Market Brief

The RBA cut its OCR rate from 2.50% to 2.25% as mostly priced in. The rate action aims to foster economic activity given that the growth remains below the trend and the inflation in line with the policy target, according to the RBA. AUD/USD sold-off to 0.7651. The bearish trend strengthens, extension to 75 cents is now a matter of time. Option barriers trail below 0.7750 for today expiry and should limit corrective bulls. AUD/NZD tests 1.06 support, AUD/JPY tumbled down to 89.451 for the first time in a year. Next support stands at 88.244 (Feb’14 low). NZD/USD extends weakness to 0.7185, now subject to 0.72 barriers through the end of the week. The next key support stands at 0.7118 (2011 low) before the 0.70 psychological support.

USD/CHF continues testing 200-dma resistance (0.9293) on December trade data. Swiss exports tumbled 3.1% m/m in December, pulling the trade surplus down from 3.80 billion (revised) to 1.52 billion francs. Sharp deterioration is foreseen in January data, following the removal of EUR/CHF floor. We expect deeper downside correction in CHF. USD/CHF is expected to normalize toward 50-100dma (0.9570/91), while EUR/CHF upside seems choppy due to business owners, retailers looking to sell euros at “good” price as hedge/protection.

USD/JPY and JPY crosses traded sluggish as Honda announced to reduce Suzuka plant production by 20%; the Nikkei stocks wrote-off 1.27%. Else, the monetary base grew at slower pace (37.4% vs. 38.2%) in January to 278.6 trillion yen. USD/JPY sold-off to 116.88. Trend and momentum indicators are now negatively biased, after failed attempt for upside correction. The daily conversion line trends lower (117.74) with offers building stronger above.

It seems the USD/JPY will miss the option bids above 118.00 for today expiry. EUR/JPY trades water in the tight range of 132.39/133.46. Correction bias should remain for a daily close above 133.11 (MACD pivot).

Stronger bullish momentum sent USD/BRL above 2.70 at week open. The pair advanced to 2.7274 as trade deficit has been higher than expected in January (-$3,174mn) due to more than 20% drop in Brazil’s exports. The CPI (source FIPE) spiked to 1.62% on month to January (from 0.30%) as country moves away from price repressions. The board national price index is due on February 6th and should confirm overheating in consumer prices.

BRL bulls should remain on the sidelines through the week. Traders are reluctant to build long carry positions pre-US NFPs due Friday. On the option markets, decent vanilla calls stand above 2.70 for the second half of the week.

USD/ZAR steps in the bullish zone, the positive MACD suggests the extension of gains for a day close above 1.5445 (pivot). The BRL, ZAR and TRY bulls will likely stay in the sidelines before the US jobs data. We see limited volumes in fresh carry positions this week as the risk of a short squeeze tempers appetite in high-yielders pre-US jobs. Stronger NFP read should revive the Fed-hawks, ease buying pressures on the US sovereign curve and strengthen USD appetite by the end of this week.

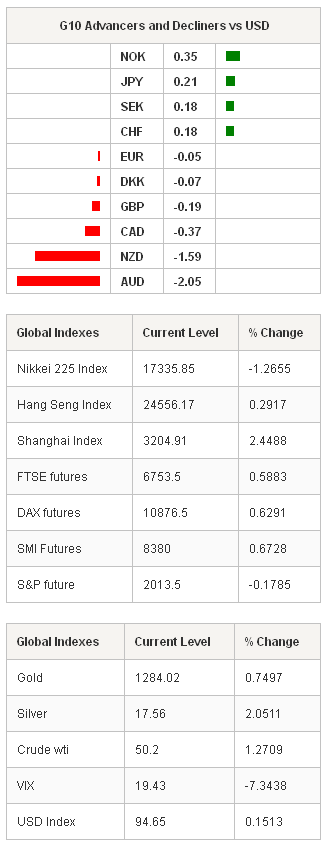

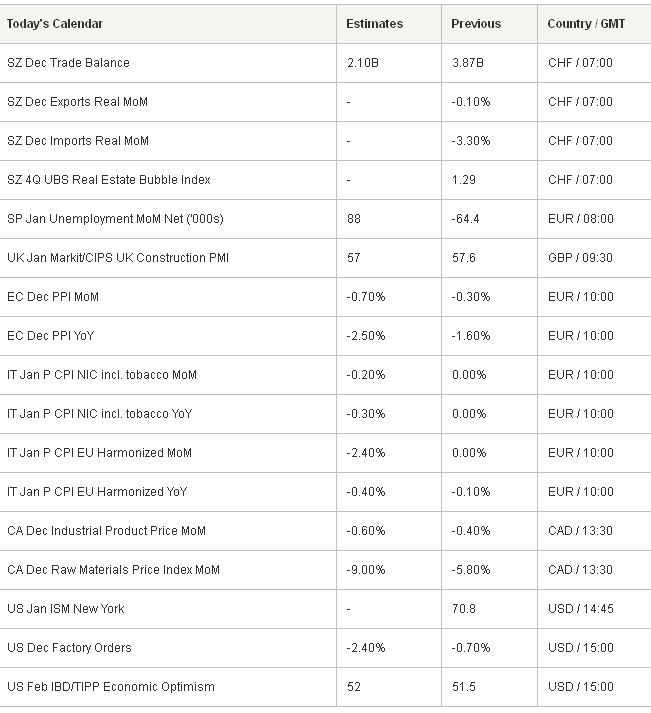

Today’s economic calendar: Swiss December Trade Balance, Exports & Imports m/m, UBS Real Estate Bubble index in 4Q, Spanish January Unemployment, UK January Construction PMI, Euro-zone December PPI m/m & y/y, Italian January (Prelim) CPI m/m & y/y, Canadian December Industrial Product and Raw Materials Price Index m/m, January ISM New York, US December Factory Orders and US February IBD/TIPP Economic Optimism.

Currency Technicals:

EUR/USD

R 2: 1.1541

R 1: 1.1460

CURRENT: 1.1334

S 1: 1.1224

S 2: 1.1098

GBP/USD

R 2: 1.5351

R 1: 1.5224

CURRENT: 1.5016

S 1: 1.4989

S 2: 1.4952

USD/JPY

R 2: 119.32

R 1: 117.74

CURRENT: 117.22

S 1: 116.66

S 2: 115.86

USD/CHF

R 2: 0.9500

R 1: 0.9368

CURRENT: 0.9262

S 1: 0.9170

S 2: 0.8936