- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

RBNZ's Orr Shocks NZD Shorts Again

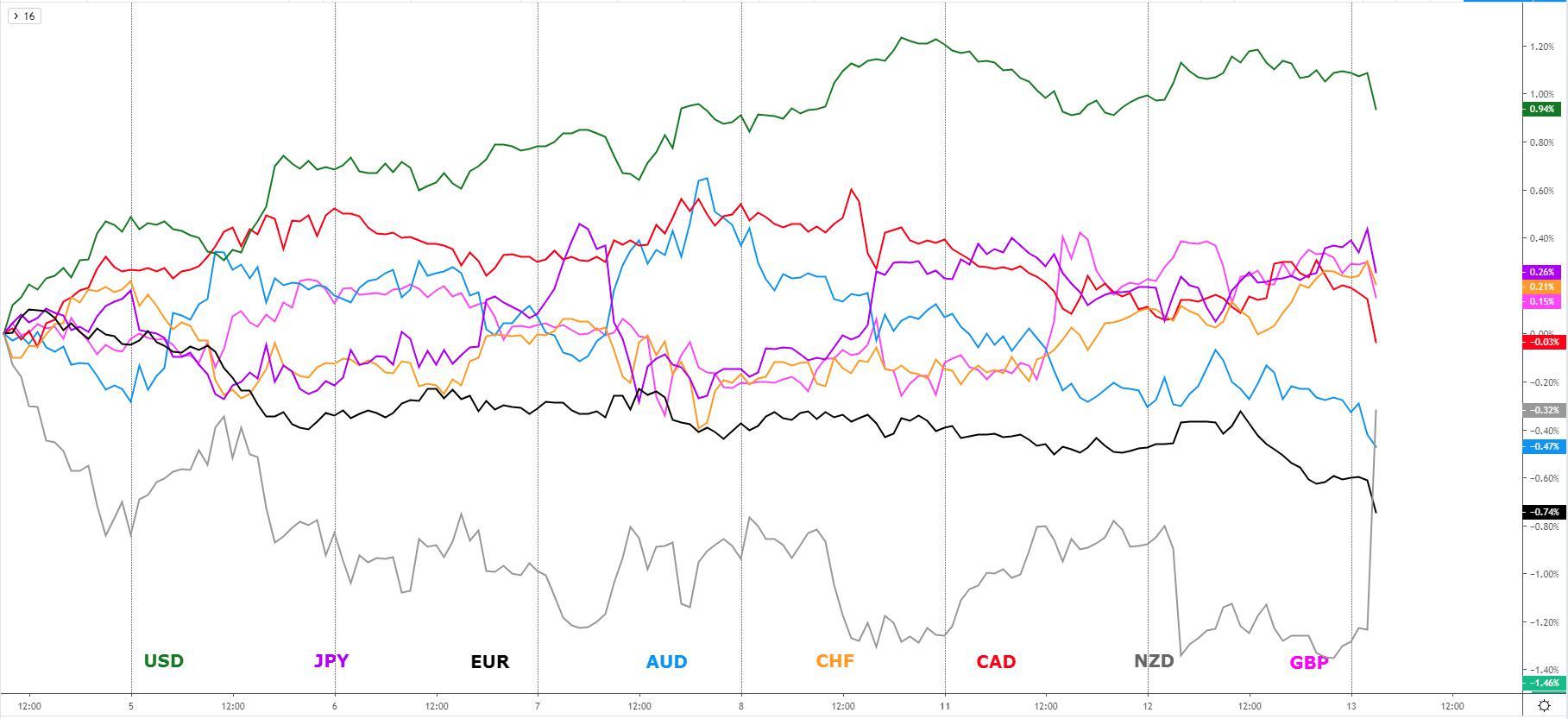

The Kiwi is on fire after the RBNZ left rates on hold, a counter-intuitive decision not expected by market forces. After a slow start of the week, the market is finally coming to life. Trading opportunities continue to be up for grabs amid the anomaly in JPY strength. The follow-through demand in the GBP is also an interesting trade to exploit. Find out about all these nuggets in today's report, which as usual, leaves no stone unturned...

