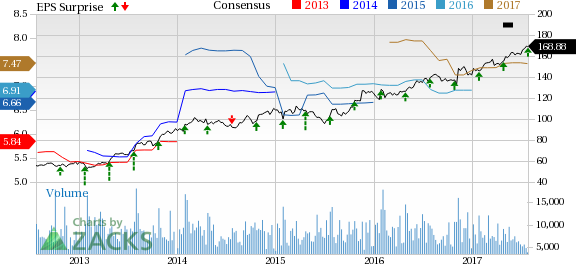

Raytheon Company (NYSE:RTN) reported second-quarter 2017 adjusted earnings from continuing operations of $1.98 per share, beating the Zacks Consensus Estimate of $1.74 by 13.8%. The figure also improved 5.3% from $1.88 in the year-ago quarter.

The adjustment was done by excluding a one-time charge of 9 cents associated with the early retirement of debt.

Including the one-time item, the company reported earnings of $1.89 from continuing operations, down 21.5% year over year.

Operational Performance

The company’s second-quarter revenues of $6,281 million saw 4.2% year-over-year growth. The reported number also surpassed the Zacks Consensus Estimate of $6,226.5 million by 0.9%.

Raytheon’s bookings in the second quarter were $6,532 million compared with $7,103 million in the year-ago quarter, reflecting a decrease of 8%. Total backlog at the end of the quarter was $36.2 billion, down from $36.7 billion at 2016-end.

Total operating expenses increased 7.4% to $5,432 million. As a result, operating income of $849 million dropped 12.7% from $972 million a year ago.

Segmental Performance

Integrated Defense Systems: The segment’s revenues grew 5% year over year to $1,462 million due to higher sales on an international early-warning radar program awarded in the prior quarter. Operating income decreased to $245 million from $376 million.

Intelligence, Information and Services: The segment’s revenues of $1,555 million were lower than the year-ago level of $1,587 million by 2%. Operating income in the reported quarter also dropped to $115 million from $120 million a year ago.

Missile Systems: Segment revenues grew 11% to $1,901 million from $1,706 million a year ago, driven by higher net sales on the Standard Missile-2 (SM-2), Standard Missile-3 (SM-3), and Paveway programs. Operating income inched up to $236 million from $233 million a year ago.

Space and Airborne Systems: Revenues in the quarter improved 4% year over year to $1,608 million, driven by higher net sales on a domestic classified program. Operating income improved 6% to $218 million due to a change in program mix and higher volume.

Forcepoint: This commercial cyber-security segment generated net sales of $138 million in the second quarter, up from $137 million a year ago. The joint-venture entity registered operating income of $2 million in the reported quarter, down from the year-ago figure of $10 million.

Financial Update

Raytheon ended the second quarter with cash and cash equivalents of $2,167 million, down from $3,303 million as of Dec 31, 2016. Long-term debt was $4,747 million, down from an outstanding debt of $5,335 million as of Dec 31, 2016.

Operating cash flow from continuing operations was $741 million in the quarter compared with $1,071 million in the year-ago quarter.

In the reported quarter, Raytheon repurchased 0.6 million shares of common stock for $100 million.

Guidance

Raytheon has raised its top and bottom-line full-year guidance. The company currently expects 2017 revenues in the range of $25.1–$25.6 billion, up from the prior guidance range of $24.9–$25.4 billion. It now expects earnings from continuing operations at around $7.35−$7.50 per share, up from the $7.25−$7.40 band.

Raytheon, however, continues to project 2017 operating cash flow from continuing operations at approximately $2.8−$3.1 billion.

Zacks Rank

Raytheon currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Recent Peer Releases

Northrop Grumman Corporation (NYSE:NOC) reported second-quarter 2017 earnings of $3.15 per share, beating the Zacks Consensus Estimate of $2.84 by 10.9%. Reported earnings were also up 10.5% from $2.85 recorded in the year-ago quarter.

Textron Inc. (NYSE:TXT) reported second-quarter 2017 adjusted earnings from continuing operations of 60 cents per share, beating the Zacks Consensus Estimate of 55 cents by 9.1%.

The Boeing Company (NYSE:BA) reported adjusted earnings of $2.55 per share for second-quarter 2017, beating the Zacks Consensus Estimate of $2.32 by 9.9%. In the year-ago quarter, the company had reported a loss of 44 cents.

More Stock News: Tech Opportunity Worth $386 Billion in 2017

From driverless cars to artificial intelligence, we've seen an unsurpassed growth of high-tech products in recent months. Yesterday's science-fiction is becoming today's reality. Despite all the innovation, there is a single component no tech company can survive without. Demand for this critical device will reach $387 billion this year alone, and it's likely to grow even faster in the future.

Zacks has released a brand-new Special Report to help you take advantage of this exciting investment opportunity. Most importantly, it reveals 4 stocks with massive profit potential.

Northrop Grumman Corporation (NOC): Free Stock Analysis Report

Boeing Company (The) (BA): Free Stock Analysis Report

Textron Inc. (TXT): Free Stock Analysis Report

Raytheon Company (RTN): Free Stock Analysis Report

Original post