We blame the bond rally on geopolitical tensions, and on post-supply relief. It looks set to continue but deeply negative real rates lessen the pressure on the ECB to deliver a dovish message next week. Higher rates may have to wait a few more days, but they will come.

Government bonds: riding high

The strength in developed market government bonds this week, and in particular yesterday, is a puzzle worth solving for whoever is trying to infer rates direction into next week. One potential driver is escalating tensions between the US and Russia, and the latest round of sanctions imposed by the former on the latter’s bond market. Our Russian economist and emerging market strategist think that the medium term impact should be contained, as the sanctions are limited to primary markets. Be that as it may, it is possible that flight to quality flow found its way into US and German bonds as a result.

It was perhaps more surprising that the bond rally, and associated drop in swap rates, occurred on the day another batch of strong US data was released. While industrial production numbers disappointed later in the day, a consequence of poor weather and chip shortages, retail sales and jobless claims registered marked improvements. After the muted reaction to a jump in US CPI earlier this week, it is tempting to conclude that rate markets have fully integrated the US’ economic rebound, and that one needs to go elsewhere in search of a driver for higher rates. We disagree. Where they stand, USD rates are far from reflecting growth and inflation dynamics we anticipate over the coming years.

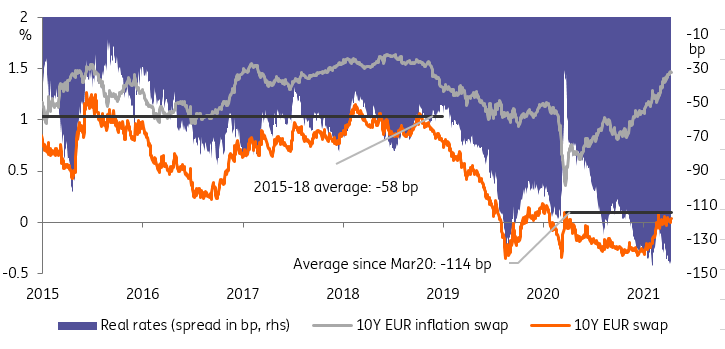

EUR real rate dipped further this year, lowering pressure on the ECB as a result

Source: Refinitiv, ING

Today’s events and market view

With a fairly benign event calendar today, consisting mostly of US housing and consumer confidence indicators, the focus will quickly turn to next week. We anticipate EUR supply will be limited after this week’s flurry of syndicated deals, and as the week will be interrupted by Thursday’s ECB meeting. The auctions scheduled should be more modest in terms of duration, allowing for the technical rebound in bonds to continue at the beginning of the week.

There isn’t much to expect from the ECB next week, after it agreed to speed up the implementation of PEPP asset purchases in March. If anything, real rates have dipped further after the central bank’s announcement so we think the pressure to deliver dovish communication will be lower. What’s more, the outlook has improved since March, tentatively. It would be premature for the ECB to pop the bubbly already, but displays of optimism would not be amiss. As a result, we would be wary of calling too early the end of the recent drop in EUR rates, but it seems likely to reverse around the ECB’s meeting.

Original Post

Content Disclaimer: The information in the publication is not an investment recommendation and it is not an investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument.

This publication has been prepared by ING solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. Read more