U.S. markets are in the driving seat as CPI looms. With the labour market providing the room and inflation data stressing the necessity of further Fed tightening, the US curve inversion can extend further, though supply this week may blur dynamics. In Europe, headlines surrounding Italy are likely to keep the European Central Bank busy

Brace for deeper U.S. curve inversion

Given the empty calendars elsewhere, markets should take their cues from the US this week. And here the focus is very much on the Fed and to what extent it sees further substantial hikes as necessary and what room it has left to deliver them. The surprisingly strong jobs data of last Friday has provided the room at least for the next moves, and the CPI data should underscore that indeed there is still a job to be done in fighting inflation.

Fed speakers have accordingly reiterated that the central bank is “far from done yet

Recent Fed speakers have accordingly reiterated that the central bank is “far from done yet”, as the Fed’s Mary Daly said, though her remark that a 50bp hike in September was clearly on the table did look dovish when compared to markets already pricing an almost 70bp increase for September. The Fed’s Bowman stating that after the last two 75bp hikes "similarly-sized increases should be on the table until we see inflation declining in a consistent, meaningful and lasting way" is more in line with the current market momentum turning towards a third consecutive 75bp hike.

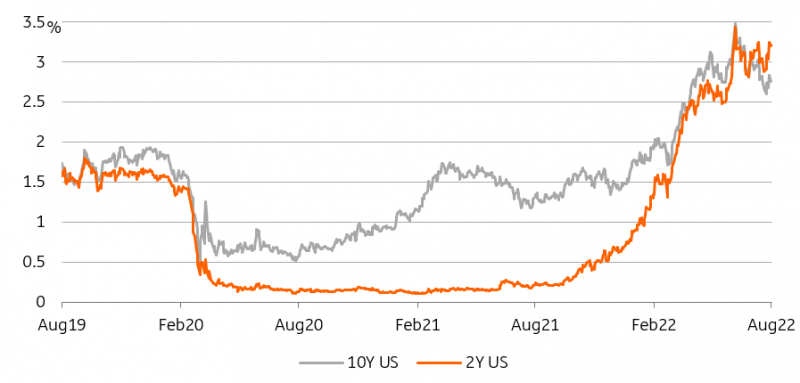

The U.S. Treasury curve has continued to flatten as one would suspect with the 2Y-10Y curve taking staking out new lows towards -45bp. Further inversion cannot be excluded with the CPI data likely to show year-on-year core inflation inching up to 6% again.

A beat in U.S. CPI would deepen the US curve inversion

Source: Refinitiv, ING

Summer markets take their cue from the US, but keep an eye on Italy

Euro rates have largely followed their US peers. The flattening dynamic here had been reinforced by the more aggressive hike of the ECB last month, although the 2Y-10Y Bund curve flattening appears to run into some resistance now that this year's lows of just above 40bp have been reached. Investors are still being kept on their toes by energy supply fears that are now also compounded by higher consumption amid extreme heat and low water levels now also endangering supply chains.

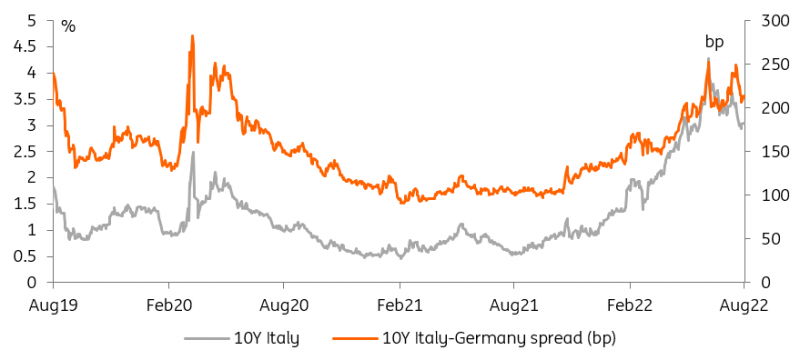

The more direct market-moving headlines of late have concerned the situation in Italy, though. The spread of Italian government bonds had seen a notable tightening up until last Friday after ECB data earlier had confirmed that central banks were deploying vast amounts to aid periphery bond spreads within its flexible PEPP reinvestment policy.

The ECB will be kept busy defending spreads

The tightening trend has hit a snag yesterday with the key 10Y Italy/Bund spread bouncing off the 200bp threshold and rewidening to 208bp. In an unscheduled rating review Moody’s had lowered the outlook on Italy’s Baa3 rating to ‘negative’ citing the economic impact of Russia's invasion of Ukraine as well as domestic political developments. Ahead of the snap elections in September political uncertainty still looms large as was highlighted by one party quitting a centre-left alliance surrounding the Democratic Party only days after it had been formed in an attempt to offer a counterweight to the right wing bloc led by the Brothers of Italy party.

Although the break in primary market supply after Italy cancelled this week’s auctions should also offer near-term support for Italian bonds, we still suspect the ECB will be kept busy defending spreads.

Italian spreads struggle to hold on to gains

Source: Refinitiv, ING

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more