traded higher 4 out of 5 days this week ending the week just above its 8 day MA. I am mildly friendly but at the moment am not positioned in either direction with clients. As long as the 8 day MA supports we could push back above $99/barrel in August. I’d prefer to be long natural gas or in the crack spread in this sector. The August crack spread (long RBOB/short heating oil) gained 170 points today and is 250 points off it widest mark. I expect RBOB to gain on heating oil in the coming weeks. Natural gas was lower by 5.46% on the week and early entries were likely stopped out on bullish trades. Late comers may still be in their positions as some of my clients are long September and were advised to either sell calls or buy puts against their futures. If we can get back above $3.70 next week this could be a great trade…stay tuned.

Stock Indices: I thought window dressing would’ve lifted indices through their 50 day MAs but the resistance held to conclude the month/quarter just under that key pivot point. In the September S&P that level is 1614 and in the Dow at 14943. Let’s key in how action starts next week to identify the direction of the next leg. It’s really a coin toss right now in my opinion.

Metals: Today’s chart of the day was brief and mostly touched on technicals in silver. Sorry it was so short I was extremely busy wrapping things up for month end and Q2. As most of my clients and followers know already a lot of my trading decisions are based on technical analyses as is so today’s piece should have made sense to most accustom to my style. As I tell clients almost daily if ever my ramblings do not make sense pick up the phone or shoot me an email. A 7% reversal in silver today MAY signal a bottom. I’ve said in recent days even if we trade lower medium-term we should short-term get a tradable bounce and the market delivered. Traders could be lightening up as we advance on recently purchased back ratio spreads in September silver. $19 will need to hold Sunday night and my first upside objective from here is $21/ounce. Copper finished lower for the fifth consecutive week but 7 cents off its lows and I think the key is we held $3/lb. If risk returns as I anticipate we should see $3.15/3.20 next week. In the last two weeks gold is lower by $170/ounce but the way we rejected a sub $1200 trade the last twos sessions we may get bounce from here. August settled $46 off intra-day lows to close out the month down 12%. I think we get a bounce from here that may prove to be a dead cat bounce…time will tell. Those in August option spreads were advised to buy back their bottom leg today. Now we should be able to get some value back on the upper leg if we rebound $100-150 in the coming week. It will likely still be a losing trade though. For fresh long entries your objective should be $1350.

Softs: For the last 6 days cocoa has tread water establishing a base in September just above 2125. Scale into bullish trade. Sugar failed to close above its 50 day MA but for medium to longer time frame swing trades I can think of far worse places to be in bullish trade. Test the waters as long as the recent lows hold. OJ has been one of the worst performers in the last 3 weeks and is now low enough to be attractive for a buy in my eyes. See recent chart of the day for trading ideas, in both options and futures. For the first time in eight weeks coffee closed in the green, albeit it's only a 1.1% gain on the week. A very small victory but a step in the right direction for those buying alongside my clients. My suggestion is long futures with some sort of options hedge in September or December.

Treasuries: 30-yr bonds closed slightly positive on the week and are currently almost 3 points off their recent lows ending just under the 9 day MA. I think we get a grind higher and have an objective in September futures at 137’00 followed by 139’00. 10-yr notes too pared losses closing out just under its 9 day MA as well. I’m calling for trade back to 128’00. Eurodollars have rebounded but not enough for me to get back in with a large position for clients just yet. So this is a little different strategy then I typically do so pay attention. My bias is to be bearish but we should get a bounce short term in my eyes. Get short 1/3 to 1/2 of the ultimate futures position you desire. Buy call options against your futures (same # of contracts) that we ride up on a bounce… liquidate you options and then add to the short futures from higher levels.

Livestock: Live cattle lost 0.73%...could this be the interim top I’ve been calling for? If so, I’d expect August to track back near $119. All it took was an article on the front page of the WSJ today on lean hogs claiming it the best commodity long to get this market to reverse, closing down nearly 2% today. If I knew that I would’ve have pushed for an article weeks ago for my clients sake. August closed under the 9 day MA for the first time since 5/20. Those that stuck with it may finally get their redemption. My clients are targeting 95.50, 94.00, and 92.50.

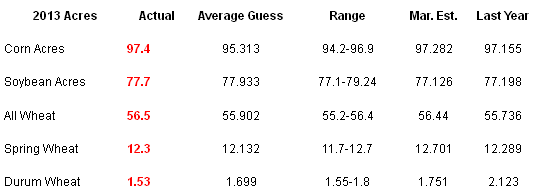

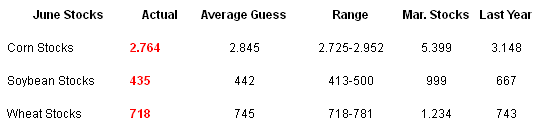

Grains: A rather bearish USDA report had bulls on their heels in Ag today.

December corn hit the hardest losing over 5% trading back to the bottom of the recent range. I would not rule out a sub $5/bushel trade next week. I will be shopping bullish trade for clients next week…expect to see trade ideas and my levels once the dust settles. November soybeans gave up 1.82% and are trading just better than a dime above the 50 day MA. Let’s see how a challenge of that level looks next week. Under $12.45 if breached we could see a return to the April/May lows…stay tuned. Wheat followed corn lower today losing 2.54% dragging futures to their lowest levels in 12 months. I was lightly long into the number so clients took some heat today. Most that are long futures have options hedges but we will need to find footing next week or I will let go of this trade. I think we retake $7/bushel very soon. If forced to choose one of Ag market to be long my pick is wheat as opposed to corn or beans all things considered.

Currencies: The US dollar has gained the last 2 weeks but I see little gas in the tank. Consecutive settlements under the 50 day MA next week would confirm an interim top, that level 82.85. Selling is starting to abate in the Swiss and Euro but the Pound continues to get pounded, down 10 out of the last 11 sessions. The Aussie reversed today giving back the week’s gains and stopping my remaining clients out with their biggest loss in weeks if not months. This one was rough as I held on way too long. I stopped out because a trade under .9100 could lead to .8500, an additional $6,000 per futures. The Loonie held on a little better but not much. It will take settlements over .9550 for me to improve my feeling and shift from bearish to neutral. The Yen came within tics of completing a 61.8 % Fibonacci retracement. Bearish option plays would be my only call here but I currently have no client exposure.

Risk Disclaimer: This information is not to be construed as an offer to sell or a solicitation or an offer to buy the commodities and/ or financial products herein named. The factual information of this report has been obtained from sources believed to be reliable, but is not necessarily all-inclusive and is not guaranteed to be accurate. You should fully understand the risks associated with trading futures, options and retail off-exchange foreign currency transactions (“Forex”) before making any trades. Trading futures, options, and Forex involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more than your initial investment. Opinions, market data, and recommendations are subject to change without notice. Past performance is not necessarily indicative of future results. This report contains research as defined in applicable CFTC regulations. Both RCM Asset Management and the research analyst may have positions in the financial products discussed.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

RCM Commodity Update: Crude Oil Trading Higher

Published 06/28/2013, 01:39 PM

Updated 07/09/2023, 06:31 AM

RCM Commodity Update: Crude Oil Trading Higher

Energy: Crude oil

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.