Quick Take

The NZD has been marked up aggressively after a surprising decision to hold rates unchanged at 1% by the RBNZ. Ahead of the risk event, the marked was pricing in 76% chance of a rate cut in today's rate call following the low reading in yesterday's RBNZ's survey of business inflation expectations (1y and 2y out). The AUD has failed to piggyback the rise in the NZD as a WSJ crossed the screens warning that tariffs continue to be the main stumbling block as part of the U.S. and China Phase One trade deal. The world's reserve currency (USD) has found steady demand to start the week following its top performance last week.

There have been no drivers for the USD even if that's about to change as the market prepares for the US inflation report and a Fed Chair Powell speech testifying on Capitol Hill before the Joint Economic Committee. What still doesn't add up is the stubborn appreciation by the yen and the Swiss franc amidst the reflationary trade environment (carry trades encouraged) currently present. The rise since last week in equities and global bond yields in tandem is a testament of the anomalies at play between the risk profile (positive) and the relatively high levels in JPY, CHF. The euro and the pound continue to show a stark contrast in performance, the latter boosted by Farrage's Brexit party not contesting Tory seats in the election, while the euro keeps under pressure by micro sell-side campaign even if the German economic sentiment data keeps improving. Lastly, demand flows into the CAD remain limited as the market is still under the impression that selling the currency is a well-justified trade based on the newly adopted dovish stance by the BOC as it readies to go for insurance rate cuts.

Narratives In Financial Markets

* The Information is gathered after scanning top publications including the FT, WSJ, Reuters, Bloomberg, ForexLive, Institutional Bank Research reports.

RBNZ keeps rates on hold: In a surprise decision, the RBNZ decided to hold its interest rate unchanged at 1%. Following yesterday’s RBNZ survey of expectations, which showed 2-year inflation expectations slipping from 1.86% to 1.80%, the market had been pricing in a 25bp rate cut at 76%. The NZD has been immediately marked up in response to the announcement in what has been an outsized move s an overly short market runs for the exits. One must bear in mind that the next RBNZ meeting won’t be until Feb 12th, hence today’s decision to hold rates is even more relevant as it implies the Central Bank won’t be flexing its muscles with further easing for another 3 months.

RBNZ presser reiterates low rates here to stay: The Reserve Bank of New Zealand Governor Orr press conference revealed that the RBNZ decision to leave its cash rate on hold was unanimous. Orr said that the policy is very stimulating at the moment but more stimulus will be added if needed. Orr reiterated what the statement reflected in terms of rates to stay low for a long period of time.

Trump's speech sounds like a broken record: President Trump, in a rare speech at the Economic Club of NY in NY, ended with little new information for markets to price in. The focus was on whether or not would fill in the market with any new insights on the US-China Phase One deal. At the end, we haven’t learned anything new, with the speech oriented towards a review of the economic, regulatory and fiscal landscape, with the usual bashing against the Democrats and the Fed. One of the new highlights was when Trump said “the US could substantially raise China tariffs if the deal is not reached.”

Kudlow outlines prudence before trade deal with China: US Economic Adviser Kudlow didn’t help to fuel optimism about a quick resolution on the Phase One trade deal with China, saying that he “would not put a timeline on China trade deal.” Kudlow also detailed that “we made a lot of progress on currency stability and IP theft”, and that “tariff reduction may be part of the package but not until the entire deal is put together.” Nonetheless, stocks and bond yields were sustained near the highs, reinforcing the notion that the environment remains characterized by playing into the view of the reflationary trade.

