An interesting announcement was made by the Reserve Bank of New Zealand this morning regarding the currently high New Zealand Dollar. Intervention by the RBNZ is a distinct possibility at these high levels, therefore a medium term short trade on the Kiwi could pay dividends.

RBNZ Governor Wheeler said: “If the currency remains high in the face of worsening fundamentals, such as a continued weakening in export prices, it would be more opportune for the Reserve Bank to intervene in the currency market to sell NZ Dollars”.The worsening fundamentals Mr Wheeler is talking about here is the global dairy price. He was speaking at dairy industry conference in Hamilton this morning so it’s no surprise dairy was the example he gave. He listed the challenges China is facing as risks for the NZ dairy industry. The high Kiwi dollar reduces the amount of income the New Zealand dairy industry earns as dairy prices are quoted in US dollars. As dairy is New Zealand’s largest export sector, this has broader implications for the New Zealand economy.

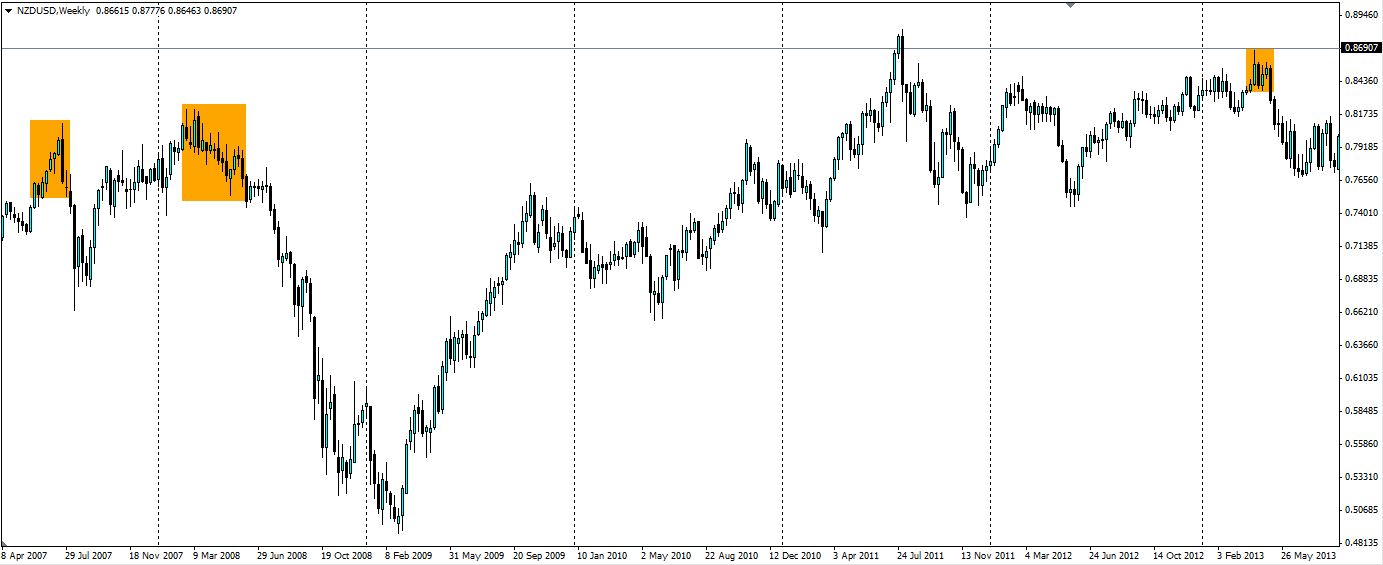

The RBNZ is no stranger to currency interventions. A year ago, it announced it had sold NZ$256m on the open market in April 2013 in an attempt to bring the dollar down from what it calls ‘unsustainable’ levels. Prior to that, the bank sold NZ$736m in June 2007 and $1.5b in July 2007. The following year, it sold another $1.5b between February and May 2008.

Governor Wheeler himself has said he does not expect to materially move the currency market but “only hope to smooth the peaks off the exchange rate and diminish investor perceptions that the New Zealand dollar is a one-way bet, rather than attempt to influence the trend level of the Kiwi." He is wise to take this view. In a market where NZ$100b is traded every day, the RBNZ has capacity to sell less than $10b,depending on its reserves.

