Raven Russia Ltd (LON:RUS) worked hard in 2015 to mitigate the impact of a harsh trading environment. Management focused on maintaining income at the best level achievable, in whatever currency the market will allow, while protecting cash balances. It ended the year with $202m in cash, a significant share of the current market cap. Underlying profits provided management the room for continued distributions while maintaining the balance sheet prudence necessary for Raven to participate in the upside when conditions improve. A ruble/oil price recovery or easing of sanctions are potential catalysts.

Weathering the storm

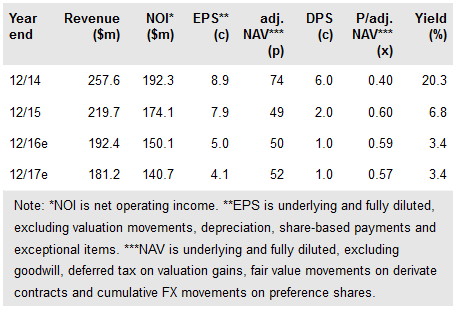

Underlying profits declined 13% to $65m but revaluation losses of $256m contributed to an IFRS loss of $192m and a fully diluted underlying NAV per share decline to 70 cents (c 49p) from 106 cents (c 74p). Revaluation losses reflect weakness in rents that is yet to fully feed through to earnings along with the full year effect of the decline in occupancy to 82% at the year end versus 94% at end 2014. A 1p final distribution by way of a tender offer is proposed, making 2p for the year. Raven entered the Russian economic and currency crisis in good shape and continues a cautious strategy aimed at maximising cash flow and paying down debt so as to be in a position to benefit from a turn in the market.

To read the entire report Please click on the pdf File Below