RBNZ cut rates for the first time since November 2016, taking it to a new record low of 1.5% today. Yet whilst NZD is broadly lower, RBNZ’s hint 1.5% is it, for now, could limit downside over the near-term.

Summary of the statement:

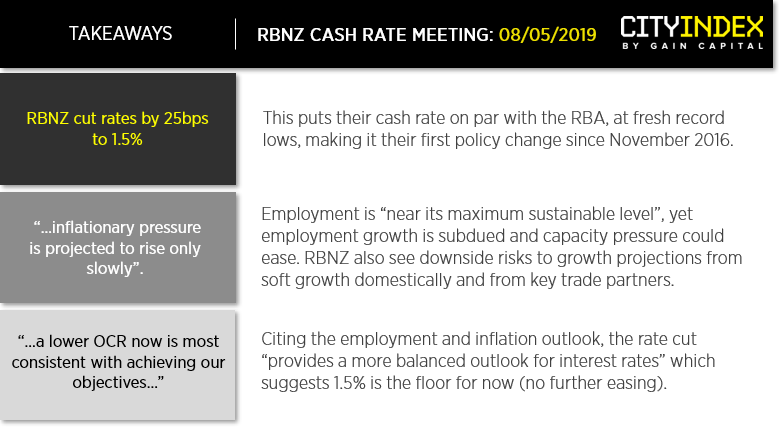

- (OCR) has been reduced to 1.5 percent

- Lower OCR necessary to support the employment outlook and inflation consistent with its policy remit

- Global economic growth has slowed since mid-2018

- Uncertainty about the global economic outlook

- Domestic growth slowed from the second half of 2018

- Employment near maximum sustainable level, yet growth outlook is more subdued Inflationary pressures projected to rise slowly

- OCR now consistent with objective and provides a more balanced outlook for rates

Markets were quick to respond, with NZD crosses shedding over 1% in a flash and breaking key levels. AUD/NZD spiked within pips of our 1.0732 target and NZD/CAD endeavoured to ‘break it down’. However, given that RBNZ suggests 1.5% could be the floor then we should question how much is priced in, at least over the near-term.

At the time of writing NZD/USD is forming a potential bullish pinbar on the daily and four-hour charts. Today’s spike lower momentarily tested the lower bounds of its regression channel (using 2 standard deviation band) and prices are trying to recover back above the breakout level highlighted yesterday. For now though, we’d prefer to see prices stabilise before considering further shorts, although if bullish momentum breaks comfortably above its channel then it’ll be on the backburner. Whereas a break above 0.6685 invalidates the bearish trend structure.

Keep in mind that trade talks will likely dictate sentiment from here, and this places export nations such as New Zealand (and therefore their currency) in the crossfire. So if prices can stabilise and retain their bearish structure, the original bearish target near the 0.6425-65 lows still stands.