Chair Powell has sent a clear message: the Fed is back in the driving seat. At a very minimum, the Fed has given itself the option to deliver a 50bp hike from the March meeting. It's now discounted that way. Friday's payrolls are key though. So is next week's US CPI report. As that rate hike pendulum still has swing potential back to 25bp, it's all about the data.

Powell gives the Fed a free option to up the pace to 50bp, if needed...

The market has now re-priced to a 50bp hike from the March meeting. It's not fully discounted, but it's discounted enough to give the Federal Reserve the option to deliver 50bp if required. In the end, it will be up to the data releases to come, especially this Friday's payroll report. The clearest remark made was that the labor market remains very tight, and the ex-housing services sector inflation is too high. These are related, as a material loosening in the labor market is likely required in order to mute services sector inflation.

Expect volatility in the rate hike expectation for March to remain elevated though. It could just take the outcome of a sub-150K payroll on Friday to swing the rate hike pendulum back towards a 25bp hike, especially if accompanied by some calming in wage inflation. Typically the Fed can have a heads-up on some data releases ahead of time, and if that's the case here then the outcome of a subdued payroll is less likely. But clearly, this is a key number and is followed by the February CPI report due on Tuesday of next week.

The back end is continuing to resist the full extent of the Fed's message for the front end.

Financial conditions have not materially tightened though, partly as longer-dated market rates did not rise in any material fashion. The 10yr briefly broke above 4% as a bit of an impact reaction, but then fell back below. Risk assets came under some pressure, putting some interest back into core duration buying. The curve in consequence hit a new cycle extreme for inversion, with the 2/10yr breaking through -100bp. The back end is continuing to resist the full extent of the Fed's message for the front end.

We'd argue that this degree of inversion is being driven by longer-dated real yields being too low. If the US economy is as dynamic as is being portrayed, then a real yield in the 10yr at 1.6% is too low. A move up to the 2% area would make sense, offset by further falls in the 10yr inflation breakeven (now 2.4%). That combination would not need to push the 10yr above 4.25%, but it could or should certainly be moving in that direction if a 50bp hike is to be really justified on pure macro grounds.

In the background, the Fed will no doubt have noted the remarkable rise in the 2yr inflation breakeven, which was at 2% in mid-January and reached 3.4% before Chair Powell spoke. It's now at 3.25% – a step in the right direction.

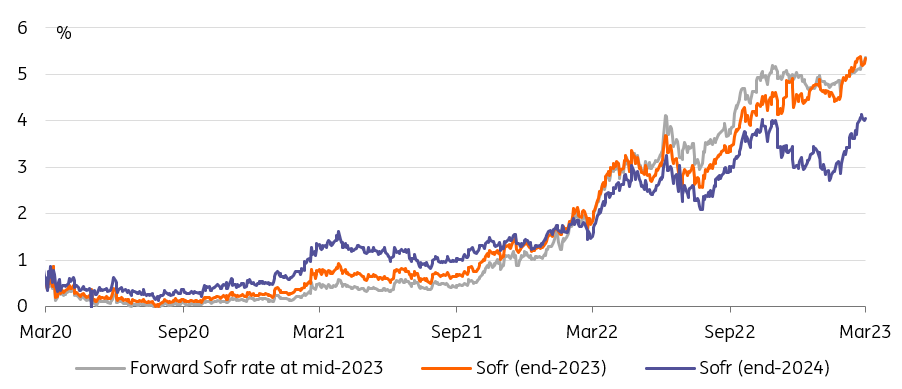

2023 forwards show the Fed is reacting to strong US data, but 2024 forwards lag behind

Source: Refinitiv, ING

European rates also show central banks are back in charge

On European curves too, there are signs that central banks are back in control. Ever since Holzmann has put successive 50bp hikes until July on the table, markets are behaving more like the European Central Bank will do what is necessary to get inflation under control. The most obvious evidence of this is the further flattening of the yield curve, pricing both an aggressive central bank but also the depressing medium-term impact on growth and inflation. No doubt the moves in the US and Europe are compounding each other but we note that around 2.70%, 10yr Bund yields are already 130bp below the expected terminal deposit rate in this cycle.

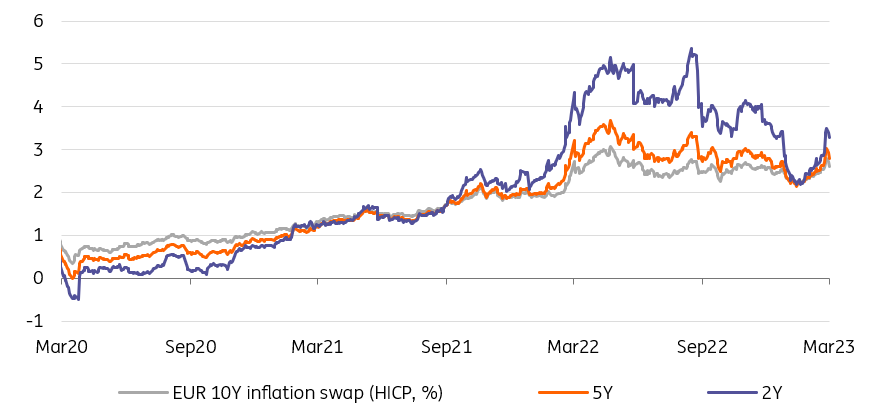

Exhibit two is the reversal in inflation swaps so far this week. To be sure, a decline in long-term inflation expectations in the ECB’s consumer survey has helped, but we think this is a reflection of a more general view that here too, central banks are back on their front foot. This means an upside to both front and back-end yields, but a hawkish ECB should also bring further curve inversion. Whether this view survives next week’s ECB meeting is another question. Its communication has sometimes confused markets and a wide range of opinions has been expressed in the run-up to the quiet period starting tomorrow.

We are fond of saying that risk sentiment cannot ride the recovery wave forever, as more aggressive central banks will inevitably take their toll on valuations. There were signs of this message affecting risk assets yesterday but, in a way, a scenario where central banks keep their eyes on the road and only step off the brake when inflation is under control is the better outcome. The even worse alternative is one where inflation expectations continue to rise for a while with an even more drastic intervention down the line.

EUR inflation swaps have stopped rising after hawkish ECB comments

Source: Refinitiv, ING

Today’s events and market view

Speeches by the ECB’s Lagarde and Panetta feature prominently on today’s calendar. Today is also the last day before the pre-meeting ‘quiet period’ kicks off, and so the last chance to manage market policy expectations before next week.

Also on the topic of central bank commentary, Powell will conduct the second of his two-day Congressional testimony. His prepared statement will be the same as yesterday’s but questions and answers might shed more light on the Fed’s thinking.

Bond supply will come from Germany 7yr and Portugal (10yr/13Y) in Europe, and from the US (5yr).

Last but not least, two US job market indicators will be released today: ADP employment, and job openings. The former isn’t rated very highly by our economists but can still move the market in case of significant deviation from the 200K consensus. Job openings are more relevant in our view. The rebound in late December is one of the key indicators that helped rates find a floor at the start of February but the consensus is now for a decline.

***

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more