the tone but I a mildly friendly thinking we could see a trade near $4 in the coming weeks.

Stock Indices: The Bulls train is back on the tracks and after closing above the 50 day MA on 7/5 they have not looked back as we are inching closer to revisiting record highs made in mid-May. We are less than 20 points off that level in September futures in the S&P and just better than 100 points in the Dow. Expect new highs to suck in more money before a correction, in my opinion.

Metals: Overnight trade has gold higher by 2.7%...as of this post probing the 20 day MA. I’m not saying we’ve turned the corner gold bugs but we should at least get a bounce. A challenge of the trend line around $1300 is expected this week and on a violation of that level $1335 the 40 day MA should be the next stop. $1340 represents a 50% Fibonacci retracement…trade accordingly. Silver hit the ground running overnight higher by 3.1% as of this post. A violation of $20/ounce in September futures could lift prices to a $21 trade IMO. Remember some clients recently purchased September back ratio spreads and a volatile 5-7% appreciation would be ideal. Copper is 12 cents off its recent lows and appears to have gas in the tank…objective $3.21 in September. Palladium is $5 away from completing a 61.8% Fib retracement gaining a quick $100 in the last 2 weeks…did I say buy Palladium lately?

Softs: Higher trade has been rejected at the 20 day MA the last 2 sessions in cocoa. That should change moving forward. Scale into bullish trade as we should experience a grind higher in the coming weeks. A bearish engulfing candle puts sugar back near 16 cents. There will be a catalyst that will get sugar turned around but what and when? Small bullish probes are justified in my eyes but no sign of a bottom just yet. With December cotton above its 20 day MA closing at 3 week highs the path of least resistance is now higher. Do not rule out trade back to the June highs…just over 3% from current trade. OJ had it first negative day in the last seven sessions. Support is seen in September at $133 followed by $129. Inside day in coffee with futures closing just under their 20 day MA. I am bullish but based on coffee’s track record do not rule out a return to the lower end of the trading range around $119.

Treasuries: 30-yr bonds are catching a bid higher by 1’16 as of this post. A further retracement that could lead to short covering has the potential to lift futures to 137’00/138’00 relatively quickly. Those in bearish trade with open profits take money off the table. 10-yr notes gapped higher on the open and are nearly 2 points off lows from last week. This is a big jump in such a short time. A grind higher to the trend line that has capped upside for 3 months lifts September futures to 127’16. Fade a rally in the Eurodollar and if fortunate enough to get 20-30 points on top of the 15-20 we see already overnight in 16’ contracts I will be tickled. My favored play remains short futures while buying calls 1:1 and letting go of the calls on a rally and adding to your futures…contact me for precise details.

Livestock: August live cattle closed on their lows just under the 9 day MA. I see solid resistance near $123 and see lower trade in our future. Not an all out collapse but a 2% deprecation in my opinion. Higher trade was rejected in August lean hogs at the 9 day MA with futures closing in the green but nearly 1% off its highs. I’m looking to lighten up on bearish plays with clients under 94 cents and unload the remainder closer to 93 cents.

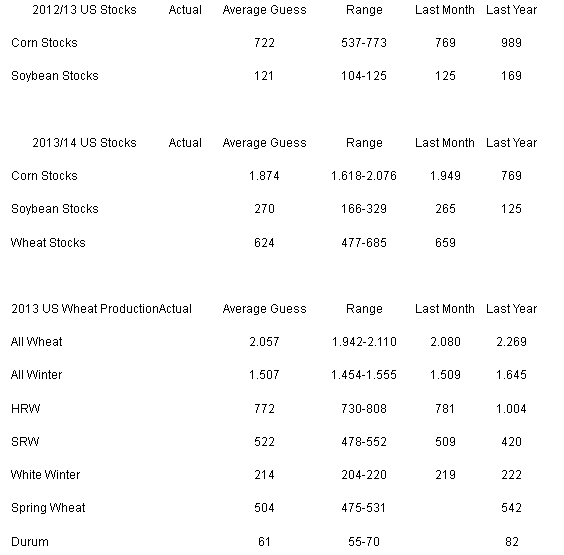

Grains: USDA Supply/Demand report tomorrow Corn has rallied just better than 30 cents in the last 3 days ending the session at its 38.2% Fibonacci level. I’m neutral into the # but a betting man I’d say there is more risk to lower trade than higher trade on the report. 4-5% deprecation should be bought in my eyes if given the opportunity. November soybeans are above their 20 day MA and within 15 cents of $13/bushel as of this post. I will be in cash in beans headed into the report willing to buy a dip. Support is seen in November at $12.60 followed by $12.45. My lone Ag position into tomorrow’s # is wheat. I have small size in bullish trade with some clients in futures and options. My preferred play is long December futures and selling out of the money calls 1:1. A 61.8% Fibonacci retracement lifts this contract to $7.20/bushel.

*Dow Jones

Currencies: Don’t look now but the US dollar is down 1.4% gapping lower and 2.4% off this week’s highs…no that is not a typo. An interim top? A 61.8% Fibonacci retracement puts September at 82.25…current trade 83.10. Did any followers buy foreign crosses this week…if so congratulations and lighten up booking partial profits. The Euro up over 4 cents in the last 2 sessions, the Cable 3.50 cents off lows, the Swiss 3.50 cents. In the Swiss and Euro last week’s loss were erased. Do not be afraid to hedge some of your futures with options I promise you are no less of a man or woman. Have the commodity currencies turned a corner? As of this post the Aussie is probing its 20 day MA and the Kiwi its 34 EMA. The pick of the litter in my opinion is the Loonie nearly 2% off recent lows and back in my neutral territory. As long as prices remain above .9550 I think we see higher trade. Use .9800 as an objective in the weeks to come. The Yen is back above par and has shifted from a sell rallies market to a buy dips market...$1.0500 here we come.

Risk Disclaimer: This information is not to be construed as an offer to sell or a solicitation or an offer to buy the commodities and/ or financial products herein named. The factual information of this report has been obtained from sources believed to be reliable, but is not necessarily all-inclusive and is not guaranteed to be accurate. You should fully understand the risks associated with trading futures, options and retail off-exchange foreign currency transactions (“Forex”) before making any trades. Trading futures, options, and Forex involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more than your initial investment. Opinions, market data, and recommendations are subject to change without notice. Past performance is not necessarily indicative of future results. This report contains research as defined in applicable CFTC regulations. Both RCM Asset Management and the research analyst may have positions in the financial products discussed.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Polski

- Português (Portugal)

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

RCM Commodity Update: Will The Relentless Crude Oil Move Lower?

Published 07/10/2013, 12:22 PM

Updated 07/09/2023, 06:31 AM

RCM Commodity Update: Will The Relentless Crude Oil Move Lower?

Energy:Crude oil

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.