The Fed delivered 75bp, and pre-warned for another one in July. The approach of big figure 4% is on the horizon now, for market rates and the Fed, and a curve flattening bias.

The European Central Bank took a step towards addressing sovereign spreads widening, and the Bank of England opted for a small hike given the state of its economy.

US funds rate, repo, reverse repo and excess reserves all up by 75bp. But SOFR continues to lag…

With the Fed delivering 75bp, the biggest hike since the 1990's, the Fed's dots and the fund futures strip are now threatening the approach of 4%. Longer tenor market rates will not lead us there though, as the baseline view is that risks are heightening for a subsequent slowdown, and rate cuts later in 2023.

The full spectrum curve should maintain a flattening bias on the back of this.

SOFR will likely have difficulty climbing above 1.5% in the coming days

In terms of money market technicalities, the Fed may not like to admit it, but the issues that have plagued the front end of the market not only remain in place, but have intensified in an uncomfortable direction in the past few weeks.

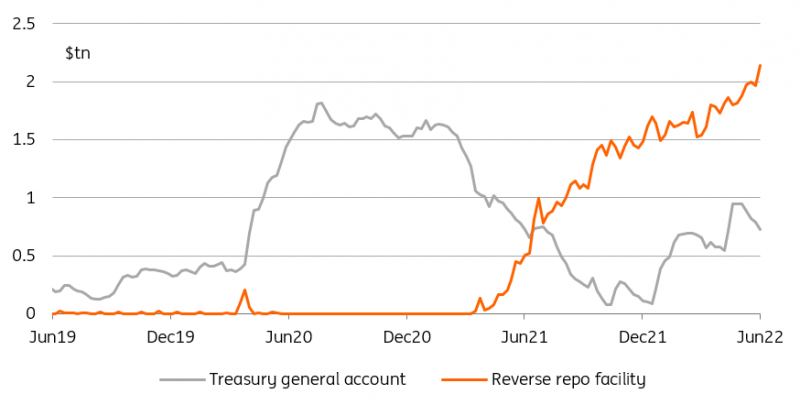

The volumes of cash going back to the Fed on the reverse repo facility is in the area of USD 2.25trn, a huge number that reflects difficulty for market repo to match the 80bp on offer by the Fed.

In fact, SOFR has just slipped to below 70bp, reflective of where market overnight repo has trended towards. The Fed has now hiked by 75bp, thus pushing the reverse repo rate to 1.55%.

Based off where the repo market is currently trading, SOFR will likely have difficulty climbing above 1.5% in the coming days, as there has not been any material change in liquidity circumstances in the wake of the FOMC outcome.

More cash is being placed at the Fed's reverse repo facility

Source: Saint Louis Fed, ING

Other key rates also reflect the full 75bp move in the Fed funds range to 1.5%–1.75%. The rate on the standing repo facility has been hiked to 1.75% (from 1.0%), a facility that tends not to get used currently, reflecting the bias towards an excess of liquidity, that instead pushes use of the reverse repo facility.

The rate on excess reserves has been hiked to 1.65% (from 90bp). Cash getting compensated in this bucket has in fact been on the decline in recent months, as bank reserves have fallen from USD 4.3trn to USD 3.3trn, reflecting a tightening in conditions at the level of commercial banks.

This process is likely to continue to the extent that banks underdeliver in terms of deposit hikes, relative to what the Fed has delivered (and will deliver).

A small step in the right direction for peripheral bonds

The ECB took a step towards addressing financial fragmentation in an emergency meeting yesterday. It confirmed that it will use Pandemic Emergency Purchase Program (PEPP) reinvestments to lean against sovereign spread widening and said it will accelerate work on a new instrument.

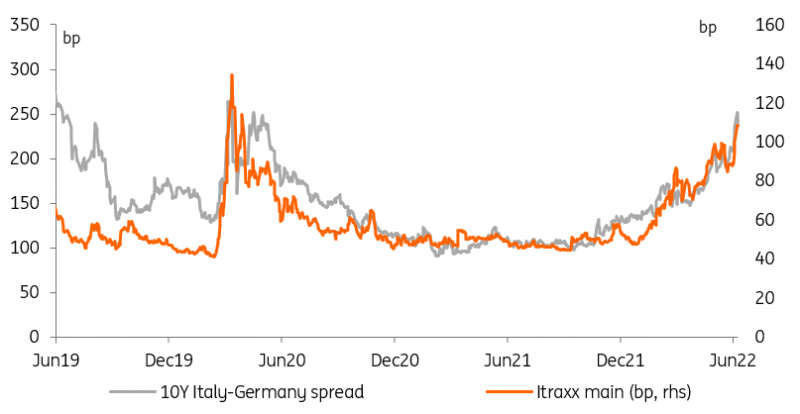

The announcement was light on details but was enough to tighten 10Y Italy-Germany spreads by roughly 25bp in one day. As usual, the devil is in the details.

Any new instrument would need to follow a number of legal and political constraints that might reduce its efficacy. It is not surprising that the ECB has been reluctant to unveil its details.

Wider peripheral spreads are consistent with other markets

Source: Refinitiv, ING

The ECB needs to be ready to buy an unlimited amount of bonds at next to no condition

A new instrument would be different from quantitative easing in that its ultimate goal would be to crowd private investors in rather than out. It needs to be credible enough for them to reassess the risk of peripheral debt and make up for the shortfall in ECB buying once PEPP and Asset Purchase Program net purchases cease.

To that end, the greater the program, the more likely it is to succeed. Paradoxically, the ECB needs to be ready to buy an unlimited amount of bonds at next to no condition if it wants to minimize how much it ends up buying, and avoid working at cross purposes to the monetary tightening it is trying to deliver.

BoE to refrain from more drastic hikes

The BoE concluded its meeting today with a 25bp hike. Despite a sizeable minority, we were expecting a vote for a larger 50bp move, the case for accelerating tightening is less clear than in the US, on account of a weaker domestic economy.

Our economics team also thought that the BoE sent a clear message at the May meeting when it signaled that the implied path for the Bank Rate at the time was enough to bring inflation back below target within its forecasting horizon.

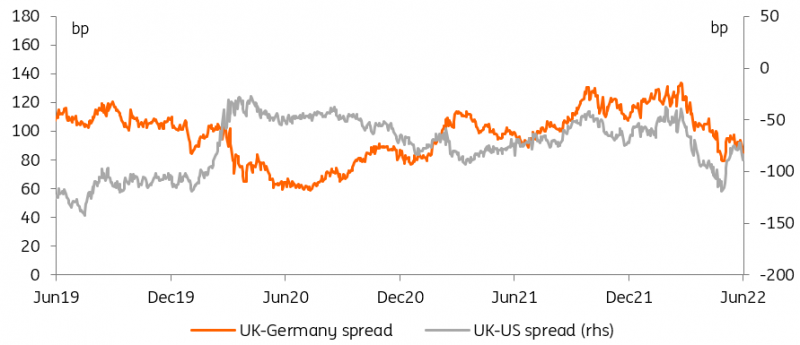

Gilts tightening to Bund and Treasuries illustrates the economic gloom

Source: Refinitiv, ING

GBP markets have less of a case in anticipating faster tightening

In spite of the economic gloom, gilts have not been immune to the sell-off in global government bonds. This being said, their yields struggled to rise as fast as their US Treasury and Bund equivalents over the past months.

The only three more 25bp hikes envisioned by our economists suggest that gilts will continue tightening relative to their international peers, today’s meeting should be a reminder that the BoE is ahead of the curve compared to other central banks and that GBP markets have less of a case in anticipating faster tightening.

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more