RBNZ: Less cautious than expected, but Wheeler drags NZD down

- The RBNZ kept its policy unchanged overnight, as was widely anticipated. The Bank acknowledged that CPI inflation softened in Q2, but noted that it still remains within the target range. Importantly, officials did not push back the timing of their first planned rate hike (Q1 2020), as may have been anticipated in the face of softer data. They did, however, express a greater discomfort about the recent strength of the kiwi, indicating that “a lower New Zealand dollar is needed”. In the previous statement they only noted that “a lower New Zealand dollar would help”. Nonetheless, the language around the economic outlook as well as the currency may have been less dovish than what was expected by investors, evident by the spike higher in NZD on the decision.

- The kiwi did not hold on to its gains for long though, with the currency turning back down to trade much lower in the following hours. We think this reversal may have been due to some remarks by Governor Wheeler, who said that the option of FX intervention is “always open”.

- Moving forward, we think that the outlook for NZD remains cautiously negative. The market is currently pricing in the first RBNZ hike in one year’s time (Q3 2018), according to New Zealand’s OIS, while the Bank’s own forecasts suggest that this is far too early. The market could push its expectations back in the foreseeable future to be more in line with those of the Bank, especially if the recent softness in economic indicators persists. What’s more, policymakers clearly want a weaker kiwi, implying they could continue to jawbone it, should it continue to trade at undesirable levels for the Bank. Finally, the recent rise in geopolitical risks also argues for a weaker NZD, as the currency tends to underperform when risk appetite is low.

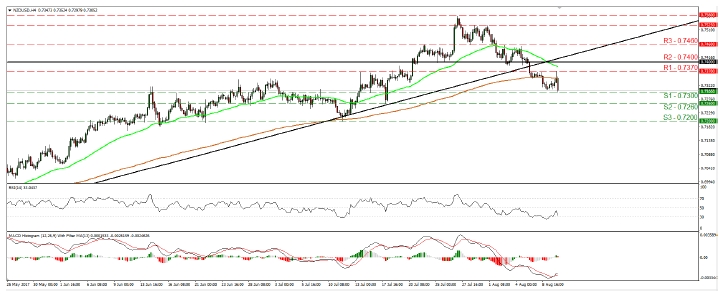

- NZD/USD spiked higher on the RBNZ rate decision to hit resistance at 0.7370 (R1). However, the pair was quick to give back those gains and trade even lower on Governor’s Wheeler’s reference to intervention. At the time of writing, the rate is testing the 0.7300 (S1) line, and given that the short-term trend remains negative, we would expect a clear dip below that level to initially aim for the 0.7260 (S2) support, marked by the low of the 18th of July. Another break below 0.7260 (S2) may set the stage for extensions towards our next key support of 0.7200 (S3). As for the bigger picture, we stick to our guns that the dip back below 0.7400 (R2) combined with the negative divergence between our daily oscillators and the price action increase the likelihood for the pair to continue drifting lower in the foreseeable future.

Today’s highlights:

- During the European day, Norway’s CPIs for July will be in focus. The forecast is for both the headline and the core rates to have declined notably. Even though something like that could reverse some of the NOK’s recent gains, we doubt that it will cause the Norges Bank to shift to a more dovish bias, considering that the Bank already expects inflation to continue drifting lower in the months ahead. We also get industrial production data for June from both Sweden and the UK. In the US, the PPI rate for July and initial jobless claims for the week ended on the 4th of August are due out.

- We have only one speaker on the agenda: the influential President of the New York Fed, William Dudley. It would be very interesting to hear his view on inflation. His most recent comments on the subject were back in June, when he said that even though inflation is a bit low, it should rebound alongside wages as the labor market continues to improve. Considering that inflation has remained subdued since then, we think Dudley could change tune (as Yellen did) and indicate that the recent softness in inflation may not be entirely transitory. Any such comments could bring USD under renewed selling interest.

- USD/JPY fell below 109.90 (S1) yesterday, the lower bound of the range that had been containing the price action since the 28th of July. Nevertheless, in the early US session, the rate rebounded back above that barrier. Although the brief dip painted a lower low on the 4-hour chart, we prefer to wait for a decisive close below the crossroads of the 109.90 (S1) level and the upside support line taken from the low of the 17th of April before we get confident on larger downside extensions. The catalyst for such a move may be inflation concerns by NY Fed President Dudley.

- Support: 0.7300 (S1), 0.7260 (S2), 0.7200 (S3)

- Resistance: 0.7370 (R1), 0.7400 (R2), 0.7460 (R3)

USD/JPY

- Support: 109.90 (S1), 109.45 (S2), 109.00 (S3)

- Resistance: 110.25 (R1), 111.00 (R2), 111.30 (R3)