Investing.com’s stocks of the week

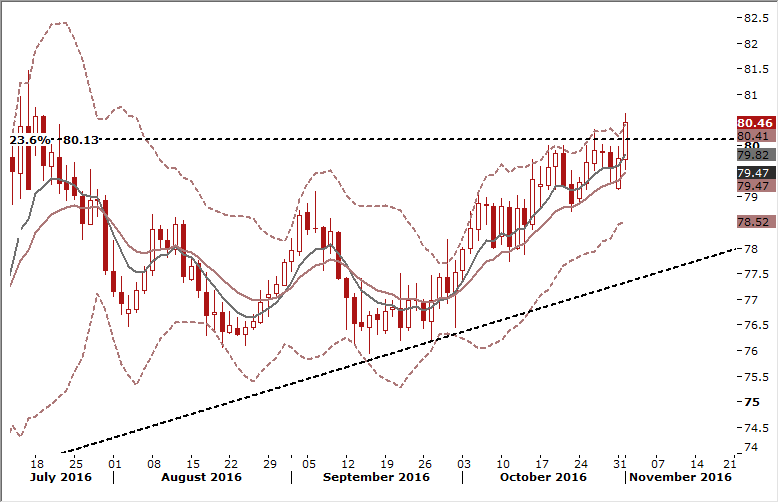

AUD/JPY: RBA And BOJ Keep Their Policies Steady

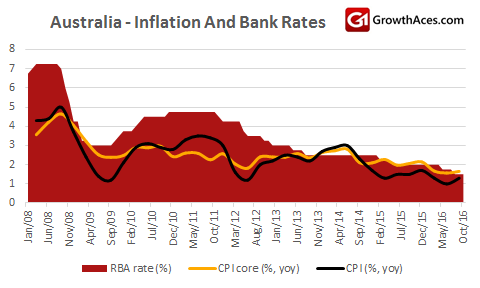

- The Reserve Bank of Australia ended its monthly policy meeting with rates unchanged at a record low of 1.5% and offered no explicit easing bias.

- Instead, Governor Philip Lowe provided a balanced statement: "Over the next year, the economy is forecast to grow at close to its potential rate, before gradually strengthening". Inflation was expected to remain low for some time, but would "pick up gradually over the next two years."

- The steady decision was widely expected given policy makers had sounded optimistic on the economic outlook amid higher prices for key commodity exports.

- Interbank futures imply a one-in-three chance of a cut next year, compared to one-in-two previously, lifting the Australian dollar up. In our opinion the monetary easing cycle has already ended.

- A chief argument against the need for further stimulus is a recent acceleration of house price gains in Australia's two largest cities, Sydney and Melbourne. The trend was highlighted by Lowe who said prices in some markets "have been rising briskly" over the past few months. Figures from property consultant out on Tuesday showed values galloped 10.9% higher in October from a year earlier, while Melbourne boasted a 9.1% gain. Prices rose for the 10th month across all the major cities to be up 7.5% for the year.

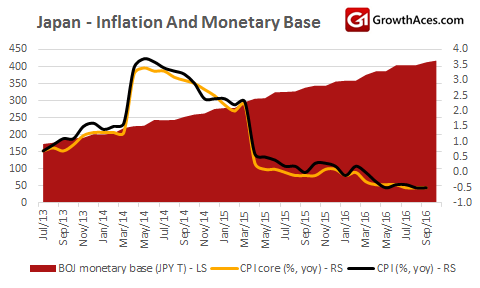

- The Bank of Japan held off on expanding stimulus despite once again pushing back the timing for hitting its inflation target, signalling that it will keep policy unchanged unless a severe shock threatens to derail a fragile economic recovery.

- The BOJ maintained its view that the world's third-largest economy will expand moderately as exports and consumption emerge from the doldrums. But it also warned that risks to the outlook were skewed to the downside and that price momentum was weakening, an unusually bleak assessment that underscored its waning conviction of achieving the elusive inflation target.

- In a quarterly review of its forecasts released alongside its policy decision, the BOJ pushed back the timing for hitting 2% inflation by as much as a year to "around fiscal 2018". In July, the BOJ had said inflation will hit 2% by around March 2018.

- Kuroda said the central bank stands ready to deploy "all available means" to hit his inflation target, seeking to keep alive market expectations of additional stimulus. But he added that fiscal and monetary measures can reinforce each other, signalling that government steps to spur growth needed to accompany the BOJ's efforts to eradicate deflation.

- The AUD/JPY firmed after the RBA decision and is close to our target at 81.00. In our opinion the bullish trend on this pair may last longer and we will consider opening a long position in the long-term part of our trading portfolio.

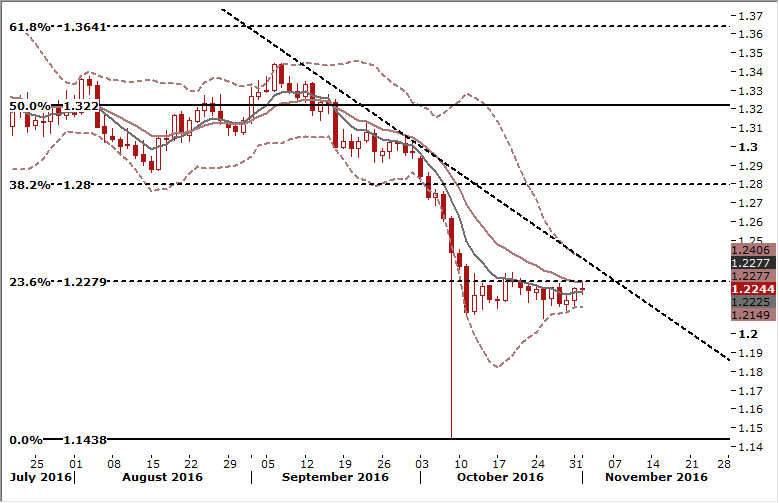

GBP/USD: Sterling Supported After Carney Comments, Eyes On PMIs And BoE Decision Now

- Sterling hit an almost two-week high on Tuesday, with expectations of more upbeat news on the economy helping it build on gains after Bank of England Governor Mark Carney said late on Monday he would be staying on until 2019. Criticism from some senior ruling Conservatives and right-leaning newspapers had prompted speculation over the past week that Carney might even leave before the end of his initial term, set to end in 2018.

- Investors will look to PMI surveys for the manufacturing, construction and services sectors this week, expected to show the economy expanding strongly. That will also lay the ground for expected rises in some of the Bank of England's forecasts for the economy when it publishes its latest inflation report on Thursday.

- We expect British MPC to remain on hold when it announces its monetary policy decision on Thursday. Financial markets have now fully priced out the chances of a cut in the bank rate. A steady BoE outcome can offer sterling a further support.

- We stay GBP/USD long, but the position size is relatively low because of elevated risk on GBP trading.