RBNZ Interest Rate Decision

- RBNZ is to announce it’s interest rate decision on Thursday during the early Asian morning. It is expected to stay pat at +1.75%. Currently, the market seems to have priced in the possibility of RBNZ remaining on hold by 99.14% (NZD OIS). The decision will be the first with Mr. Adrian Orr as governor of RBNZ and the first with a dual mandate (unemployment and inflation). We do not see the case for the presence of a new governor to change the bank’s policy quickly but we see the case for the bank to remain data-driven. Also, the new second mandate may result in the bank drilling deeper in employment data, as well as a more balanced approach to the economy. Market focus is expected to shift to the accompanying statement as well as the following press conference. We see the case for accompanying statement to retain a neutral to dovish tone, especially as the inflation rate dropped to +1.1% yoy which is at the lower bound of RBNZ’s target (2±1%). On the other hand, low unemployment could provide reasons for optimism as it remains at 4.4%, a rather low unemployment rate compared to other countries. Should there be a rather dovish statement we could see NZD weakening.

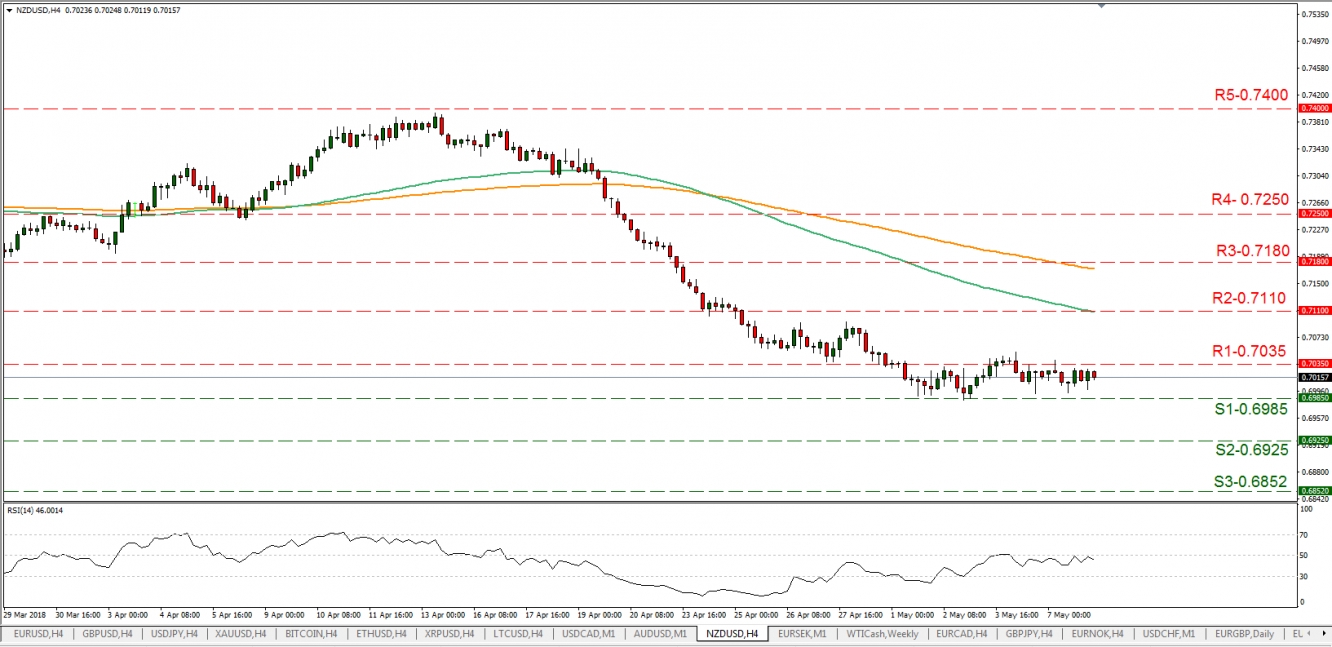

- NZD/USD has been trading in a sideways manner for the past week testing the 0.7035 (R1) resistance line as well as the 0.6985 (R2) support line. The pair could continue to trade in a sideways manner, however, we also could experience some bearish tendencies, as the RBNZ interest rate decision early on Thursday’s Asian morning could weaken the Kiwi. On the flipside, US inflation data could favor the greenback. Also, we could see the market starting to position itself prior to the release of the financial data. Should the bulls take over the reins we could see the pair breaking the 0.7035 (R1) resistance line and aim for the 0.7110 (R2) resistance hurdle. Should the bears be in the driver’s seat, we could see the pair breaking the 0.6985 (S1) support line and aiming the 0.6925 (S2) support barrier.

