Key Points:

- RBNZ will need to raise rates to combat rising inflationary pressures.

- Inflation will largely stem from a tightening job market.

- CPI data suggests we may already have entered a high inflation period.

After being trapped in a low-interest rate environment for such an extended period, talk of real normalisation can, at times, seem more like wishful thinking than anything else. However, for one country at least, the data is beginning to put pressure on its central bank to finally begin the process of lifting rates back to historic norms. Specifically, New Zealand could see a slew of hikes moving forward as the RBNZ attempts to keep inflation in check and within its mandated band.

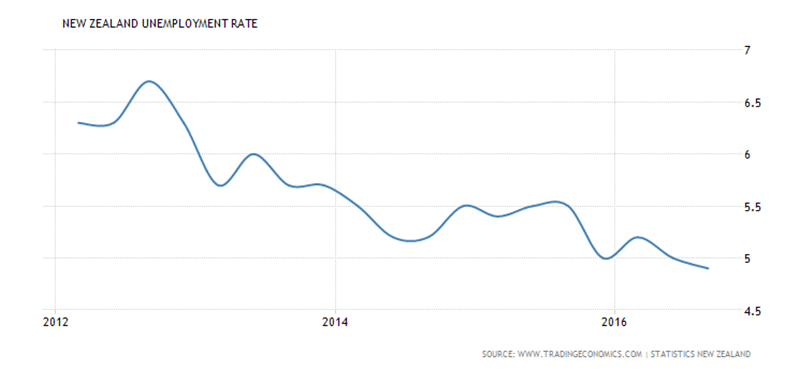

First and foremost, the question has to be asked, are inflationary pressures really building? In short, yes they are and there are a number of key drivers which are contributing to this uptick. Primarily however, blame can be laid at the feet of a tightening job market as, at 4.9%, unemployment is below the widely accepted natural rate for the country. As a result of this low unemployment rate, wage inflation is almost certain to be on the rise this year and general inflation should follow suit.

In addition to wage inflation, the property bubble in the nation’s largest city will be contributing to overall inflationary pressures. Specifically, rental prices have skyrocketed by around 7.1% over the past 12 months due to the lack of housing supply. What’s more, the mere presence of the bubble provides an incentive for the RBNZ to step in with some hikes as increasing rates would help to cool off the red hot property market.

Regardless of what is causing inflation to spike, the fact remains that we are already beginning to see the start of this period of higher inflation as was made quite clear in the latest CPI results. Coming in at 1.3% q/q, the figure was in stark contrast to the historically low inflation seen across the ditch in Australia which took most of the market by surprise. Further upticks of this magnitude will see the nation’s inflation rate move above the 3% upper limit targeted by the RBNZ which will necessitate at least a 25bps hike in the OCR.

Ultimately, we will have to wait and see whether or not the central bank will take this first move towards seeing rates back to their normal levels. However, faced with strong GDP growth of 3.5% y/y, recovering dairy prices, robust retail sales, and the other factors mentioned above, the RBNZ will be fairly loath to keep rates on hold. As a result, keep an eye on the February OCR announcement as it could be the first step in a road towards normalised rates.