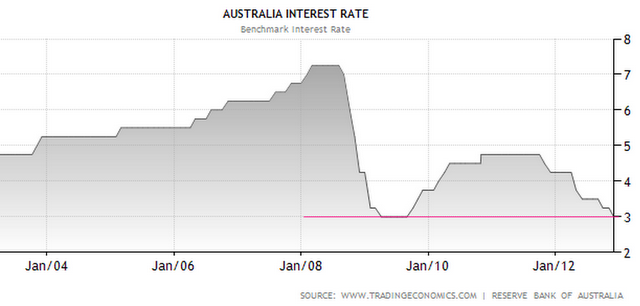

The Reserve Bank of Australia continues to surprise with their hawkish stance. In spite of lowering the benchmark rate to 3%, the RBA made comments suggesting that they are going into a holding pattern for a while. Since the RBA has never gone below 3%, it seems to represent something of a "support level."

The Australian: "People are speculating we are nearing the end of the easing cycle," said Matthew Johnson, a UBS interest rate strategist.

"The Reserve Bank is uncomfortable about further cuts and will only make them if they absolutely have to."

UBS chief economist Scott Haslem said: "If the non-mining sector continues to improve, as we expect, this should allow the RBA to stay on hold from here, and possibly for an extended period."

It's a brave thing to do for a central bank that is facing "currency wars," particularly by its competitors (see discussion). The Australian dollar has experienced a massive appreciation relative to the Brazilian real for example, making it difficult for Australia's exporters to compete. This is especially tough when global demand for natural resources remains weak.

Businesses are calling for the central bank to weaken the currency and will not be happy with the RBA in a holding pattern.

To cheer up our friends down under, here is an article about the RBA's rate policy published on NASDAQ's website about a month ago. When was the central bank renamed?

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

RBA Remains Hawkish After Rate Cut (And Who Renamed The Central Bank?)

Published 12/05/2012, 03:58 AM

Updated 07/09/2023, 06:31 AM

RBA Remains Hawkish After Rate Cut (And Who Renamed The Central Bank?)

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.