German inflation has given financial markets another headache on top of Fed and Bank of England tightening this year. Core bonds are at the epicenter of the market reaction but stress could quickly spread to riskier debt. We also attempt to answer some of the questions raised by the BoE’s balance sheet reduction

ECB hike expectations hot up

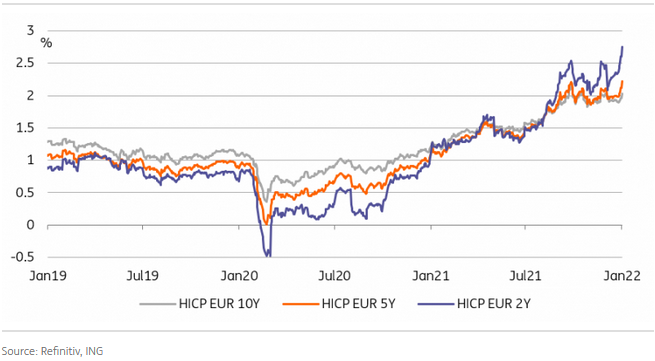

Markets have had a first glimpse of January inflation in the Eurozone, and they didn’t like it. The failure of German CPI to slow down as much as expected, despite supportive VAT effects dropping out of the annual calculation, was the final straw that tipped EUR bond markets into another sell-off, even outstripping the rise in the more volatile USD and GBP rate markets. This upside surprise is also reflected in the recent jump in EUR inflation (HICP) swaps, in particular short-dated ones.

EUR inflation swaps are on the rise once again

Interestingly, this affected core bond markets the most. This is a slightly surprising development for a number of reasons. First, if stickier inflation is confirmed, the market might be tempted to start questioning the European Central Bank’s sequencing of policy tightening (first tapering QE and then hiking rates). This isn't consistent with bond yields rising faster than swap rates, and it isn’t consistent with sovereign spreads remaining tight.

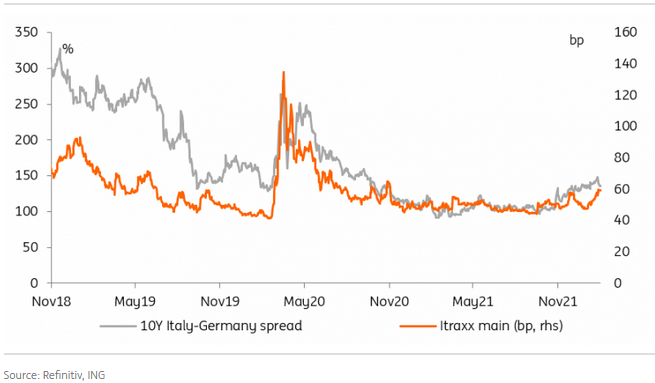

The inflation scare is the most potent driver and is likely to send spreads back on a widening trajectory

The result of Italy’s presidential election goes a long way towards explaining the good performance of the local bond markets, and indeed, the 10Y Italy-Germany spread did flirt with the 120bp level we identified on a best case scenario outcome to the vote whereby Mattarella and Draghi remained in their respective roles.

Also as we highlighted in our preview, we think the relief will prove short-lived. Ultimately, the inflation scare is the most potent driver and is likely to send spreads back on a widening trajectory, this is all the more true if last week’s widening of credit indices is the start of a more material move.

The widening of credit indices is another threat to peripheral debt

The BoE readies to unwind its balance sheet

Of course, the ECB is not the only central bank keeping markets awake at night. This week will also see the BoE hike and kick off its balance sheet reduction.

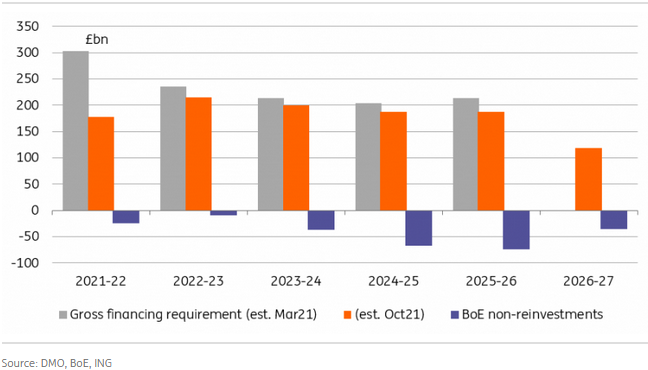

Markets seems to be relatively relaxed at the prospect, for now at least, perhaps because the initial 'passive' phase will only feature an end to reinvestment of bonds maturing in its portfolio. Put in the context of material reduction in the Debt Management Office’s (DMO) reduction in supply projections in October, this does not seem to be a major challenge.

Passive BoE tightening is manageable in the near term

Thing may change if the BoE decides to actively sell gilts, something it might do after the Bank Rate reaches 1%. This does not seem to be a very well defined plan yet but we find that all of the options at its disposal have their own challenges, not to mention the risk of worsening any market stress. For these reasons, we expect the BoE to tread carefully.

Events and market view

Following the upside surprise in German and Spanish CPIs released Monday, it was fair to say that expectations for French inflation were higher than suggested by the Bloomberg consensus. The bar was thus for the release to add selling pressure on bonds in itself. Momentum, on the other hand, would be responsible for the sell-off to accelerate.

Most of the manufacturing PMIs that came out yesterday were second readings, and thus were less likely to impact market direction. The exceptions were the Dutch, Spanish, and Italian indices.

In the US session, the ISM manufacturing and JOLTS job openings were the main events. Some degree of softening was expected but this could still weaken conviction for a 50bp March Fed hike.

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more