The RBNZ decision to hold the OCR steady at 2.25% pummelled the AUDNZD, much to the delight of Governor Wheeler. The move to stay steady comes on the heels of the abysmal New Zealand Trade Balance result of 117M.

As a result, the plunge to 1.0991 will likely be a relief to Wheeler as the waning health of the NZ dairy sector needs all the help it can get amid rock bottom Global Dairy Prices. However, the pair could go lower still if the current support is broken.

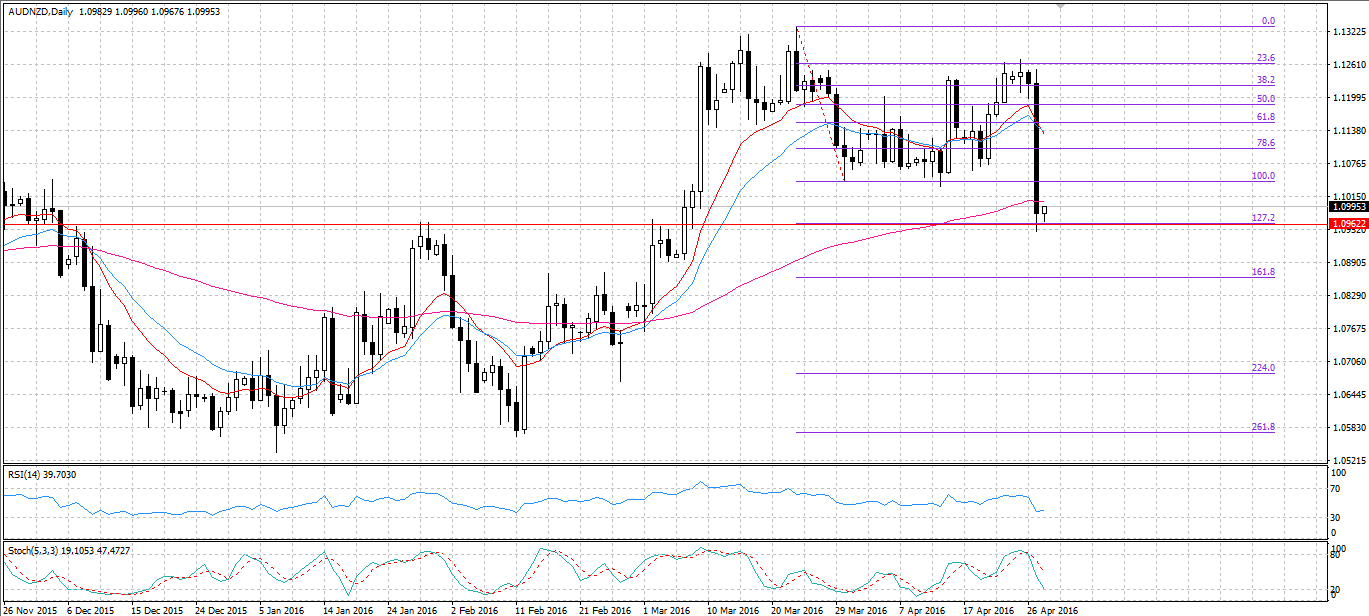

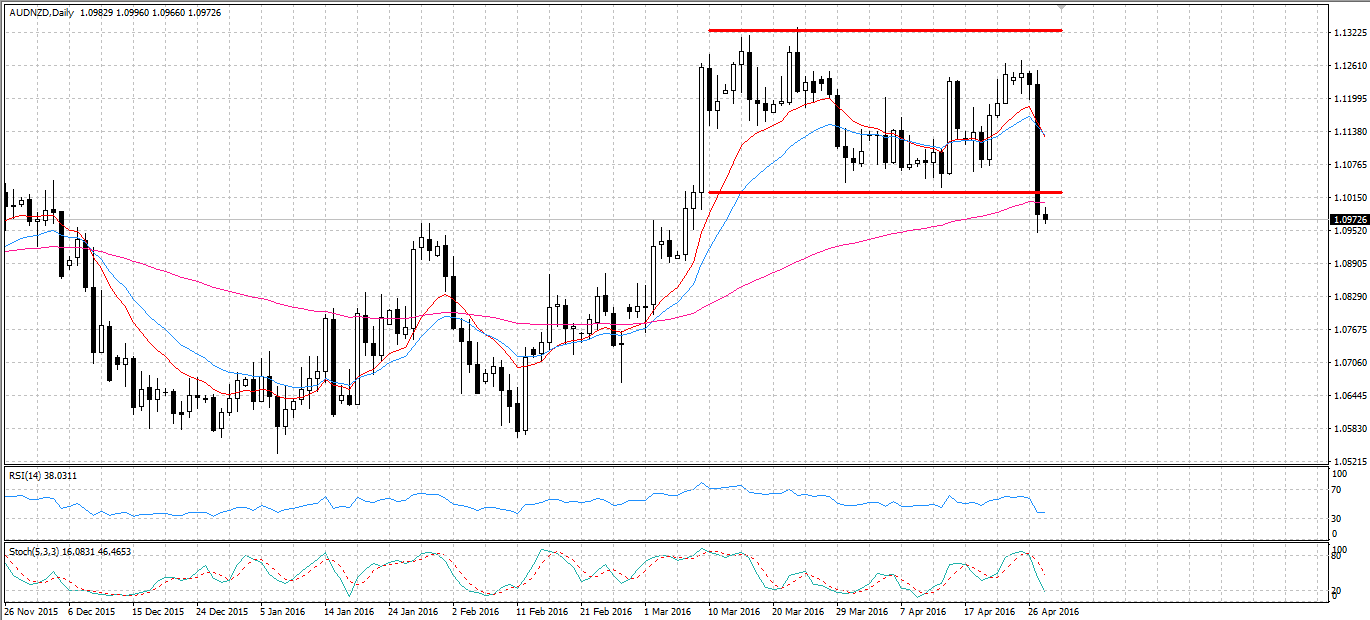

As shown on the daily chart, the AUDNZD found support around the 127.2% Fibonacci retracement level at 1.0962. Whilst the freefall began amid the awful 117M NZ Balance result, the OCR announcement drove the pair into the ground. Additionally, Wheeler’s well-documented willingness to ease rates fuelled speculation about another rate cut. Consequently, significant selling pressure mounted in the lead up to the RBNZ announcement.

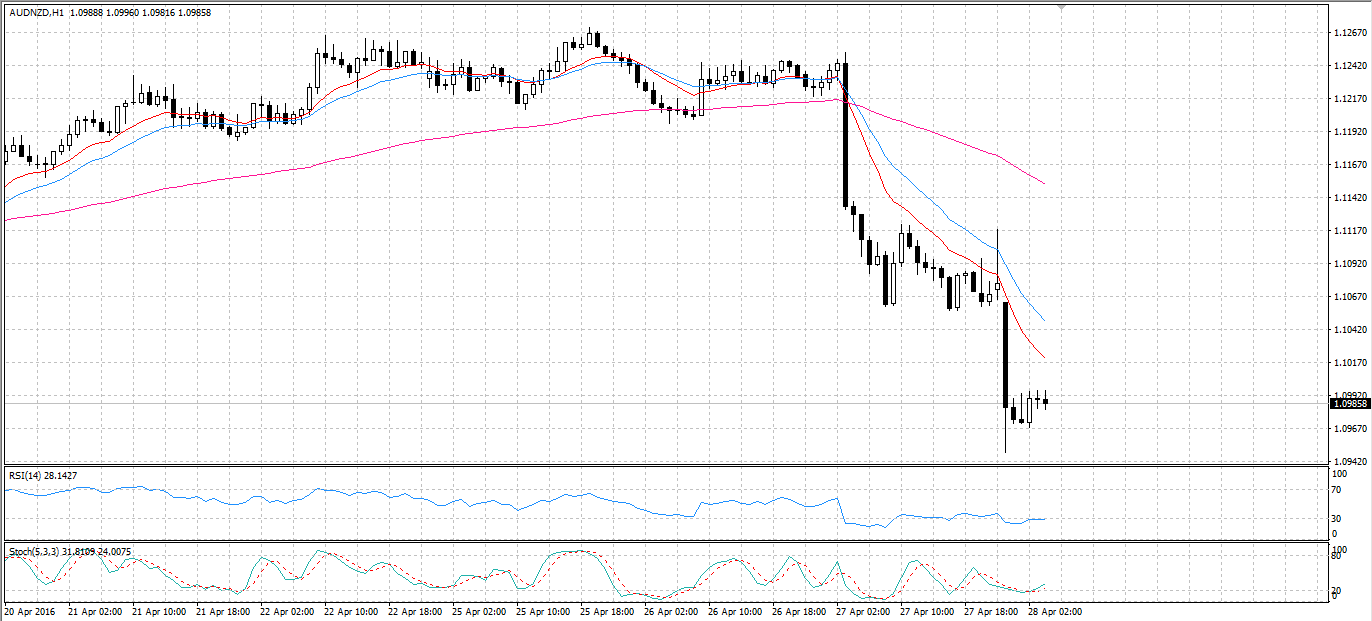

Whilst the plunge of the AUDNZD has been quite spectacular, the pair could go lower still. Despite the massive slip, the stochastic and RSI oscillators are still signalling that the pair is not yet oversold. Consequently, as liquidity increases later in the session we could see the pair sink well below support at 1.0962. Additionally, the pair has well and truly broken the lower constraint of its channel. As a result of the breakout, latecomers may keep selling pressure steady in the coming session.

Moreover, the 12 and 20 period EMAs on both the daily and hourly charts are indicating that the downtrend is still in full swing. As shown on both charts, crossovers of the EMAs have occurred which could mean the recently bullish NZD is becoming bearish in the long-term. Additionally, on the hourly chart the 12 and 20 period EMAs have crossed the 100 period EMA. Consequently, there is now a very strong signal that the pair is going to trend lower.

Ultimately, the NZD has been unjustifiably high for some time and the current freefall demonstrates this in spectacular fashion. Patently, Governor Wheeler has used the expectations channel to great effect in order to force a depreciation of the NZD. As a result, New Zealand’s dairy sector will be welcoming the increasing competitiveness of their exports in the country’s largest export market. As time progresses, we will see if the weaker NZD can give the boost the nation’s largest export sector needs to improve the Trade Balance.