While the Fed and Bank of England have provided hints that they are near the end of their hiking cycles, the European Central Bank's policy stance remains too easy for comfort in light of still-hot inflation. Hawks may reassert their posture with upcoming inflation data, and render end-of-cycle curve dynamics premature for EUR rates

ECB's stance likely too easy for comfort

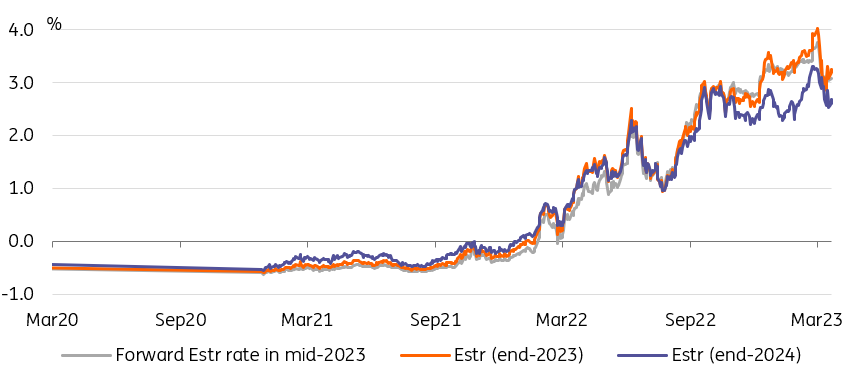

Expectations of further ECB policy tightening are still under the spell of this month’s banking turmoil. Only cautiously are markets baking rate hikes back into curves. The ECB terminal rate is now seen at 3.37%. Compare that to early March when it was around 4.1%. This implies the market is currently looking at most for another 50bp of tightening from the ECB. Of course, there is still a chance that the turmoil will have a more lasting impact as banks' appetite for risk is diminished and credit conditions are tightened. This scenario has also seeped into inflation expectations - the 5y5y forward inflation swap is at 2.4%, just ahead of the turmoil it was on a march towards 2.6%.

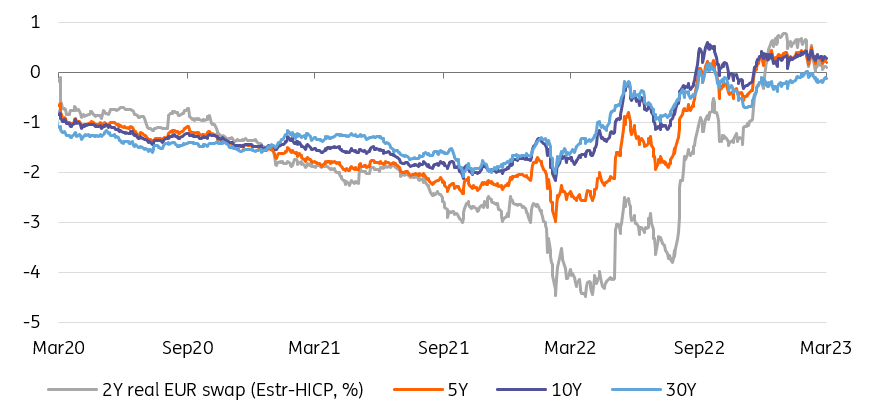

Real rates look hardly restrictive given the ECB still has an acute inflation problem

One way to gauge a central bank’s overall policy stance in this context is to look at real rates. Especially the shorter to intermediate real rates out to 5y are now closer to the bottom of this year’s ranges. That looks hardly restrictive when keeping in mind that the ECB still has an acute inflation problem at hand. If the consensus is right, tomorrow’s core inflation print will rise to another record of 5.7%.

Some dovish-leaning ECB officials have argued recently that the ECB targets headline inflation, and that is indeed moving in the right direction in big steps. But we would also refer to Chief Economist Lane, who pointed out at the beginning of March that underlying inflation gives “an estimate of where headline inflation will settle in the medium term after temporary factors have vanished”.

- A headache for the ECB: short real EUR rates have eased to the bottom of this year's range

Source: Refinitiv, ING

Limited financial stress means interest rates will have to rise further

After having been forced into a defensive position by the market turmoil, ECB officials themselves are currently re-focussing on their inflation mandate. There are still some elements of caution and added caveats. For sure, the ECB is now talking more in terms of scenarios and stresses data dependency. Some usually hawkish leaning ECB members such as Slovakia’s Kazimir yesterday suggested that perhaps a slower pace of hiking is now warranted. But behind that curtain of caution, there is still a view that the ECB should not back down on rates.

ECB's Lane: More hikes are needed in the baseline scenario

The ECB’s Lane also acknowledged that we were currently “probably in the most intense phase of inflation.” He does have the outlook that it will come down significantly, but crucially to ensure that this actually happens, he also sees more hikes – note the plural – being needed in the baseline scenario. His outlook for interest rates still needing to go up remains if the “financial stress is non-zero”, though “still fairly limited”.

- ECB rate hike expectations have rebounded, but remain well below their early March levels

Source: Refinitiv, IN

Today’s events and market view

Especially for the ECB, inflation will remain key. Starting today we will receive CPI estimates from individual countries – Germany, Spain and Belgium – ahead of tomorrow’s estimate for the euro area. Markets should take the data as a reminder that the ECB is still far from meeting its inflation mandate and that the ECB could well reassert it hawkish poise – inflation is too high today, and knock-on effects to the euro area from the turmoil will only gradually materialize, if ever.

While we see end-of-cycle dynamics taking hold in USD and GBP, we still think EUR curves stand more of a chance to re-flatten first – if only on a relative basis – as policy tightening is more likely to be priced back into the front end.

Aside from the euro area country CPI readings, we will be watching the US data. We will get the weekly initial jobless claims which have painted a relatively resilient picture of the job market so far. The third print of fourth quarter 2022 GDP will give us a rear mirror view of the economy. Closely watched will be the Fed's update later in the day on the aggregate recourse to the discount window and the new bank term funding program. Fed speakers scheduled for the day are Barkin, Collins and Kashkari.

In primary markets Italy will auction 5Y and 10Y bonds as well as floating rate notes for a total of up to €9bn.

***

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more