Investing.com’s stocks of the week

Market Brief

As expected, the RBA maintained its target cash rate unchanged at 2.50% for the 16th consecutive month. Given the weak commodity markets and moderate growth, Governor Stevens reiterated “the most prudent course is likely to be a period of stability in interest rates”. The RBA stated that the Aussie is still considered overvalued, “lower exchange rate is likely to be needed to achieve balanced growth”. AUD/USD rebounded from yesterday’s lows and rallied to 0.8543, as the announcement of status quo unwound RBA-doves. The narrower-than-expected current account deficit (AUD -12.5bn vs. -13.5bn exp. & -13.7bn last) helped sustaining recovery. Trend and momentum indicators remain bearish however with mixed option bets at 0.85. A steady descend to 80 cents is envisaged. AUD/NZD tests the Fib 23.6% on July-Sept uplift (1.0784). The bias remains on the downside, while the Fonterra auction is seen as the major NZD risk tonight.

USD/CNY test the Fib 50% on Jan-April rally. The upside pressures should push the pair higher, with next resistance placed at 6.1786/6.1803 (200-dma / Fib 61.8%). The Chinese equities expanded gains for the second consecutive day: Hang Seng Index added 1.37%, Shanghai’s Composite rallied 3.11% (at the time of writing) on speculations that the PBoC may add more monetary stimulus.

In Japan, the labor cash earnings grew at the slower pace of 0.5% in year to October (vs. 0.8% exp. & last) keeping USD/JPY and JPY crosses bid in Tokyo, Nikkei stocks traded in the green as the gloomy economic data favors dovish BoJ bets. USD/JPY tests 119.00 offers, with waning bullish momentum though. The uncertainties before December snap elections will likely keep the resistance solid at 120s. Option bids are supportive above 117.85/118.00. EUR/JPY trades with lower enthusiasm, yet above the daily conversion line (147.36). The broadly EUR-short view should keep the upside limited before Thursday’s ECB meeting. A slide below the conversion line should signal a short-term bearish reversal pattern.

EUR/USD trades under heavy downside pressures pre-1.25+ offers. The upside attempts remains limited as traders look to sell the rallies walking into the ECB meeting. Option related offers trail below 1.24, if activated will place the 1.2358 (year low) at risk. The trend and momentum indicators in EUR/GBP remain flat. A daily close below 0.7958 will push the MACD in the red zone and should intensify the downside pressures in days ahead.

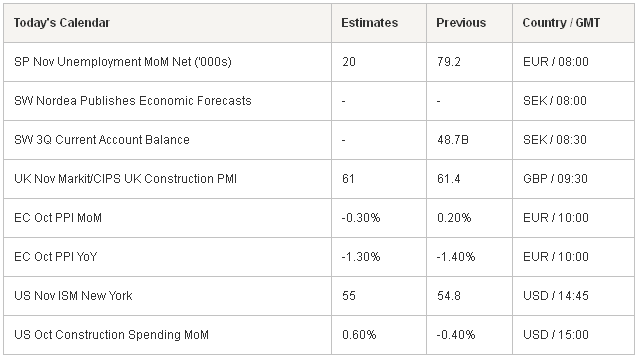

Today’s economic calendar: Spanish November Unemployment Net m/m (‘000s), Swedish 3Q Current Account Balance, UK November Construction PMI, Euro-zone October PPI m/m & y/y, Us November ISM New York and US October Construction Spending m/m.

Currency Tech

EURUSD

R 2: 1.2600

R 1: 1.2532

CURRENT: 1.2457

S 1: 1.2419

S 2: 1.2358

GBPUSD

R 2: 1.5945

R 1: 1.5826

CURRENT: 1.5718

S 1: 1.5586

S 2: 1.5423

USDJPY

R 2: 120.00

R 1: 119.14

CURRENT: 118.84

S 1: 117.89

S 2: 117.04

USDCHF

R 2: 0.9839

R 1: 0.9742

CURRENT: 0.9669

S 1: 0.9595

S 2: 0.9531