However, looking at the abovementioned interventions, they do seem to have an effect on the market. Either that or the RBNZ is good at picking the tops. As we can see on the below weekly chart for the NZD/USD, each intervention is followed by a substantial drop in the rate. Is this the signal that the Kiwi is overvalued that the market has been looking for?

Source: Blackwell Trader

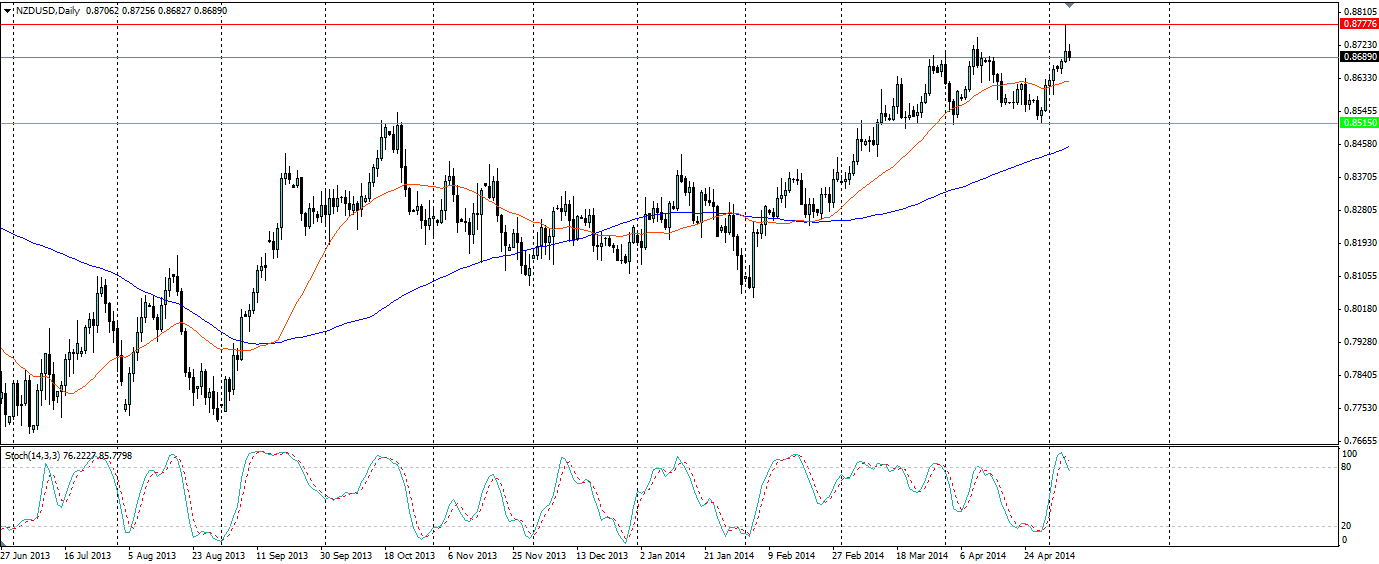

Since the announcement, the Kiwi dollar has dropped from its overnight high of US$0.8777 to its current level of 0.8690. The Unemployment rate was also announced today and it held steady at 6.0%. The market was looking for 5.8% so the Kiwi was pushed slightly lower on this but the main movement was on the announcement by Governor Wheeler of possible intervention.

Given that the market is expecting a further 3 raises in the interest rate before the end of the year, it is difficult to see any upside potential to the Kiwi. One can assume the rate hikes have been priced in, so if they materialise, the market will not move any higher. Any movement will only encourage the RBNZ to begin selling Kiwi dollars on the open market.

Traders looking to take the RBNZ’s comments as a signal the market is turning could be looking at a potentially lucrative play. Certainly, the Stochastic oscillator agrees as it has peaked 95.38 and is starting to trend downwards. Yesterday’s daily candle shows a fairly clear bearish rejection from the high 87s. Historically, the market has not liked anything above 87 cents with 88 cents only being reached once ever, but this was not sustained for long. We should see a movement down towards the 100 day moving average which is a more realistic level for the Kiwi.

Source: Blackwell Trader

The RBNZ has announced that worsening fundamentals and a high Kiwi dollar could present an ‘opportune’ time for it to intervene in the currency markets to bring the dollar down. With the expected interest rate hikes already priced in, this presents traders with an opportunity to go short on the Kiwi in the medium term.