The RBA’s minutes revealed what many had expected, by stating it’s ‘more than likely’ they’ll have to ease further in the period ahead.

RBA Minutes On Monetary Policy

- Members judged that a decline in interest rates was unlikely to encourage a material pick-up in borrowing by households that would add to medium-term risks in the economy.

- Risks to the forecasts for growth and inflation in both directions.

- It was more likely than not that a further easing in monetary policy would be appropriate in the period ahead.

- Lower interest rates were not the only policy option available to assist in lowering the rate of unemployment".

- In assessing whether further monetary easing was appropriate, developments in the labour market would be particularly important.

Australian dollar - Japenese yen

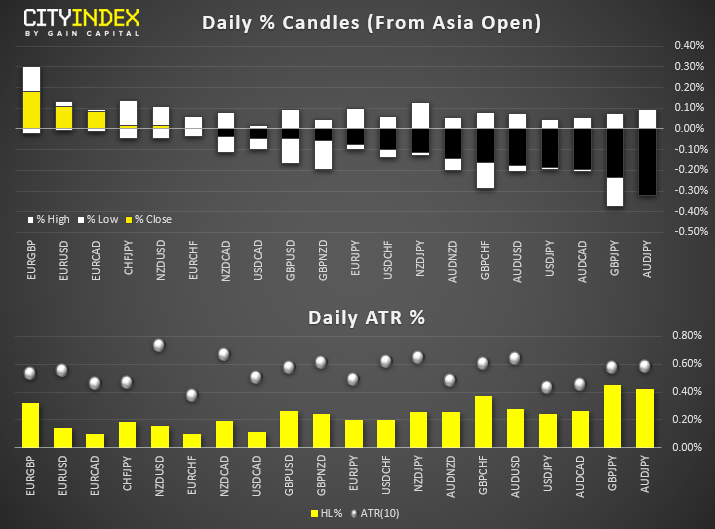

The biggest mover of the session so far is AUD/JPY, which dropped 0.4% after the release and is currently today’s biggest mover among FX majors and crosses. Currently at its lowest point since January’s flash-crash, bears remain keen to sell into any pullbacks in line with its bearish trend structure. Over the near-term, it’s arguable that prices are a little stretched (as really, nothing major and new was revealed in the minutes), although the Japanese yen is the strongest major Trump is sending 1,000 troops to the Middle East.

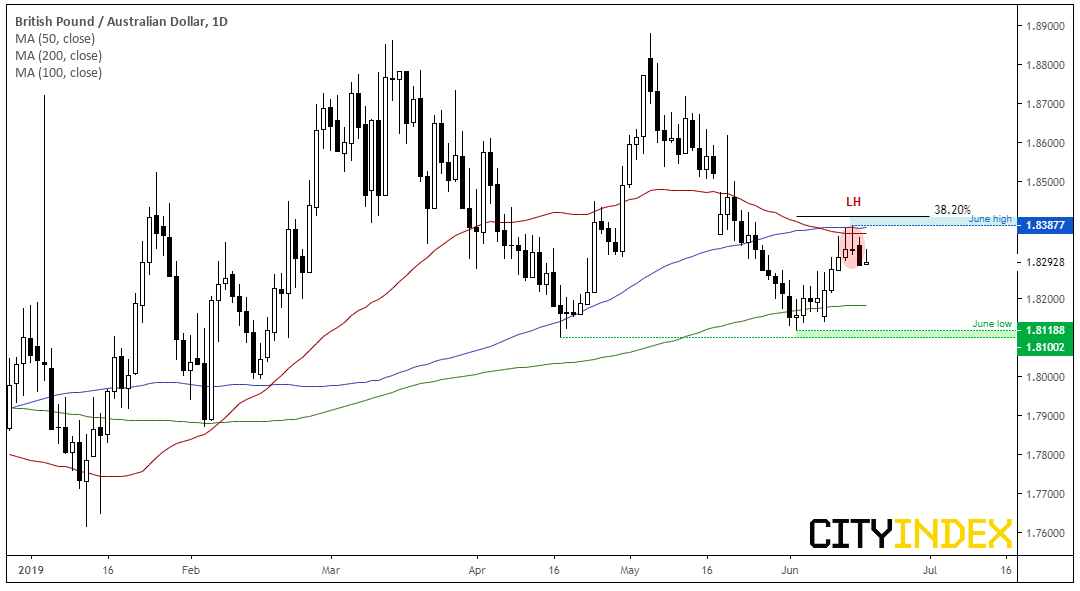

British pound - Australian dollar

GBP/AUD has shown its ability to provide wild swings, although the recent rally from the June low appears to be running out of steam. Resistance has been found at the 50 and 100-day MA, where a bearish hammer and pinbar formed ahead of yesterday’s bearish engulfing candle yesterday. Furthermore, this potential swing high has failed to test the 38.2% Fibonacci level to further highlight how the dynamics appear to have changed on the cross. From here, we remain bearish whilst it trades below the 1.8390 – 1.8410 area.

Australian dollar - New Zealand dollar

AUD/NZD has managed to hold above a 50% retracement level, although price action has essentially remained in a choppy sideways correction. Furthermore, prices are trapped between the 50 and 100-day MA’s, with the 200-day MA also providing resistance. However, a potential bullish flag could be forming which, if successful, projects a target around 1.0900. Yet we’d need to see bullish momentum break the 200-day MA or prior swing high before assuming a bull flag is playing out. Keep an eye on NZ GDP data tomorrow as this could prove a bullish catalyst for AUD/NZD if it misses the mark by a wide enough margin.