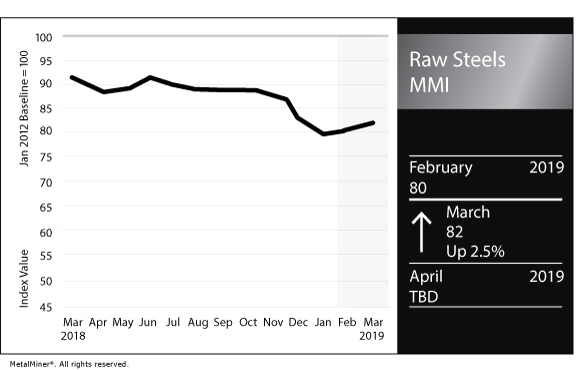

Raw Steels Monthly Metals Index (MMI) increased slightly again this month, moving to an MMI reading of 82, an increase of 2.5% month on month.

This month, U.S. raw steel prices stopped their multimonth decline off peak highs and began moving sideways overall. Typically, steel prices tend to trend upward through Q1, but that is not a hard and fast rule (supply and demand factors and general macroeconomic conditions play a role).

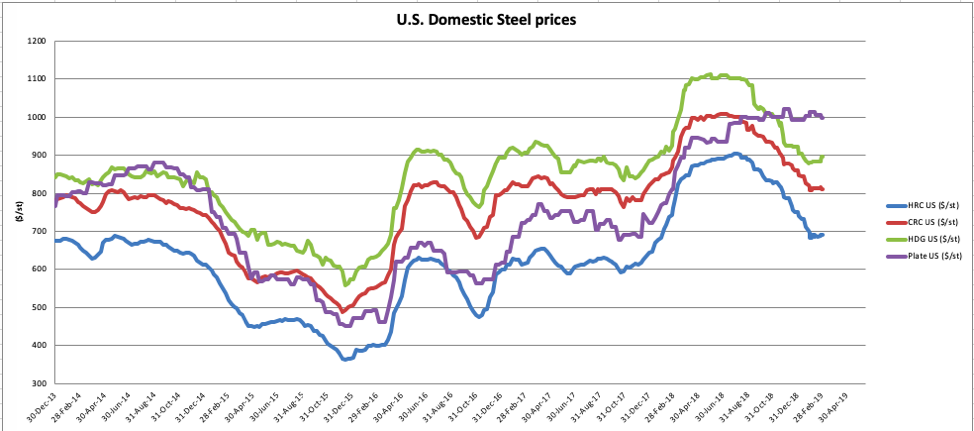

Source: MetalMiner data from MetalMiner IndX(™)

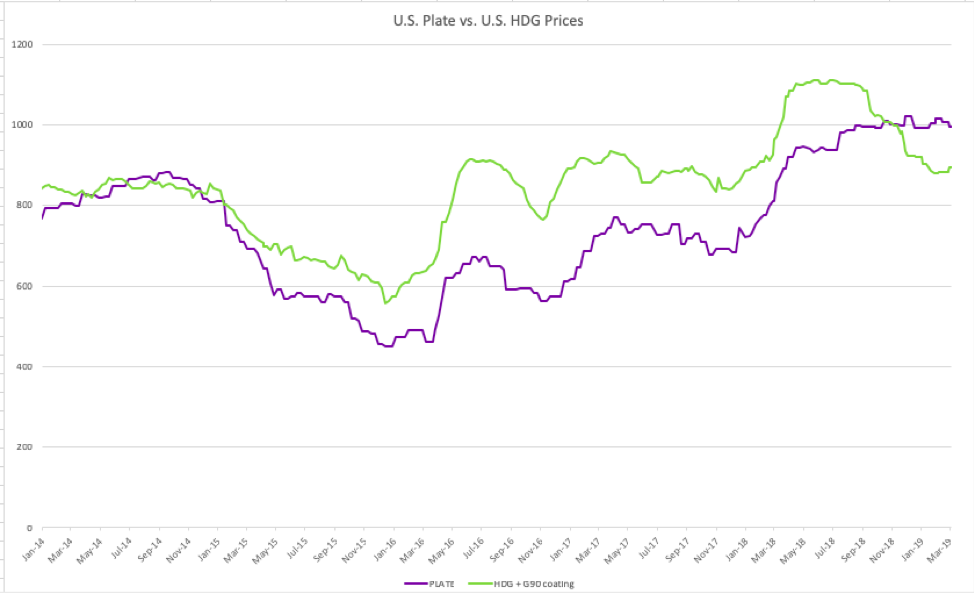

Plate prices seemed to finally hit a point of price resistance this month and fell back to $997/st. Even at this price, plate prices remain at a historic high. Typically, HDG prices trend higher than plate. However, the plate price exceeded the HDG price this fall and continues to ride higher than HDG.

Source: MetalMiner data from MetalMiner IndX(™)

The HDG price has dropped from the 2018 price surge and now appears back at levels typical of 2016-17 when the price oscillated around the $900/st mark, which served as a historically significant resistance point during 2014 (prior to steep HDG price decreases in 2015).

Iron ore prices increased during February based on continuing supply concerns, but supply issues will likely ease as the year progresses.

Based on a better-than-expected China manufacturing PMI release in February, iron ore, Coking Coal and Coke Futures prices increased in late February on a four-day rally based on optimism over the steel sector’s 2019 performance. In early March, however, prices appear to have moderated on demand concerns.

What This Means for Industrial Buyers

Plate prices may have peaked but they remain historically high, oscillating around the $1,000/st mark after reaching $1,022/st in December.

HRC, CRC and HDG prices moved sideways during the month, a shift from the recent downward trend in prices.

Given the shift in trend to sideways for raw steels, buying organizations will want to watch the market carefully for opportunities to buy.

Actual Raw Steel Prices and Trends

U.S. shredded scrap prices registered a month-over-month price increase of 5.73%, rising to $332/st, reversing last month’s 11% price decrease.

LME scrap prices also increased. The primary one-month futures price increased by 9.58%, while the LME primary three-month price registered an increase of 2.78% since the beginning of February.

Korean standard scrap steel prices fell by 11.28%, reversing the price increase during the past few months, and ended at $155.56/mt (down from the October high of $193.69/mt).

Chinese coking coal prices increased this month by 2.34% — flattening out somewhat after recent monthly double-digit increases — to $322.56/mt at the start of March.

Chinese iron ore prices were flat month on month. The Chinese pig iron price fell 9.5%.

by Belinda Fuller