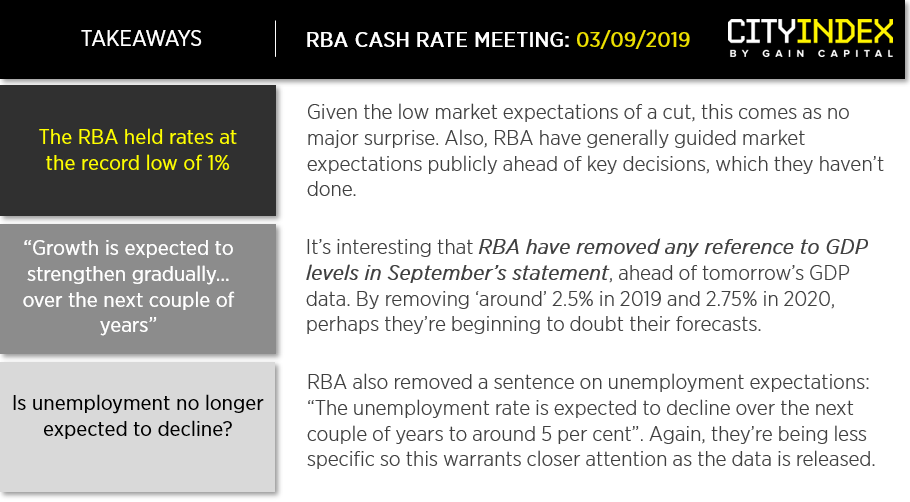

RBA held rates as expected, although there we some subtle changes to the statement which warrant keeping tabs on.

Summary Of The RBA September Statement

- The outlook for the global economy remains reasonable, although risks are tilted to the downside

- GDP in H1 has been lower than expected, with low income growth and declining house prices weighing on consumption

- Growth is expected to strengthen gradually to be around trend over the next couple of years

- Employment growth is strong and participation is at a record high

- Wage growth remains subdued with little upward pressure

- Inflation pressures remains subdued and likely to be the case for some time yet

- It is reasonable to expect that an extended period of low interest rates will be required

- The Board will continue to monitor developments, including in the labour market, and ease monetary policy further if needed

Whilst there’s a couple of interesting developments around growth and unemployment, RBA remain relatively upbeat on the economy further out, although further easing remains on the table. Recently we’ve heard comments from Philip Lowe joining the chorus of central bankers saying that monetary and fiscal policy have to work together, so perhaps wouldn’t make too much sense to provide a dovish statement at this stage. Moreover, GDP data tomorrow may end up providing a greater market reaction should it beat expectations.

AUD/USD pared losses and is holding above 0.6673 support. If prices can hold above this key support level, we see potential for a bounce. Considering the depth of AUD losses in recent weeks, a surging USD, lower iron ore prices and trade tensions, AUD/USD is doing well to hold support which in itself can be taken as a sign of strength. So unless GDP rolls over tomorrow, perhaps a bounce could be on the cards.

- A break below 0.6673 suggests the bearish trend is resuming, although we urge caution as prices are looking a little stretched to the downside

- Counter-trend traders could look to enter long at the lower end of the range

- Bears could look to fade into moves below 0.6832 if/when a bounce materialises. A break above 0.6832 suggests a deeper correction is on the cards.

Related analysis:

RBA and GDP On Tap For AUD and ASX200