Tariffs main sticking point in US-China trade negotiations: The Wall Street Journal reports that “tariffs are emerging as the main stumbling block in efforts by the U.S. and China to come to a limited trade deal.” The headline, which came just ahead of the RBNZ decision, took its toll in the AUD, which later pared some of the losses piggybacking the rise in the NZD. The report adds that the “logjam centers on whether the U.S. has agreed to remove existing tariffs in the so-called "phase one" deaL or whether the U.S. would only cancel tariffs set to take effect Dec. 15."

Fed's Powell to take the stage on Wednesday: Next up, Fed Chair Powell will be testifying on Capitol Hill before the Joint Economic Committee, in Washington DC. His stance is anticipated to be one of wait-and-see approach as the Fed an everyone else awaits for further clarity in the trade war against China and the Fed allows time for the interest rate cuts to feed through the economy while assessing incoming economic data.

Good news out of Europe: It started when we learnt that the Spanish Socialist party struck a coalition deal with left wing Podemos to hopefully unlock the political crisis in the country. Then we had France’s BdF Industry Sentiment for October, upbeat at 98 vs 97 expected, only to top it off with Germany’s Economic Sentiment, Survey for November, which saw a substantial jump from -23.5 to -1.0, even if current conditions remains the main dragger.

UK employment data a sideshow: In the UK, the jobs reports saw falling employment (-58k), biggest fall in the three months to May 2015, and softer wage inflation, with the UK September average weekly earnings at +3.6% vs +3.8% 3m/y expected, even if the unemployment rate came back down to 3.8%. Remember, this data is only of relative importance at the moment as Brexit and the UK polls ahead of the UK general election is what’s driving the GBP these days. The BOE remains sidelined.

UK polls show Conservative with ample lead: The latest YouGov poll shows Conservatives at 42% vs Labour 28%, Liberal Democrats 15%. It remains to be seen how the polls will vary after Barrage’s change of stance. As a reminder, Farrage’s Brexit Party won’t contest the 317 seats won by the Conservatives at the last election. Farrage said they’ll go after the Labour-held seats, which suggests the chances of a hung parliament or a Labour-led minority government have been reduced as per the GBP reaction.

US NFIB shows tiny improvement: In the US, we had an almost vacant calendar. The small business survey (NFIB) was the only economic data of note, where a small improvement was observed. Commenting on capex, the Survey noted that “Trade policy is impacting many small firms adversely; about 30 percent recently reported negative impacts. Making commitments about production and distribution will be more difficult until import and export prices are stabilized with trade agreements”.

EU auto tariffs back on the table? There are conflicting reports about the establishment of auto tariffs by the US to Europe. FoxBusiness Edward Lawrence was on twitter saying: ”US trade representative offices will submit a report on possible tariffs on autos and auto parts. This report will be submitted to White House by tomorrow and could allow Pres. to target specific countries and EU for tariffs on autos and auto parts.” The comments come in complete contrast to reports that the White House would delay tariffs on EU order for 6 months, which is congruent to what the President of the European Commission Juncker revealed when saying there won’t be tariffs in the short run.

HK a ticking bomb for risk dynamics? The protests out of Hong Kong remain a major concern for markets in Asia, The latest we learned is that the local police made a statement that Hong Kong’s rule of law has been pushed to the “brink of total collapse” following new incidents against those taking the streets. However, this is not changing China’s stance, with China’s top agency overseeing Hong Kong endorsing the prevalence of the current tough approach by Hong Kong’s government and police to stop crimes and restore order. There is no end in sight to the ongoing conflict.

Recent Economic Indicators & Events Ahead

Source: Forexfactory

Professional Insights Into FX Charts

AUD/JPY continues to be on what I perceived to be a long accumulation phase. The discrepancy that exists between the risk-weighted line and pricing of the instrument implies that every single failed break to the downside, what we understand as compression, is an opportunity to get a better cost average to build AUD long inventory. Notice, the compressive nature of the price over the last 48h is also occurring at a key area of interest where liquidity tends to be ample. This current location in the pair respects the model of buying when the price is low and technical value is high in the context of an uptrend. Bottom line, I am expecting much higher levels in the pair, barring any off-the-cuff negative headline on the US-China trade negotiations, which would take the market by surprise.