Trump to announce a decision on Iran nuclear deal

- President Trump tweeted on Monday that he will announce his decision on the Iran nuclear deal on Tuesday. Should the US decide to impose sanctions on Iran’s central bank and oil exports we could see instability rising in the region. The possibility of the US waiving possible sanctions for the current being may not totally erase uncertainty though. Iran’s possible retaliation movements could include a reactivation of its uranium enrichment program as well as a strengthening of Shiite forces in Iraq, Syria, Lebanon, and Yemen, producing further instability in the region. On a deeper level, Iran may actually switch the base currency of its oil trading from USD to another currency, possibly weakening the USD. We see the case for the choice of Iran activating its uranium enriching program, being remote at the current being, as it could isolate Iran in the international community. Any further instability in the region could increase oil prices as well as strengthen safe havens.

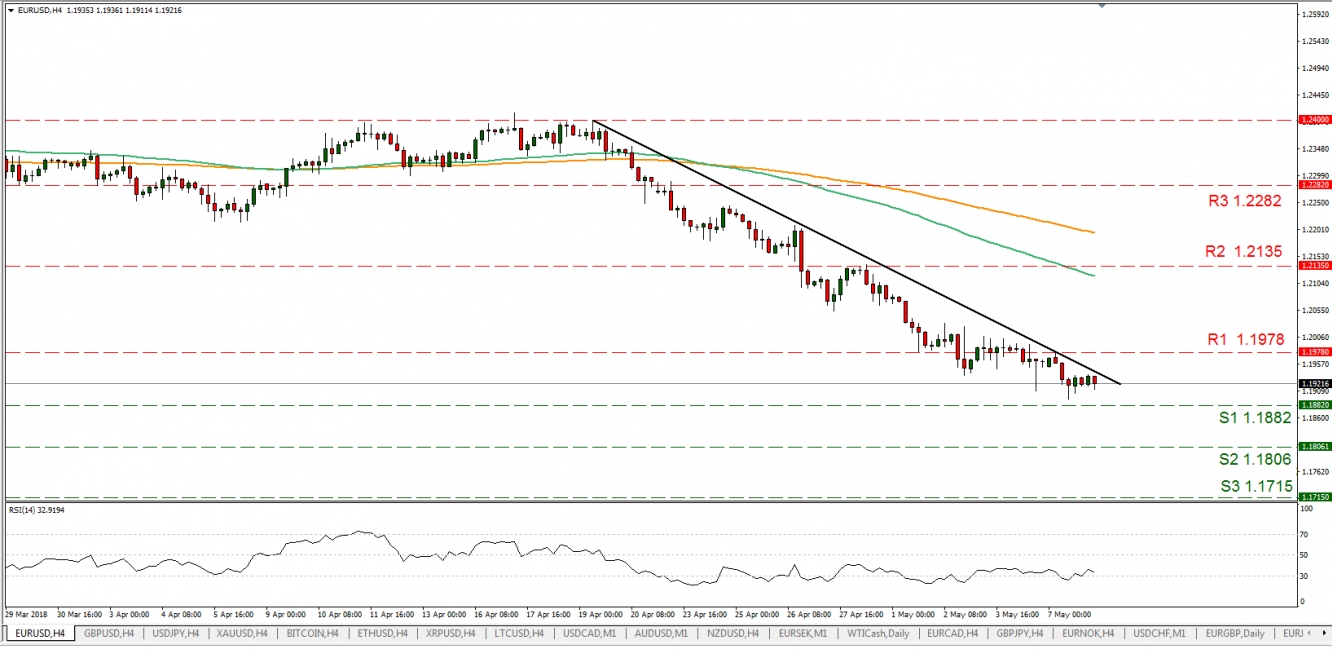

- EUR/USD dropped yesterday after testing the 1.1978 (R1) resistance line and continued on lower grounds. We could see the pair trading in a sideways manner today, however, the pair could prove sensitive to Powell’s speech as well as the financial data due out today. Should the pair find fresh buying orders along its path we could see it breaking the 1.1978 (R1) resistance line and aiming for the 1.2135 (R2) resistance level. On the other hand, should the common currency be underselling interest, we could see the pair breaking the 1.1882 (S1) support line and aim for the 1.1806 (S2) support level.

In today’s other economic highlights:

- During today’s European session we get Germany’s Industrial Output and Trade Balance for March. We also get UK’s Halifax House Prices for April. In the American session, we get Canada’s house starts for April and from the US the JOLTS Job Openings figure as well as the API weekly crude oil stocks. Please be advised that Fed chair Jerome Powell speaks today.

NZD/USD

·Support: 0.6985 (S1), 0.6925 (S2), 0.6852 (S3)

·Resistance: 0.7035 (R1), 0.7110 (R2), 0.7180 (R3)

EUR/USD

·Support: 1.1882 (S1), 1.1806 (S2), 1.1715 (S3)

·Resistance: 1.1978 (R1), 1.2135 (R2), 1.2282 (R3)