Missile maker Raytheon Company’s (NYSE:RTN) business segment, Missile Systems, won a modification contract for providing Navy Rolling Airframe Missile (RAM) Block 2 guided missile round pack (GMRP) requirements. Work related to this deal is scheduled to be over by December 2019.

Valued at $21.2 million, the contract was awarded by the Naval Sea Systems Command, Washington, D.C. Majority of the work will be executed in Tucson, AZ and Ottobrunn, Germany, while the rest will be carried out in Rocket Center, WV and Andover, MA. The company will utilize fiscal 2017 weapons procurement (Navy) funds to finance the task.

A Brief Note on RAM

RAM is a supersonic, lightweight, quick-reaction, fire-and-forget guided missile weapon system, designed to destroy anti-ship missiles. According to the company, it is the world's most modern self-defense ship weapon. This guided missile weapon system is co-developed and co-produced under an International Cooperative Program between the U.S. and Federal Republic of Germany’s governments. It's currently deployed in more than 165 ships in eight countries, ranging from 500-ton fast attack craft to 95,000-ton aircraft carriers.

RAM Block 2 is the latest variant in the development of the RAM missile, which comes with a larger rocket motor, advanced control section and an enhanced RF receiver capable of detecting the quietest of threat emitters. The improvements enhance the missile’s maneuverability by two and a half times and the effective intercept range by one and a half times.

Our View

With the increase in cyber-attacks, terrorism threats and geopolitical instability, there is an immediate need of all countries to elevate their level of security and defense. Major defense contractors in the nation like Raytheon, AeroVironment, Inc. (NASDAQ:AVAV) , Orbital ATK, Inc. (NYSE:OA) , Rockwell Collins, Inc. (NYSE:COL) are putting their best to make most of this opportunity and expand their business in the country.

In particular, Raytheon’s advanced Missile Systems business segment won consistent orders from the United States as well as international customers. To this end, last month, the company won a $614.5 million worth modification contract from the Missile Defense Agency for manufacturing 17 Standard Missile-3 (SM-3) Block IIA missiles.

Earlier, in late June, the U.S. State Department filed Congressional Notification for a potential deal with Taiwan valued at up to $1.4 billion, approximately half of which Raytheon expects to book within the next 24 months. These programs include the company’s Standard Missile-2s along with a handful of other defense equipment. This emerging opportunity reflects the continued solid demand that Raytheon enjoys in the foreign market, apart from its domestic front.

Based on the 11% sales growth that Missile Systems unit witnessed in the second quarter of 2017 and similar strong performance anticipated ahead, the company expects to see improved operating margin for this business in the second half of 2017. We believe the recently won award along with similar ones anticipated in the near future will enable the company to achieve the target of its missile business growth.

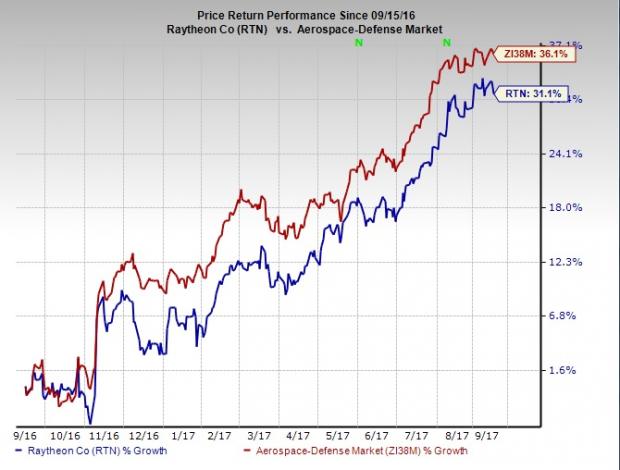

Price Performance

Raytheon’s stock has returned 31.1% in the last one year, underperforming the 36.1% rally of the industry it belongs to. This might have been caused by the earlier budget cuts inflicted by the U.S. government.

Zacks Rank

Raytheon currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

5 Trades Could Profit ""Big-League"" from Trump Policies

If the stocks above spark your interest, wait until you look into companies primed to make substantial gains from Washington's changing course.

Today Zacks reveals 5 tickers that could benefit from new trends like streamlined drug approvals, tariffs, lower taxes, higher interest rates, and spending surges in defense and infrastructure.

See these buy recommendations now >>

Rockwell Collins, Inc. (COL): Free Stock Analysis Report

AeroVironment, Inc. (AVAV): Free Stock Analysis Report

Orbital ATK, Inc. (OA): Free Stock Analysis Report

Raytheon Company (RTN): Free Stock Analysis Report

Original post

Zacks Investment Research