The filling of long-sided business in the GBP/USD has gone through my books after the price pulled back beyond the 50% retracement area where my limit order was sitting at. The current inertia of this market following the headfake of a major liquidity area in the H4 has led me to believe that we are headed higher for a retest of 1.29 before 1.28 is re-taken again. This is a view that must obviously be reconciled with the fact that off-the-cuff unexpected headlines on Brexit can see algo-led activity distort this technically constructive view, but this time, with implied vol in the GBP much lower (less noise), I am more comfortable with GBP exposure.

Gold has retested the origin of a major demand imbalance area as the green rectangle outlines, leading to an abrupt reversal in the price of the asset, which occurs in the context of a compression price formation. This type of pattern at the location that it occurred is a powerful signal that the market is looking to transition into a shift in order flow, potentially all the way towards a retest of the prior key support broken around the 1,480.00 vicinity.

Last but not least, the EUR/AUD market is exhibiting signs of a potential price pattern reversal after an area rich in liquidity was taken out only to be rejected two times in a row. The poking of price above the blue resistance line could not be sustained as a custer of offers beginning at the edge of a supply in the daily (red rectangle) prevented the market from further auctions higher. The upside failure suggests that this is a market running now the risk of a downward bias to play out in coming sessions, which would allow a re-anchoring of the lower timeframe trend with the underlying tendency in the daily, which remains to the downside.

Important Footnotes

- Risk model: The fact that financial markets have become so intertwined and dynamic makes it essential to stay constantly in tune with market conditions and adapt to new environments. This prop model will assist you to gauge the context that you are trading so that you can significantly reduce the downside risks.

- Cycles: Markets evolve in cycles followed by a period of distribution and/or accumulation.

- POC: It refers to the point of control. It represents the areas of most interest by trading volume and should act as walls of bids/offers that may result in price reversals. The volume profile analysis tracks trading activity over a specified time period at specified price levels. The study reveals the constant evolution of the market auction process.

- Tick Volume: Price updates activity provides great insights into the actual buy or sell-side commitment to be engaged into a specific directional movement. Studies validate that price updates (tick volume) are highly correlated to actual traded volume, with the correlation being very high, when looking at hourly data.

- Horizontal Support/Resistance: Unlike levels of dynamic support or resistance or more subjective measurements such as Fibonacci retracements, pivot points, trendlines, or other forms of reactive areas, the horizontal lines of support and resistance are universal concepts used by the majority of market participants.

- Trendlines: Besides the horizontal lines, trendlines are helpful as a visual representation of the trend. The trendlines are drawn respecting a series of rules that determine the validation of a new cycle being created. Therefore, these trendline drawn in the chart hinge to a certain interpretation of market structures.

- Fundamentals: It’s important to highlight that the daily market outlook provided in this report is subject to the impact of the fundamental news. Any unexpected news may cause the price to behave erratically in the short term.

- Projection Targets: The usefulness of the 100% projection resides in the symmetry and harmonic relationships of market cycles. By drawing a 100% projection, you can anticipate the area in the chart where some type of pause and potential reversals in price is likely to occur, due to 1. The side in control of the cycle takes profits 2. Counter-trend positions are added by contrarian players 3. These are price points where limit orders are set by market-makers.

Related Articles

The Japanese yen is slightly lower on Wednesday. In the North American session, USD/JPY is trading at 148.92, down 0.07% on the day. What is the best performing G-10 currency...

USD/JPY is consolidating near 149.33 on Wednesday, with the yen pausing its rally while holding near four-month highs against the USD. This stabilisation follows renewed support...

The US stock market stabilized yesterday, but there were no significant moves during the US session as speculators remained neutral ahead of Nvidia (NASDAQ:NVDA) earnings, which...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.