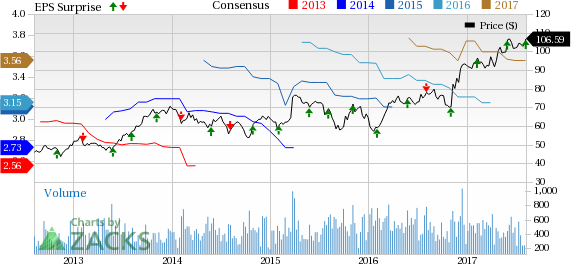

Premium machine tools & accessories company, RBC Bearings Incorporated (NASDAQ:ROLL) reported better-than-expected earnings for first-quarter fiscal 2018 (ended Jul 1, 2017).

Earnings and Revenues

Quarterly earnings came in at 91 cents per share, beating the Zacks Consensus Estimate of 82 cents per share. The bottom line also came way ahead of the year-ago tally of 77 cents per share.

Net sales in the reported quarter came in at $163.9 million, surpassing the Zacks Consensus Estimate of $161 million. In addition, the top line came in 6% higher than the year-ago figure. The upswing was stemmed by sturdy sales in both aerospace and industrial end markets.

Segmental Performance

Plain Bearings revenues improved 3.1% year over year to $72.7 million, while Roller Bearings sales climbed 12.9% to $31.4 million. Ball Bearings sales came in at $15.8 million, up 15.1% year over year. Engineered Products sales were up 3.4% year over year to $44.1 million.

Costs and Margins

Cost of sales in the reported quarter was $102 million, up 4.8% year over year. Adjusted gross margin came in at 37.8%, expanding 50 basis points (bps) year over year. The upside was driven by solid volume and greater cost discipline.

Selling, general and administrative expenses during the quarter came in at $27.8 million, up 7.7% year over year. Adjusted operating margin came in at 19.4% during the fiscal first quarter, advancing 20 bps year over year.

Other Financial Fundamentals

Existing the fiscal first year, RBC Bearings had cash and cash equivalents worth $45.5 million compared to $38.9 million recorded as of Apr 1, 2017.

In the reported quarter, RBC Bearings generated $39.8 million of cash from its operating activities as against $19.2 million in the prior-year quarter. Capital spending increased 9.5% year over year to $5.7 million.

Total debt for the quarter came in at $237.9 million, lower than $343.8 million recorded on Jul 2, 2016.

Outlook

RBC Bearings intends to lower its debt burden, introduce share buyback programs and fund growth oriented investments with increased cash flow generation. This Zacks Rank #3 (Hold) company also noted that demand from its major end markets is likely to shoot up in the upcoming quarters.

Key Picks

A few better-ranked stocks in the industry are listed below:

AGCO Corporation (NYSE:AGCO) , which sports a Zacks Rank #1 (Strong Buy) at present, generated an average positive earnings surprise of 39.70% over the trailing four quarters. You can see the complete list of today’s Zacks #1 Rank stocks here.

Apogee Enterprises, Inc. (NASDAQ:APOG) has an average positive earnings surprise of 3.42% for the last four quarters and currently carries a Zacks Rank #2 (Buy).

Deere & Company (NYSE:DE) carries a Zacks Rank #2 and has a remarkable average positive earnings surprise of 70.41% for the past four quarters.

More Stock News: Tech Opportunity Worth $386 Billion in 2017

From driverless cars to artificial intelligence, we've seen an unsurpassed growth of high-tech products in recent months. Yesterday's science-fiction is becoming today's reality. Despite all the innovation, there is a single component no tech company can survive without. Demand for this critical device will reach $387 billion this year alone, and it's likely to grow even faster in the future.

Zacks has released a brand-new Special Report to help you take advantage of this exciting investment opportunity. Most importantly, it reveals 4 stocks with massive profit potential. See these stocks now>>

Apogee Enterprises, Inc. (APOG): Free Stock Analysis Report

Deere & Company (DE): Free Stock Analysis Report

AGCO Corporation (AGCO): Free Stock Analysis Report

RBC Bearings Incorporated (ROLL): Free Stock Analysis Report

Original post

Zacks Investment Research