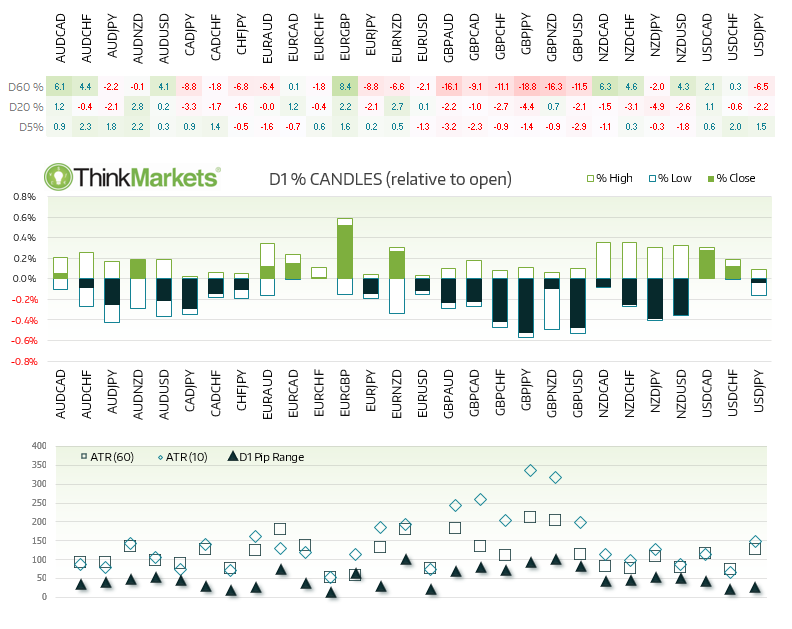

Volatility remained well within their typical daily ranges, according to 10 and 60 day ATR’s. However, the British Pound and Kiwi Dollar account for the bulk of FX major moves throughout Asia, which both trade near their daily lows at London Open. There is a bulk of data from UK shortly which should either extend these pre-emptive moves, or see them retreat toward open prices. Either way, the fact that no cross has come close to its typical daily range, we are not concerned of moves being over-stretched which could leave ‘meat on the bone’ for UK and US sessions.

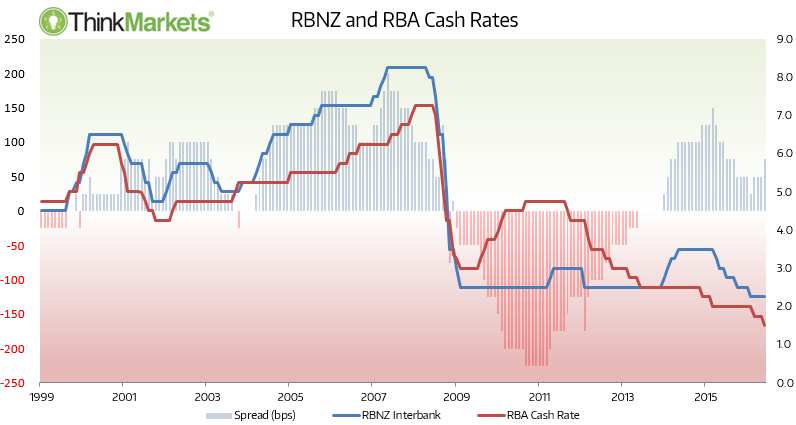

RBNZ are under pressure to cut tomorrow. RBA cutting last week certainly hasn’t helped as there is now a 75bps spread between their cash rates. Historically this may not seem high, but when both interest rates are at record lows and both central banks are clearly within an easing cycle, then the spread becomes all the more important. If they hold back from a rate cut the reason is likely to be due to their sky rocketing house prices. But when you put this alongside their low inflation (particularly tradable inflation, which remains negative) and a high exchange rate, then they may need to let house prices go higher still to help their export market with a lower exchange rate.

However, as RBNZ are more than aware of their predicament, we expect a rate cut and talk of further easing in the statement to send the Kiwi Dollar lower and EUR/NZD towards the 1.5836 swing high. Failure to do so will likely send the NZD higher across the board and EUR/NZD below the monthly pivot, for a run towards the 1.515 lows.

EUR/NZD has made multiple, intraday attempts to break below the monthly pivot. Price is currently suppressed by the descending trendline from the April high, but tomorrow’s cash rate for RBNZ could prove the catalyst to make or break the trendline or pivot support. We note the bullish flag formation which, if successful, targets the 1.601/225 zone – an area which house a prior gap from June. 1.5836 is a likely interim target as this houses the monthly R1 and July swing high. Any break above the trendline could be taken as a bullish continuation sign, leaving us the option to drop to lower timeframes and trade in the direction of bullish momentum, or await a retest of the broken trendline or monthly pivot.