The Russian economy returned to growth in 2017 and the FX market was relatively calm, creating the conditions for a significant improvement in the warehouse market supply-demand balance, with rents stabilising. Against this backdrop, Raven Russia Ltd (LON:RUS) produced strong headline earnings, including land sale gains, and a solid underlying performance, including a first benefit from 2017 accretive acquisitions. Although not reflected in our forecast, further acquisitions are likely, funded by existing cash resources, with the potential to more than offset rent reversion to market levels and return the company to growth.

Positive earnings and distribution

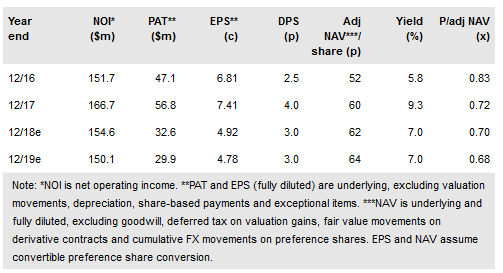

Profit after tax of $56.8m (2016: $47.1m), on the company’s underlying basis, positively surprised. A lower FX gain was more than offset by realised gains on non-core legacy UK land holdings, adding c $20m. Excluding this, underlying earnings were broadly as we had expected, with warehouse occupancy at a similar level (81% vs 80%) and much of the negative rent reversion (to lower, rouble-denominated market rents) offset by a part-year $10m contribution from acquisitions. RosLogistics continues to show good growth. The investment portfolio saw positive revaluation of $38.2m with a benefit to NAV per share (80c fully diluted or c 60p at year end). Raven will make a 3p final distribution (4p for the year vs 2.5p) by way of a tender offer buyback, the increase reflecting management confidence in the outlook as well as the land sale gains.

To read the entire report Please click on the pdf File Below: