Forex News and Events

RBA on its way to cut rates

The June Australian jobs report was rather a good surprise even though the unemployment rate increased slightly during the last month of the second quarter. The unemployment rate rose to 5.9% from 5.8% in May but this increase was largely driven by a boost in the participation rate, which rose to 64.9% from 64.8%. The Aussie economy managed to create 7.9k jobs (versus 10k expected and upward revision of 19.2k in May), while full-time employment jobs rose by 38.4k and part-time employment decreased by 30.6k. One could interpret the strong gains in full-time employment as a sign that the Aussie economy is finally gaining traction; however that would be to overlook that the trend in the job market over the last few months was rather hardly encouraging: the participation rate kept declining since the beginning of the year, full-time jobs were hard to find as the Aussie economy lost 19k posts so far in 2016, while created 62.3k part-time jobs over the same period. Therefore, we would rather be patient rather than turning bullish on the Aussie economy. Moreover, we expect the RBA to proceed with another rate cut at its August meeting, after leaving the door wide open for a rate cut in the July meeting. The decision will however be highly dependent, mostly to the development in inflation levels, and given the disappointing numbers of the first quarter and the very low expectations for the second one, it seems that another easing move from the RBA will be inevitable.

Markets expecting a BoE rate cut but…

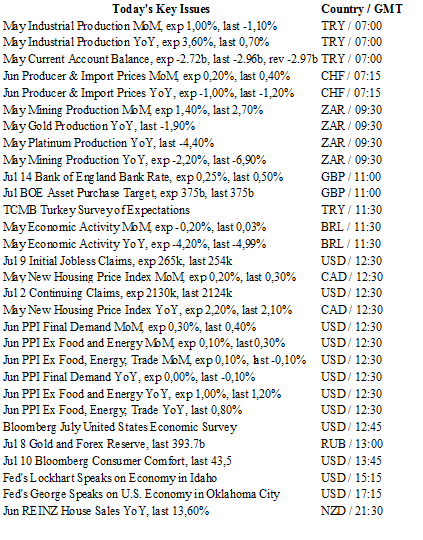

The Brexit vote’s consequences still have to be appraised but the BoE, which has repeated many times that it is awaiting further referendum developments, is expected to cut its bank rate by a quarter point to 0.25% in order to boost the UK economy. This would be the first rate cut in more than seven years.

In our view, market expectations concerning a rate cut may be too strong. Since the referendum, there has been a lack of economic data that would actually help the BoE to make a proper decision. The BoE may still decide to cut its bank rate but we feel that such a move is premature. Nevertheless, what is clear is that the Bank rate should stay low for quite some time. The inflation target of 2% by the end of 2017 still looks attainable and a rate cut would add more upside pressures on consumer prices. The pound has reached a 31-year low and while exports are clearly benefiting from that weakness, the impact on inflation still has to be correctly appraised.

We therefore have the feeling that the BoE would prefer to wait for its August meeting before cutting rates. The UK bank rate has been on hold for so long that such haste is difficult to understand.

EUR/CHF - Holding Above 1.0900.

The Risk Today

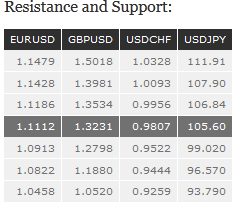

EUR/USD EUR/USD is moving slightly higher. Hourly supports are given at 1.1002 (08/07/2016 low) and 1.0913 (06/07/2016 low) while hourly resistance is located at 1.1186 (05/07/2016 high). Stronger resistance is given at 1.1479 (06/05/2016 high). Sharp moves do not have to be ruled out as there are still a lot of uncertainties on asset pricing in the market. Expected to show sideways price action. In the longer term, the technical structure favours a very long-term bearish bias as resistance at 1.1714 (24/08/2015 high) holds. The pair is trading in range since the start of 2015. Strong support is given at 1.0458 (16/03/2015 low). However, the current technical structure since last December implies a gradual increase.

GBP/USD GBP/USD's upside pressures look strong. Hourly support can be found at 1.2798 (06/07/2016 low) while hourly resistance is located at 1.3341 (04/07/2016 high). Uncertainties are important on the market, we absolutely do not rule out further decline. The long-term technical pattern is negative and favours a further decline as long as prices remain below the resistance at 1.5340/64 (04/11/2015 low see also the 200-day moving average). Key support at 1.3503 (23/01/2009 low) has been broken and the road is wide open for further decline.

USD/JPY USD/JPY has finally erased the 105-mark. Hourly supports are located far away at 100 (06/07/2016 low) and 99.02 (24/06/2016 low). Expected to further increase towards resistance at 106.84 (23/06/2016 high). We favour a long-term bearish bias. Support is now given at 96.57 (10/08/2013 low). A gradual rise towards the major resistance at 135.15 (01/02/2002 high) seems absolutely unlikely. Expected to decline further support at 93.79 (13/06/2013 low).

USD/CHF USD/CHF keeps on pushing lower. The pair has failed to remain above former hourly resistance at 0.9837 (28/06/2016 high). Hourly resistance lies at 0.9956 (30/05/2016 high). The road is wide-open to further decline towards hourly support at 0.9685 (05/07/2016 high). In the long-term, the pair is still trading in range since 2011 despite some turmoil when the SNB unpegged the CHF. Key support can be found 0.8986 (30/01/2015 low). The technical structure favours a long term bullish bias since last December.