The Reserve Bank of New Zealand (RBNZ) held rates at record lows of 1.5%, opting not to play catch up with the RBA’s 1.25%. Yet by reintroducing talk of a cut, they kept the door open for easing in August.

Statement summary:

- The Official Cash Rate (OCR) remains at 1.5 percent

- A lower OCR may be needed over time

- Domestic growth has slowed

- Downside risks related to trade activity have intensified

- Low rates and government spending to support growth and employment

- Given downside risks around employment and inflation outlook, a lower OCR may be needed.

Traders had been expecting a stronger dovish tone to the statement, yet with them keeping a cut in August as a ‘maybe’ and not a ‘likely’, it leaves potential for further short covering on the Kiwi dollar on the near-term (barring jawboning from Adrian Orr, who speaks shortly). Of course, it still paves the way for a potential cut in August, but it will likely hinge upon domestic inflation and employment data, alongside trade developments.

NZD is currently the strongest major of the session, with NZD/JPY leading the board and already testing its typical daily range. Indeed, this invalidates the swing trade short idea, as the fundamentals do not match up with the technicals. Moreover, bullish momentum has taken it clearly above the 50% retracement level highlighted.

GBP/NZD has hit a new cycle low after breaking out of compression. The 8 and 20-day eMA’s are curling lower and crossed back beneath the 200-day eMA. Given the increasingly net-short exposure of GBP traders highlighted in our weekly COT report and the political uncertainty with the UK’s hunt for the next PM, we suspect the path of least resistance likely points lower. A daily close back above 1.0908 support would place it on the backburner but, ultimately the trend remains bearish below 1.9415.

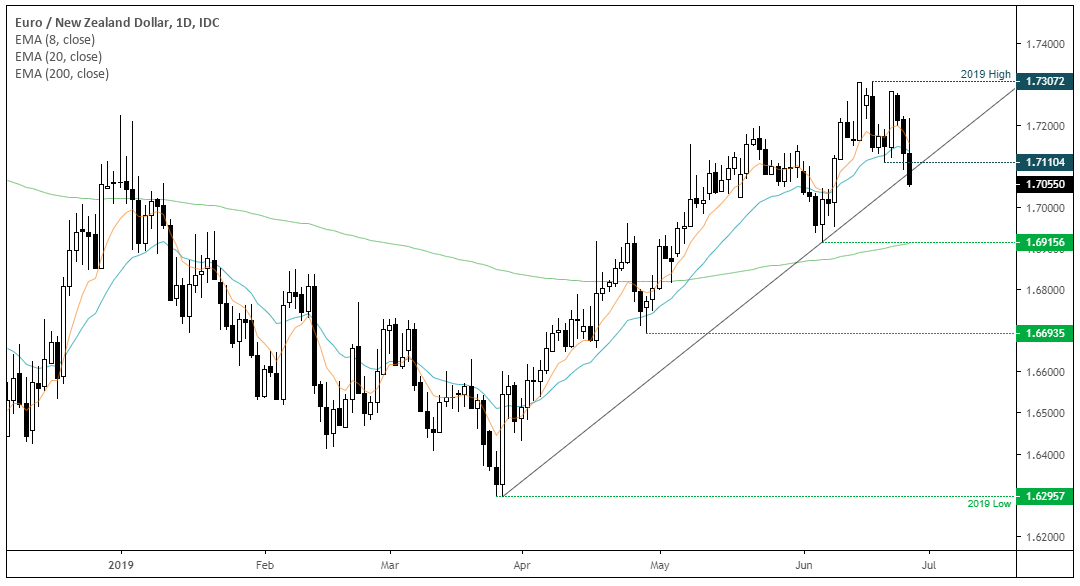

EUR/NZD has broken its March 2018 trendline and could head for the 1.6916 low, near the 200-day eMA. A dovish ECB and less dovish than expected RBNZ has proven to be a decent short catalyst. A daily close below the trendline would be preferred, however we remain bearish whilst it trades back below 1.7110.

Keep in mind that RBNZ’s governor, Adrian Orr is due to speak shortly. If he can speak without jawboning the currency and undermining the statement, the bearish bias remains for GBP/NZD and EUR/NZD.